Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You make a payment at the end of year 1 for $300. You receive $500 at the end of year 3, $1,000 at the

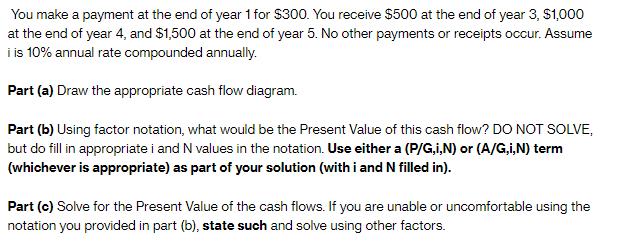

You make a payment at the end of year 1 for $300. You receive $500 at the end of year 3, $1,000 at the end of year 4, and $1,500 at the end of year 5. No other payments or receipts occur. Assume i is 10% annual rate compounded annually. Part (a) Draw the appropriate cash flow diagram. Part (b) Using factor notation, what would be the Present Value of this cash flow? DO NOT SOLVE, but do fill in appropriate i and N values in the notation. Use either a (P/G,i,N) or (A/G,i,N) term (whichever is appropriate) as part of your solution (with i and N filled in). Part (c) Solve for the Present Value of the cash flows. If you are unable or uncomfortable using the notation you provided in part (b), state such and solve using other factors.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Part a Cash flow diagram Year 1 300 Year 2 0 Year 3 500 Year 4 1000 Year 5 1500 Part b Present Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started