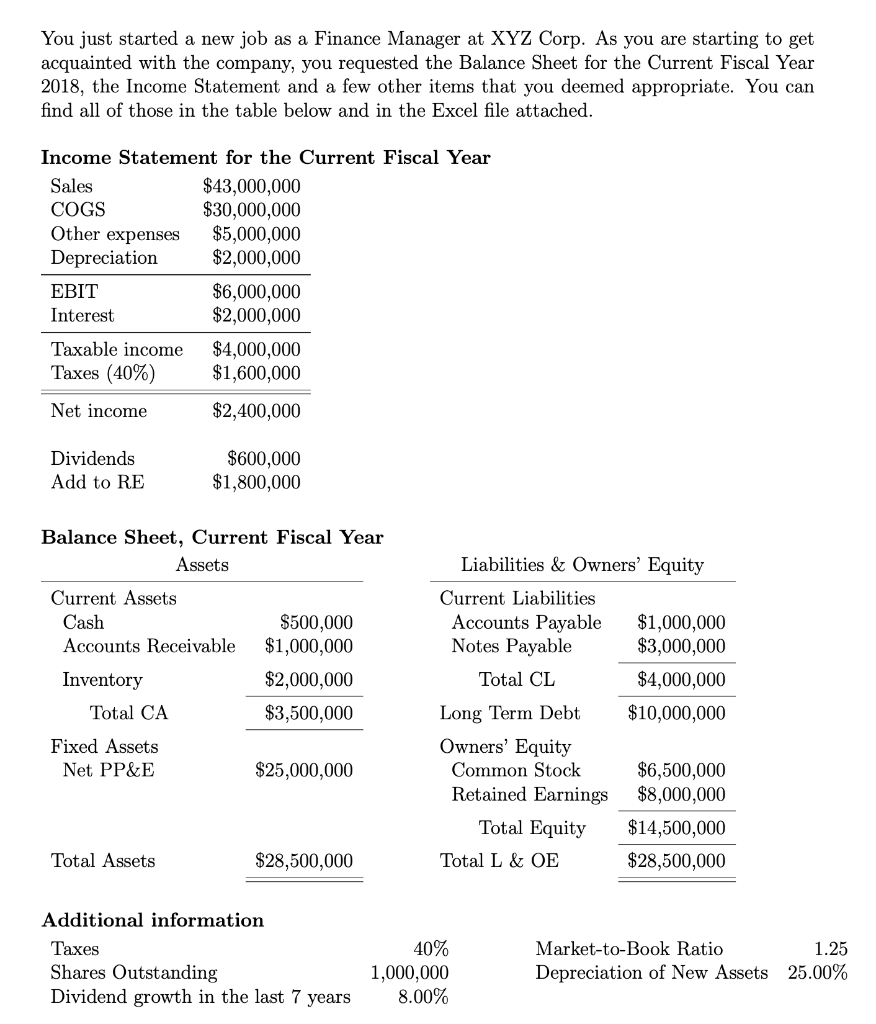

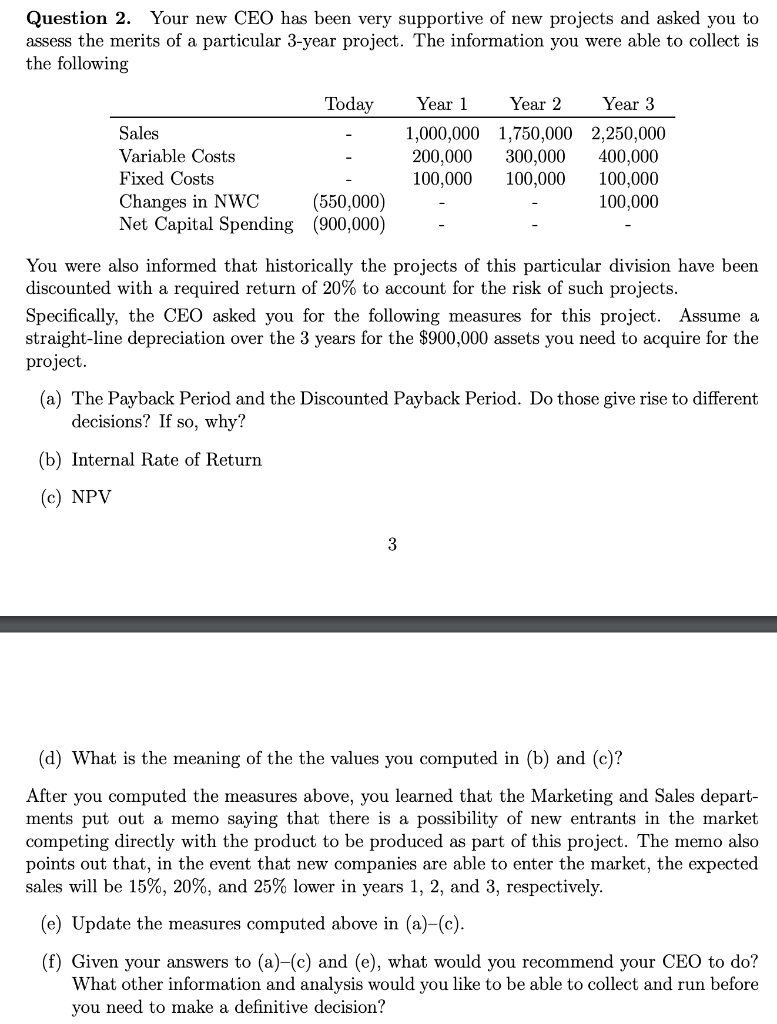

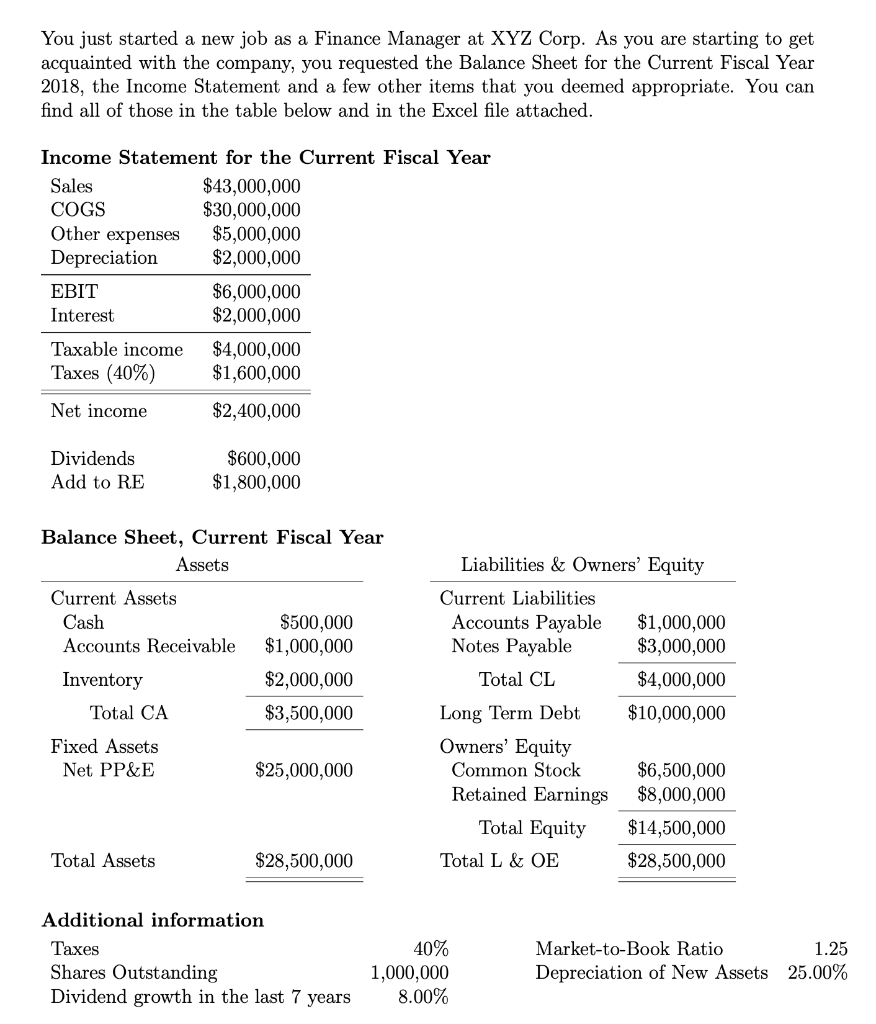

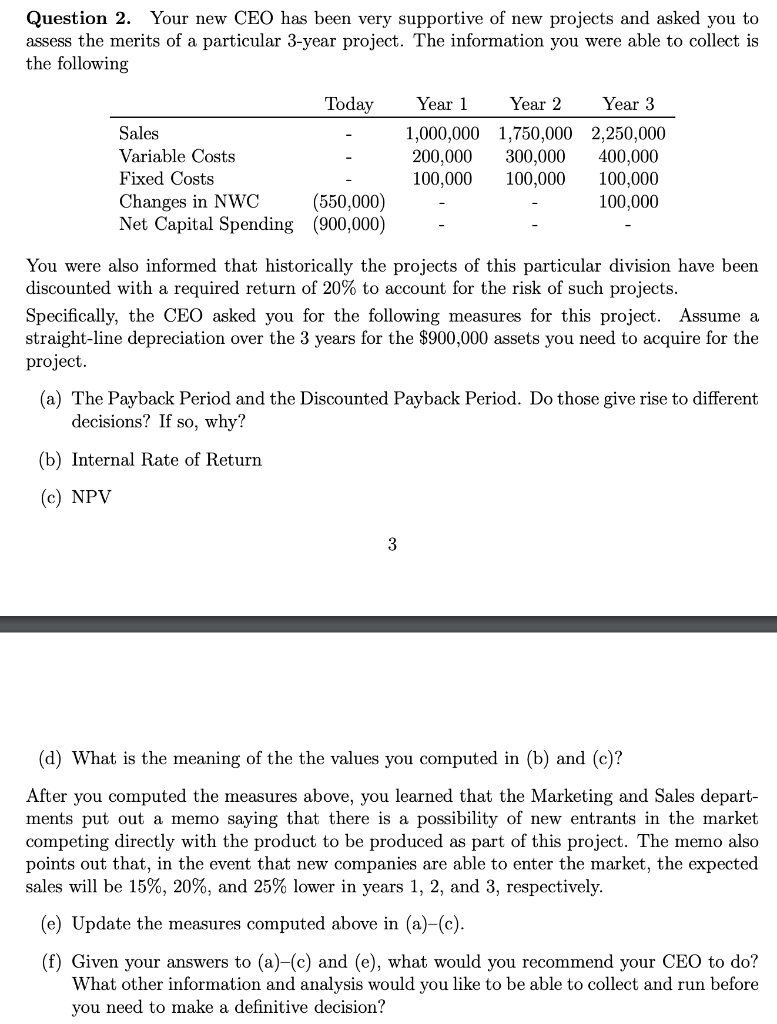

You just started a new job as a Finance Manager at XYZ Corp. As you are starting to get acquainted with the company, you requested the Balance Sheet for the Current Fiscal Year 2018, the Income Statement and a few other items that you deemed appropriate. You can find all of those in the table below and in the Excel file attached. Income Statement for the Current Fiscal Year Sales $43,000,000 COGS $30,000,000 Other expenses $5,000,000 Depreciation $2,000,000 EBIT $6,000,000 Interest $2,000,000 Taxable income $4,000,000 Taxes (40%) $1,600,000 Net income $2,400,000 Dividends Add to RE $600,000 $1,800,000 Balance Sheet, Current Fiscal Year Assets Current Assets Cash $500,000 Accounts Receivable $1,000,000 Inventory $2,000,000 Total CA $3,500,000 Fixed Assets Net PP&E $25,000,000 Liabilities & Owners' Equity Current Liabilities Accounts Payable $1,000,000 Notes Payable $3,000,000 Total CL $4,000,000 Long Term Debt $10,000,000 Owners' Equity Common Stock $6,500,000 Retained Earnings $8,000,000 Total Equity $14,500,000 Total L & OE $28,500,000 Total Assets $28,500,000 Additional information Taxes Shares Outstanding Dividend growth in the last 7 years 40% 1,000,000 8.00% Market-to-Book Ratio 1.25 Depreciation of New Assets 25.00% Question 2. Your new CEO has been very supportive of new projects and asked you to assess the merits of a particular 3-year project. The information you were able to collect is the following Year 1 Year 2 Year 3 Today Sales Variable Costs Fixed Costs Changes in NWC (550,000) Net Capital Spending (900,000) 1,000,000 1,750,000 2,250,000 200,000 300,000 400,000 100,000 100,000 100,000 100,000 You were also informed that historically the projects of this particular division have been discounted with a required return of 20% to account for the risk of such projects. Specifically, the CEO asked you for the following measures for this project. Assume a straight-line depreciation over the 3 years for the $900,000 assets you need to acquire for the project. (a) The Payback Period and the Discounted Payback Period. Do those give rise to different decisions? If so, why? (b) Internal Rate of Return (C) NPV 3 (d) What is the meaning of the the values you computed in (b) and (c)? After you computed the measures above, you learned that the Marketing and Sales depart- ments put out a memo saying that there is a possibility of new entrants in the market competing directly with the product to be produced as part of this project. The memo also points out that, in the event that new companies are able to enter the market, the expected sales will be 15%, 20%, and 25% lower in years 1, 2, and 3, respectively. (e) Update the measures computed above in (a)-(c). (f) Given your answers to (a)-(c) and (e), what would you recommend your CEO to do? What other information and analysis would you like to be able to collect and run before you need to make a definitive decision