Question

You learnt below from the annual report of SA ONE Limited: Since incorporated in 2016, the company has been a promising start-up designing tailored-made software

You learnt below from the annual report of SA ONE Limited:

Since incorporated in 2016, the company has been a promising start-up designing tailored-made software solutions for businesses. At SA ONE, our expertise in computer engineering has enabled us to create cost- effective and high-performing information systems for each of our corporate clients...

A net income of $30,000 was reported in 2019 (2018: $23,000).

Cash dividends attributable to 2018 and 2019 were declared and paid to both the preference shareholders and the ordinary shareholders before the end of each respective year. Total dividends were $8,700 in 2019 (2018: $7,500).

Each ordinary share of the company was currently traded at $180 in the stock market.

Required:

(a) Calculate below in 2019:

-

(i) Return on equity.

-

(ii) Return on common equity.

-

(iii) Dividend payout rate.

-

(iv) Book value per preference share as at 31 December 2019.

-

(v) Book value per ordinary share as at 31 December 2019.

(15 marks)

(b) Comment on the difference between the market price and the book value per ordinary share.

(7 marks)

In Question 1, round your answers to two decimal places in amount / dollar / percentage (if applicable).

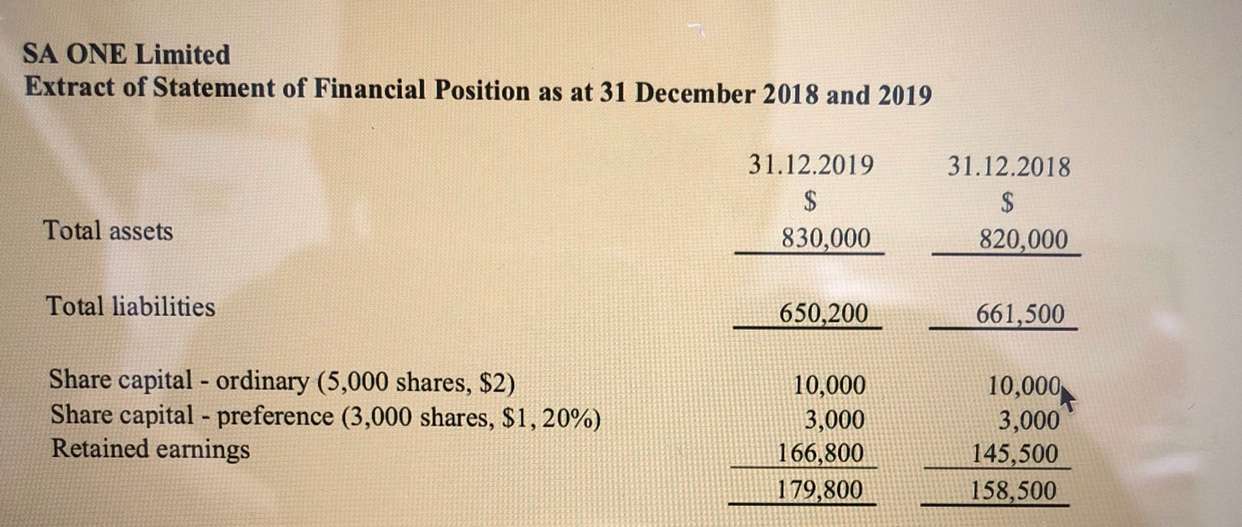

SA ONE Limited Extract of Statement of Financial Position as at 31 December 2018 and 2019 31.12.2018 31.12.2019 $ 830,000 Total assets 820,000 Total liabilities 650,200 661,500 Share capital - ordinary (5,000 shares, $2) Share capital - preference (3,000 shares, $1,20%) Retained earnings 10,000 3,000 166,800 179,800 10,000 3,000 145,500 158,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started