Answered step by step

Verified Expert Solution

Question

1 Approved Answer

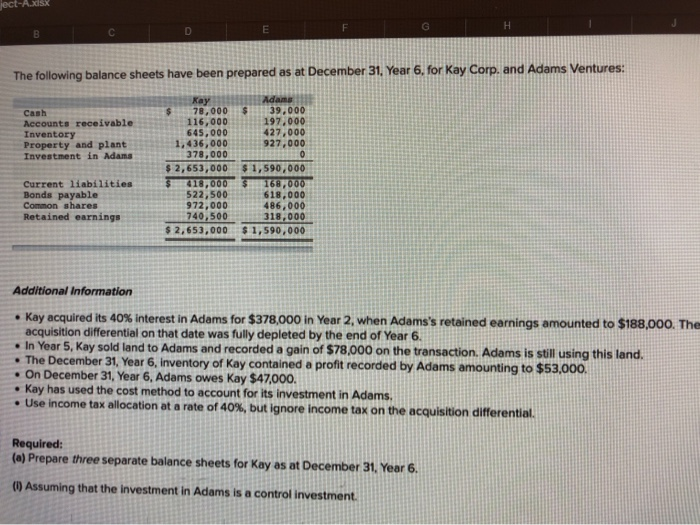

You just have to calculate Balance Sheet and using worksheet method. ject-Axlsx The following balance sheets have been prepared as at December 31, Year 6.

You just have to calculate Balance Sheet and using worksheet method.

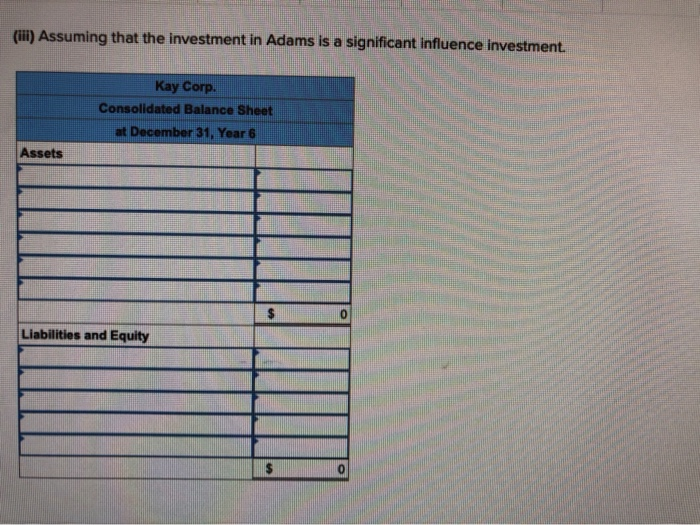

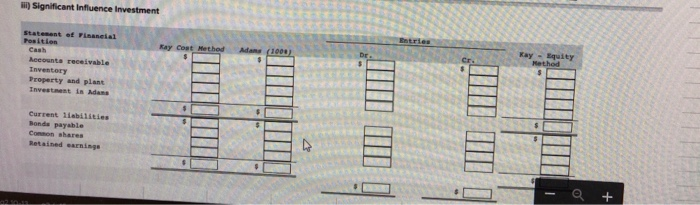

ject-Axlsx The following balance sheets have been prepared as at December 31, Year 6. for Kay Corp. and Adams Ventures: Cash Accounts receivable Inventory Property and plant Investment in Adams 0 Kay Adams 78,000 $ 39,000 116,000 197,000 645,000 427,000 436.000 927,000 378,000 $ 2,653,000 $1,590,000 418,000 3 168,000 522.500 618.000 972.000 486,000 740,500 318,000 $ 2,653,000 $1,590,000 Current liabilities Bonds payable Common shares Retained earnings Additional Information Kay acquired its 40% interest in Adams for $378,000 in Year 2, when Adams's retained earnings amounted to $188,000. The acquisition differential on that date was fully depleted by the end of Year 6. In Year 5, Kay sold land to Adams and recorded a gain of $78,000 on the transaction. Adams is still using this land, The December 31, Year 6, Inventory of Kay contained a profit recorded by Adams amounting to $53,000. On December 31, Year 6, Adams owes Kay $47,000. Kay has used the cost method to account for its investment in Adams. Use income tax allocation at a rate of 40%, but ignore income tax on the acquisition differential Required: (a) Prepare three separate balance sheets for Kay as at December 31, Year 6. (0) Assuming that the investment in Adams is a control investment. (H) Assuming that the investment in Adams is a significant influence investment. Kay Corp. Consolidated Balance Sheet at December 31, Year 6 cember 31, Year 6 Assets TUTTI Liabilities and Equity m) Significant influence Investment statement of Financial Position Ray Cost Method Adam (1000) CE Kay .. Equity Accounts receivable Inventory Property and plant Investment in Adams IT Current liabilities Ronda payable Retained ning - + ject-Axlsx The following balance sheets have been prepared as at December 31, Year 6. for Kay Corp. and Adams Ventures: Cash Accounts receivable Inventory Property and plant Investment in Adams 0 Kay Adams 78,000 $ 39,000 116,000 197,000 645,000 427,000 436.000 927,000 378,000 $ 2,653,000 $1,590,000 418,000 3 168,000 522.500 618.000 972.000 486,000 740,500 318,000 $ 2,653,000 $1,590,000 Current liabilities Bonds payable Common shares Retained earnings Additional Information Kay acquired its 40% interest in Adams for $378,000 in Year 2, when Adams's retained earnings amounted to $188,000. The acquisition differential on that date was fully depleted by the end of Year 6. In Year 5, Kay sold land to Adams and recorded a gain of $78,000 on the transaction. Adams is still using this land, The December 31, Year 6, Inventory of Kay contained a profit recorded by Adams amounting to $53,000. On December 31, Year 6, Adams owes Kay $47,000. Kay has used the cost method to account for its investment in Adams. Use income tax allocation at a rate of 40%, but ignore income tax on the acquisition differential Required: (a) Prepare three separate balance sheets for Kay as at December 31, Year 6. (0) Assuming that the investment in Adams is a control investment. (H) Assuming that the investment in Adams is a significant influence investment. Kay Corp. Consolidated Balance Sheet at December 31, Year 6 cember 31, Year 6 Assets TUTTI Liabilities and Equity m) Significant influence Investment statement of Financial Position Ray Cost Method Adam (1000) CE Kay .. Equity Accounts receivable Inventory Property and plant Investment in Adams IT Current liabilities Ronda payable Retained ning - + Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started