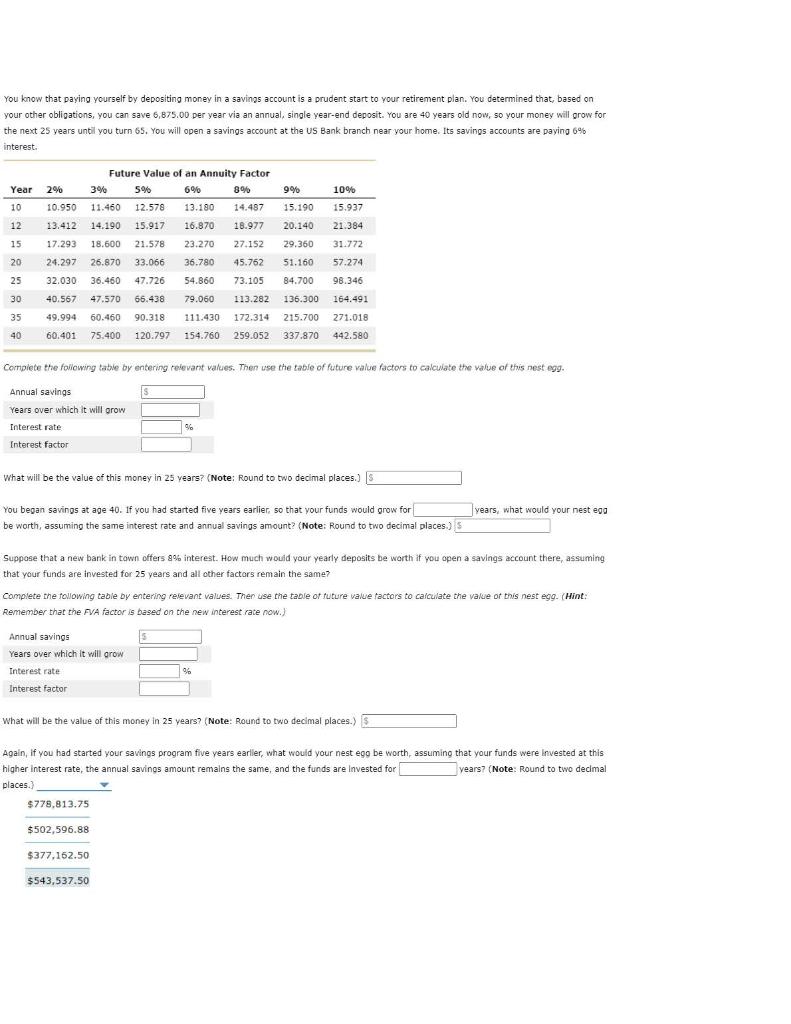

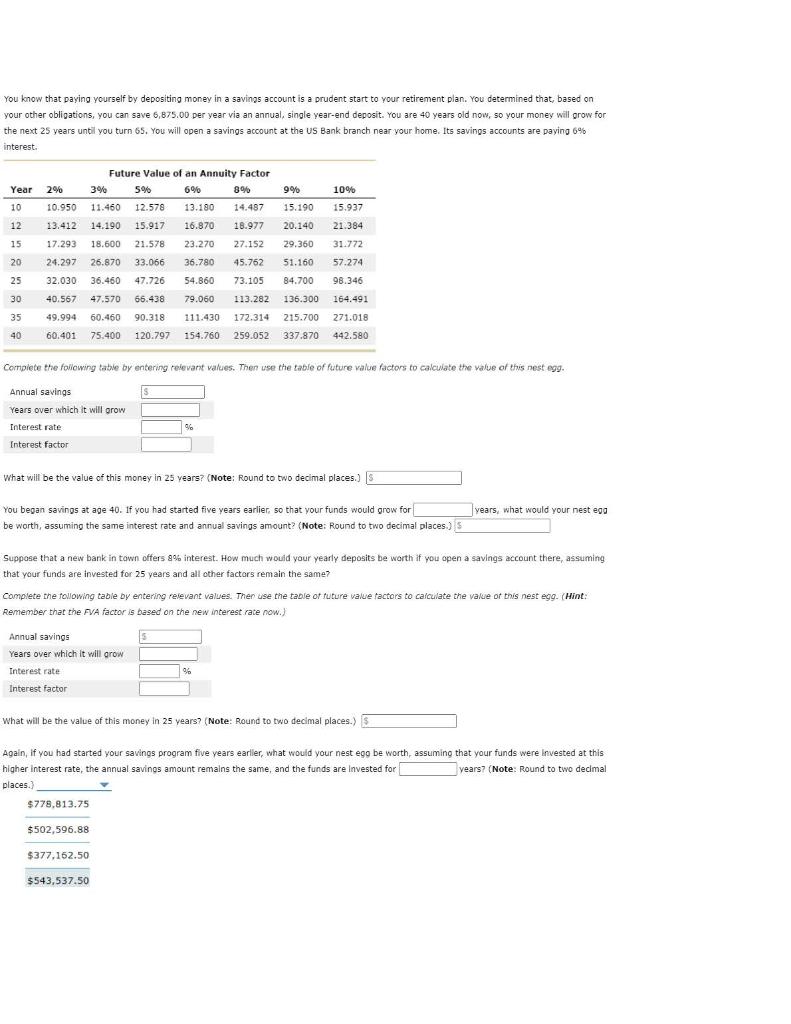

You know that paying yourself by depositing money in a savings account is a prudent start to your retirement plan. You determined that, based on your other obligations, you can save 6,875.00 per year via an annual, single year-end deposit. You are 40 years old now, so your money will grow for the next 25 years until you turn 65. You will open a savings account at the US Bank branch near your home. Its savings accounts are paying 6% interest. Future Value of an Annuity Factor 5% 11.460 12.578 3% 8% 10% 15.190 15.937 10.950 13.412 14.190 15.917 6% 13.180 14.487 16.870 23.270 18.977 20.140 21.384 17.293 18.600 21.578 27.152 29.360 31.772 24.297 26.870 33.066 36.780 45.762 51.160 57.274 54.860 73.105 84.700 98.346 32.030 36.460 47.726 40.567 47.570 66.438 79.060 113.282 136.300 164.491 35 49.994 60.460 90.318 111.430 172.314 215.700 271.018 40 60.401 75.400 120.797 154.760 259.052 337.870 442.580 Year 2% 10 12 15 20 25 30 Complete the following table by entering relevant values. Then use the table of future value factors to calculate the value of this nest egg. Annual savings Years over which it will grow Interest rate Interest factor What will be the value of this money in 25 years? (Note: Round to two decimal places.) S You began savings at age 40. If you had started five years earlier, so that your funds would grow for be worth, assuming the same interest rate and annual savings amount? (Note: Round to two decimal places.) S Annual savings Years over which it will grow Interest rate Interest factor % Suppose that a new bank in town offers 8% interest. How much would your yearly deposits be worth if you open a savings account there, assuming that your funds are invested for 25 years and all other factors remain the same? 9% Complete the following table by entering relevant values. Then use the table of future value factors to calculate the value of this nest egg. (Hint: Remember that the FVA factor is based on the new interest rate now.) $778,813.75 What will be the value of this money in 25 years? (Note: Round to two decimal places.) S $502,596.88 $377,162.50 %6 Again, if you had started your savings program five years earlier, what would your nest egg be worth, assuming that your funds were invested at this higher interest rate, the annual savings amount remains the same, and the funds are invested for years? (Note: Round to two decimal places.) $543,537.50 years, what would your nest egg