Question

You manage a $20.5 million portfolio, currently all invested in equities, and believe that the market is on the verge of a big but shortlived

You manage a

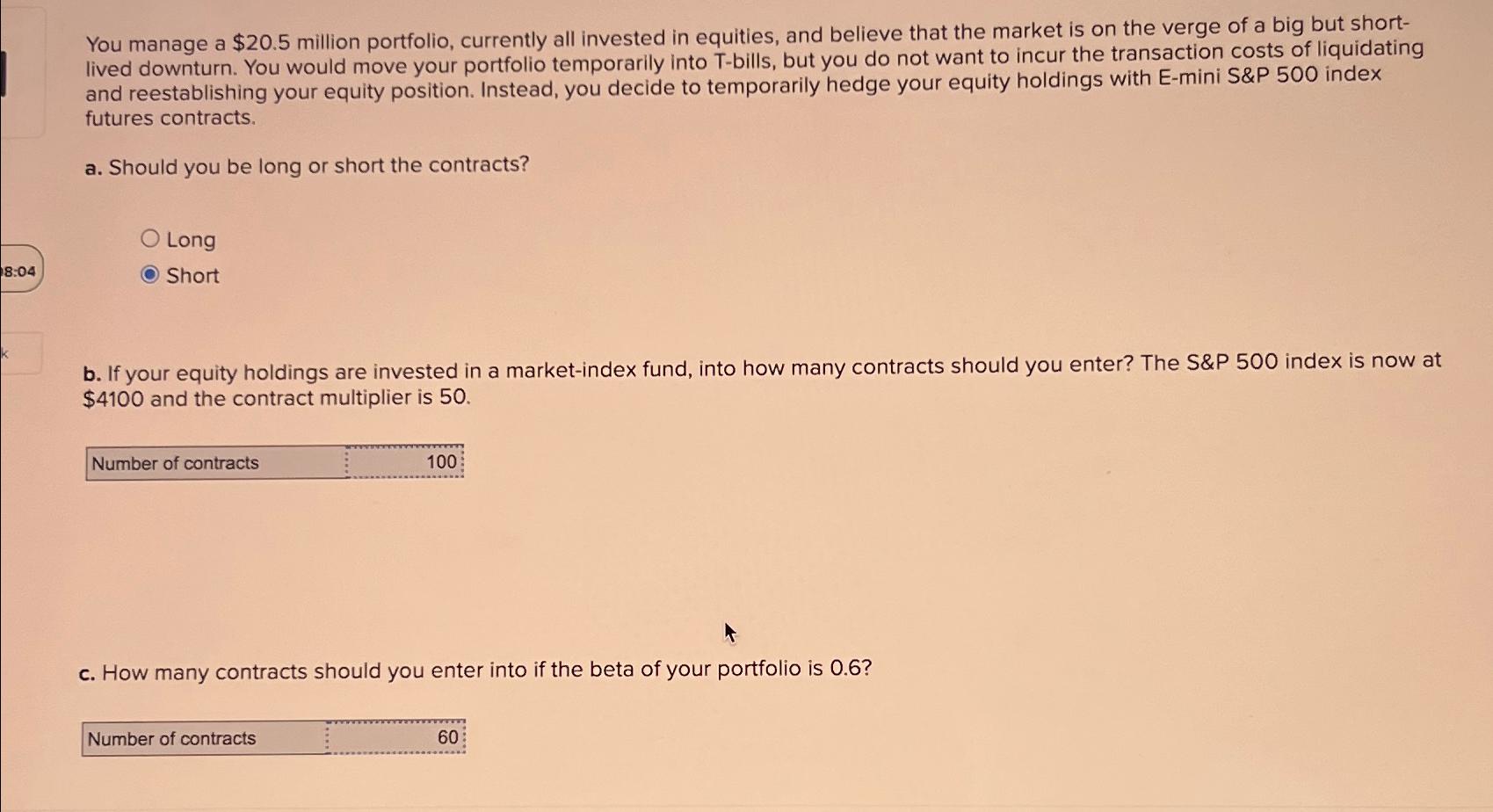

$20.5million portfolio, currently all invested in equities, and believe that the market is on the verge of a big but shortlived downturn. You would move your portfolio temporarily into T-bills, but you do not want to incur the transaction costs of liquidating and reestablishing your equity position. Instead, you decide to temporarily hedge your equity holdings with E-mini S&P 500 index futures contracts.\ a. Should you be long or short the contracts?\ Long\ Short\ b. If your equity holdings are invested in a market-index fund, into how many contracts should you enter? The S&P 500 index is now at

$4100and the contract multiplier is 50 .\ Number of contracts

,vdots.dotsdotsdotsdotsdotsdotsdotsdots\ c. How many contracts should you enter into if the beta of your portfolio is 0.6 ?\ Number of contracts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started