Answered step by step

Verified Expert Solution

Question

1 Approved Answer

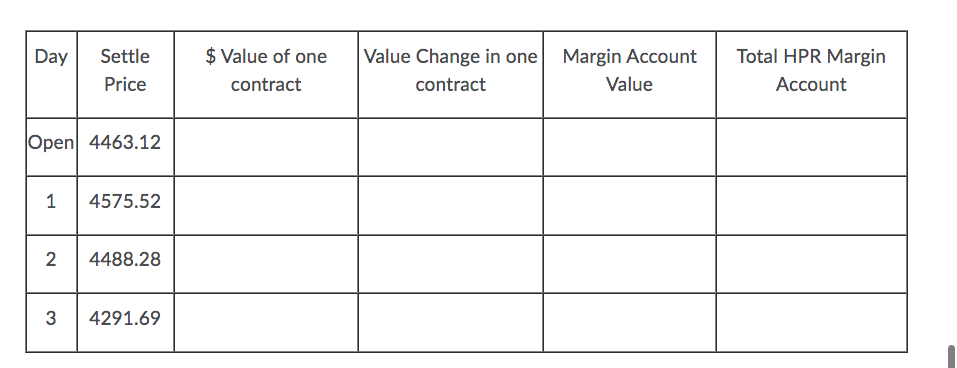

You long one S&P 500 index future contract (the multiplier is $250 for one contract). Assume the initial margin requirement is 10% of account value,

You long one S&P 500 index future contract (the multiplier is $250 for one contract). Assume the initial margin requirement is 10% of account value, and the maintenance margin requirement is 8%, will you receive a margin call on day 3? How much fund you need to put in this account to keep it working if you receive the margin call? Finish the following marking to market table.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started