Answered step by step

Verified Expert Solution

Question

1 Approved Answer

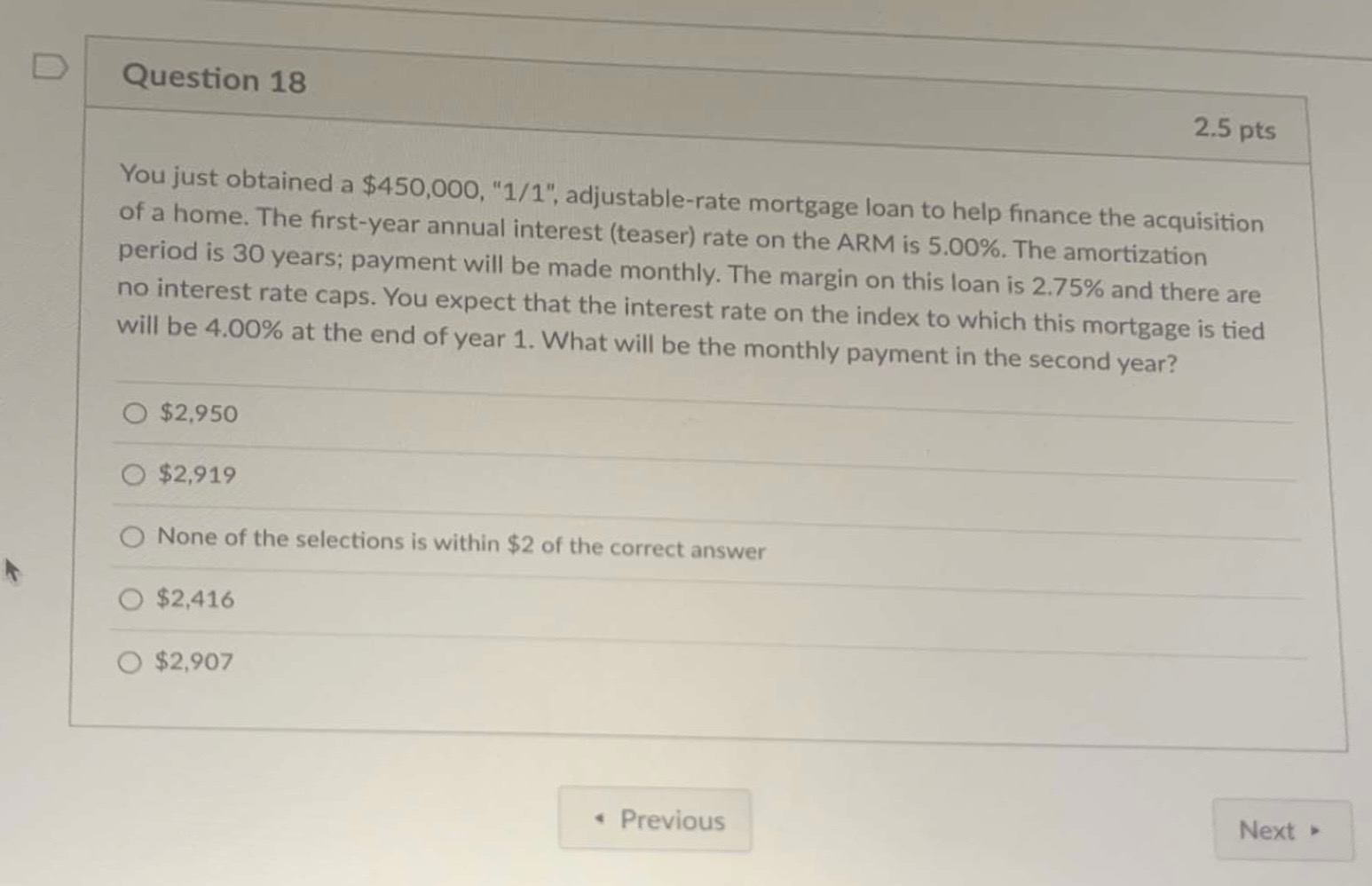

You just obtained a $450,000, 1/1, adjustable-rate mortgage loan to help finance the acquisition of a home. The first-year annual interest (teaser) rate on the

- You just obtained a $450,000, 1/1, adjustable-rate mortgage loan to help finance the acquisition of a home. The first-year annual interest (teaser) rate on the ARM is 5.00%. The amortization period is 30 years; payment will be made monthly. The margin on this loan is 2.75% and there are no interest rate caps. You expect that the interest rate on the index to which this mortgage is tied will be 4.00% at the end of year 1. What will be the monthly payment in the second year?

A) $2,950

B) $2,919

C) None of the selections is within $2 of the correct answer

D) $2,416

E) $2,907

- Even after a lender has initiated the foreclosure process against a borrower, it is still possible for the borrower to "cure" the default before the foreclosure sale by becoming current on payments, including any penalties & interest due. This right is commonly referred to as:

A. substantive default

B. Strategic default

C. deed in lieu of foreclosure

D. equity of redemption

E. statutory redemption

PLEASE HELP!!

You just obtained a $450,000, " 1/1 ", adjustable-rate mortgage loan to help finance the acquisition of a home. The first-year annual interest (teaser) rate on the ARM is 5.00%. The amortization period is 30 years; payment will be made monthly. The margin on this loan is 2.75% and there are no interest rate caps. You expect that the interest rate on the index to which this mortgage is tied will be 4.00% at the end of year 1 . What will be the monthly payment in the second year? $2,950 $2,919 None of the selections is within $2 of the correct answer $2,416 $2,907Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started