Question

You manage a bond portfolio which currently has a present value of $ 12 million. You want to hedge the value of your portfolio against

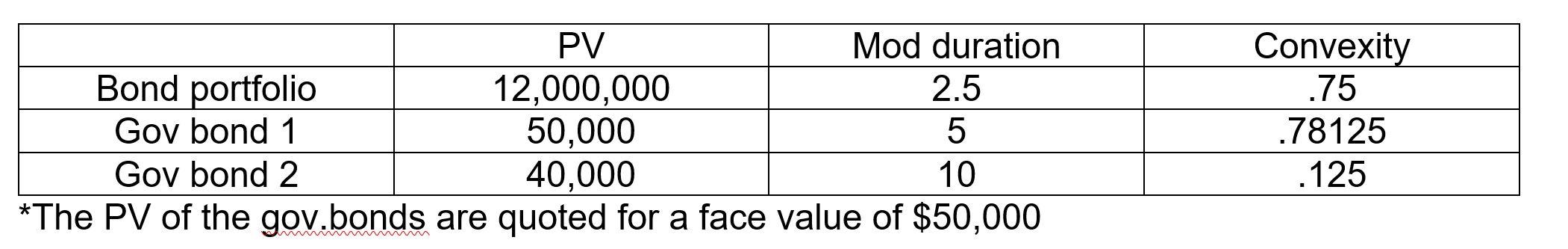

You manage a bond portfolio which currently has a present value of $ 12 million. You want to hedge the value of your portfolio against parallel movements in the yield curve. In the market there are two government bond available which can be bought or sold in multiples of $50,000 of face value. How many gov. bonds 1 and 2 do you need to buy or sell in order to achieve your aim?

Please explain in detail

Please explain in detail

Option answers:

Buy 240 gov bonds 1 and buy 150 gov bond 2

Sell short 240 gov bonds 1 and sell short 150 gov bond 2

Buy 240 gov bonds 1 and sell short 75 gov bond 2

Sell short 240 gov bonds 1 and buy 75 gov bond 2

Buy 300 gov bonds 1 and buy 150 gov bond 2

Sell short 300 gov bonds 1 and sell short 150 gov bond 2

Buy 300 gov bonds 1 and sell short 75 gov bond 2

Sell short 300 gov bonds 1 and buy 75 gov bond 2

\begin{tabular}{|c|c|c|c|} \hline & PV & Mod duration & Convexity \\ \hline Bond portfolio & 12,000,000 & 2.5 & .75 \\ \hline Gov bond 1 & 50,000 & 5 & .78125 \\ \hline Gov bond 2 & 40,000 & 10 & .125 \\ \hline \end{tabular} The PV of the gov.bonds are quoted for a face value of $50,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started