Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You just graduated from Rotman Commerce and landed a job on Bay Street. Your annual salary is $100,000, and your contract is for 5

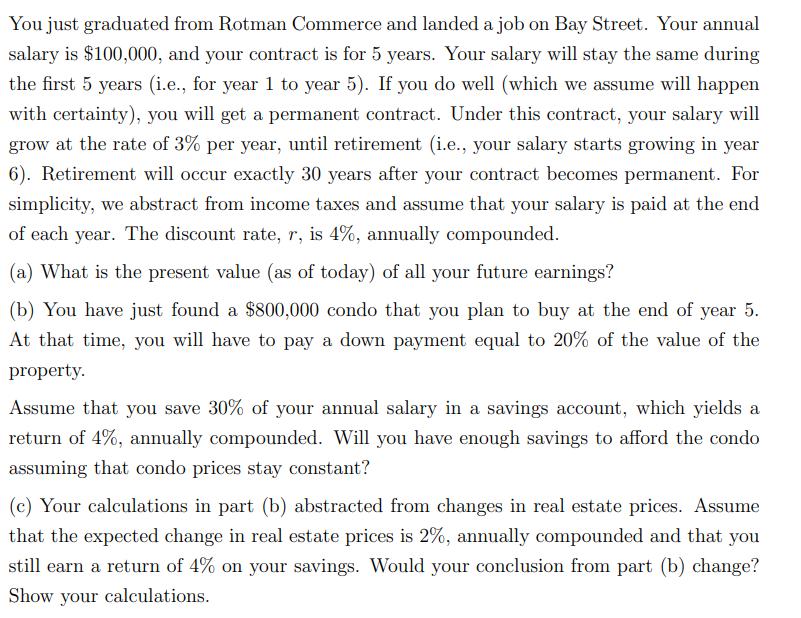

You just graduated from Rotman Commerce and landed a job on Bay Street. Your annual salary is $100,000, and your contract is for 5 years. Your salary will stay the same during the first 5 years (i.e., for year 1 to year 5). If you do well (which we assume will happen with certainty), you will get a permanent contract. Under this contract, your salary will grow at the rate of 3% per year, until retirement (i.e., your salary starts growing in year 6). Retirement will occur exactly 30 years after your contract becomes permanent. For simplicity, we abstract from income taxes and assume that your salary is paid at the end of each year. The discount rate, r, is 4%, annually compounded. (a) What is the present value (as of today) of all your future earnings? (b) You have just found a $800,000 condo that you plan to buy at the end of year 5. At that time, you will have to pay a down payment equal to 20% of the value of the property. Assume that you save 30% of your annual salary in a savings account, which yields a return of 4%, annually compounded. Will you have enough savings to afford the condo assuming that condo prices stay constant? (c) Your calculations in part (b) abstracted from changes in real estate prices. Assume that the expected change in real estate prices is 2%, annually compounded and that you still earn a return of 4% on your savings. Would your conclusion from part (b) change? Show your calculations.

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a To find the present value of all future earnings we need to discount each years salary by the appr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started