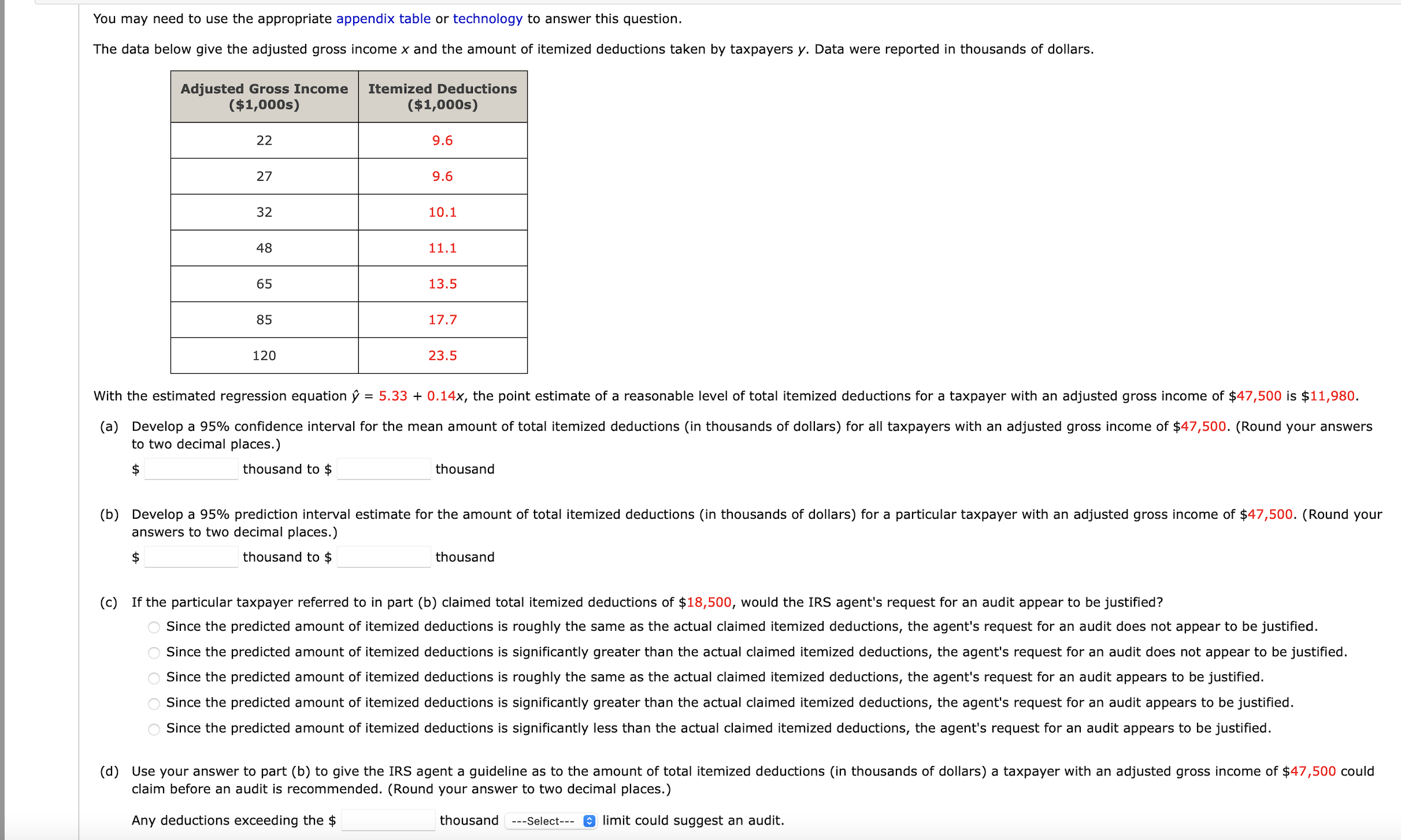

You may need to use the appropriate appendix table or technology to answer this question. The data below give the adjusted gross income x and the amount of itemized deductions taken by taxpayers y. Data were reported in thousands of dollars. Adjusted Gross Income Itemized Deductions ($1,000s) ($1,000s) 22 9.6 27 9.6 32 10.1 48 11.1 65 13.5 85 17.7 120 23.5 With the estimated regression equation y = 5.33 + 0.14x, the point estimate of a reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of $47,500 is $11,980. (a) Develop a 95% confidence interval for the mean amount of total itemized deductions (in thousands of dollars) for all taxpayers with an adjusted gross income of $47,500. (Round your answers to two decimal places.) $ thousand to $ thousand (b) Develop a 95% prediction interval estimate for the amount of total itemized deductions (in thousands of dollars) for a particular taxpayer with an adjusted gross income of $47,500. (Round your answers to two decimal places.) $ thousand to $ thousand (c) If the particular taxpayer referred to in part (b) claimed total itemized deductions of $18,500, would the IRS agent's request for an audit appear to be justified? Since the predicted amount of itemized deductions is roughly the same as the actual claimed itemized deductions, the agent's request for an audit does not appear to be justified. Since the predicted amount of itemized deductions is significantly greater than the actual claimed itemized deductions, the agent's request for an audit does not appear to be justified. Since the predicted amount of itemized deductions is roughly the same as the actual claimed itemized deductions, the agent's request for an audit appears to be justified Since the predicted amount of itemized deductions is significantly greater than the actual claimed itemized deductions, the agent's request for an audit appears to be justified. Since the predicted amount of itemized deductions is significantly less than the actual claimed itemized deductions, the agent's request for an audit appears to be justified. (d) Use your answer to part (b) to give the IRS agent a guideline as to the amount of total itemized deductions (in thousands of dollars) a taxpayer with an adjusted gross income of $47,500 could claim before an audit is recommended. (Round your answer to two decimal places. ) Any deductions exceeding the $ thousand ---Select--- & limit could suggest an audit