Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You just won $150,000 in the lottery and you decide to invest the money for 20 years to save for your retirement. However, you only

You just won $150,000 in the lottery and you decide to invest the money for 20 years to save for your retirement. However, you only get to choose one of the 4 options below. Which one would you pick and why?

A certificate of deposit paying 5.4% interest compounded annually?

A money market certificate paying 5.35% interest compounded semi-annually?

A bank account paying 5.3% interest compounded monthly?

A bank account paying 5.25% interest compounded continuously?

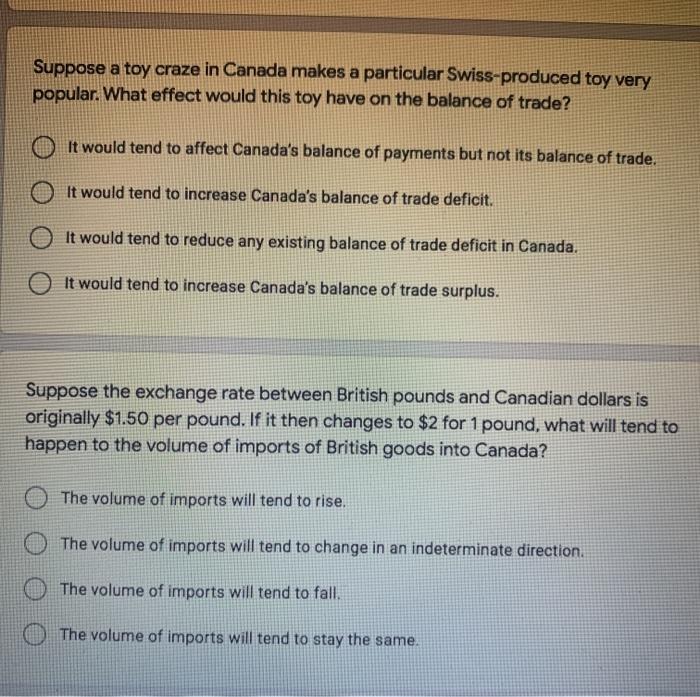

Suppose a toy craze in Canada makes a particular Swiss-produced toy very popular. What effect would this toy have on the balance of trade? It would tend to affect Canada's balance of payments but not its balance of trade. It would tend to increase Canada's balance of trade deficit. It would tend to reduce any existing balance of trade deficit in Canada. It would tend to increase Canada's balance of trade surplus. Suppose the exchange rate between British pounds and Canadian dollars is originally $1.50 per pound. If it then changes to $2 for 1 pound, what will tend to happen to the volume of imports of British goods into Canada? The volume of imports will tend to rise. The volume of imports will tend to change in an indeterminate direction. The volume of imports will tend to fall. The volume of imports will tend to stay the same.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer For the investment of 150000 for 20 years the choice of compounding frequency can significantly impact the final amount The option that compoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started