Answered step by step

Verified Expert Solution

Question

1 Approved Answer

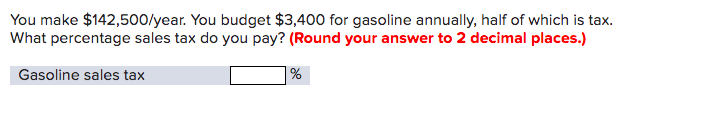

You make $142,500/year. You budget $3,400 for gasoline annually, half of which is tax. What percentage sales tax do you pay? (Round your answer

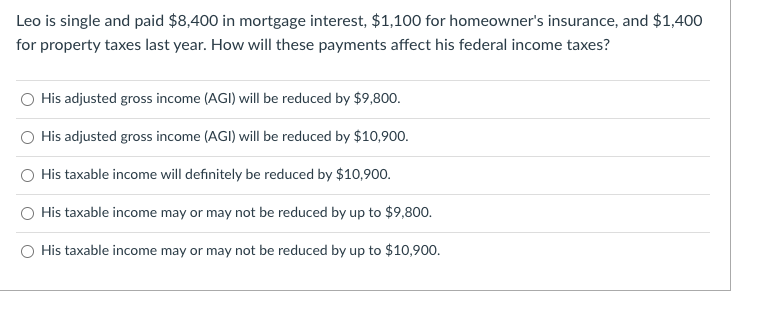

You make $142,500/year. You budget $3,400 for gasoline annually, half of which is tax. What percentage sales tax do you pay? (Round your answer to 2 decimal places.) Gasoline sales tax % Leo is single and paid $8,400 in mortgage interest, $1,100 for homeowner's insurance, and $1,400 for property taxes last year. How will these payments affect his federal income taxes? His adjusted gross income (AGI) will be reduced by $9,800. His adjusted gross income (AGI) will be reduced by $10,900. His taxable income will definitely be reduced by $10,900. His taxable income may or may not be reduced by up to $9,800. O His taxable income may or may not be reduced by up to $10,900.

Step by Step Solution

★★★★★

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Determine the amount of tax paid Since half of the annual gasoline budget is tax we multiply the total budget by 12 to get the tax amount Tax paid 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started