Answered step by step

Verified Expert Solution

Question

1 Approved Answer

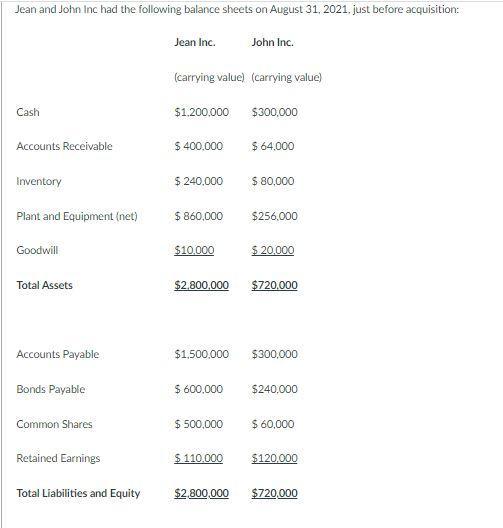

Jean and John Inc had the following balance sheets on August 31, 2021. just before acquisition: Cash Accounts Receivable Inventory Plant and Equipment (net)

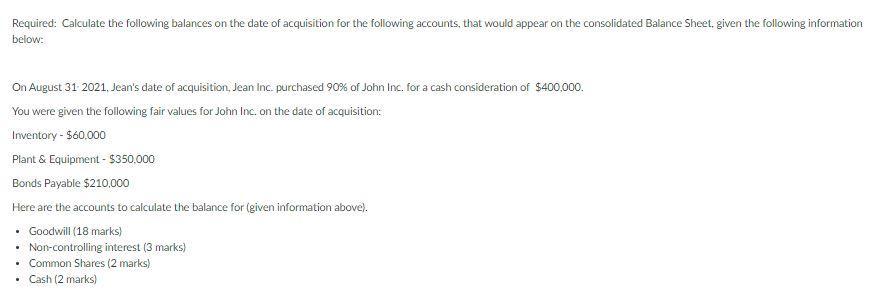

Jean and John Inc had the following balance sheets on August 31, 2021. just before acquisition: Cash Accounts Receivable Inventory Plant and Equipment (net) Goodwill Total Assets Accounts Payable Bonds Payable Common Shares Retained Earnings Total Liabilities and Equity Jean Inc. (carrying value) (carrying value) $1,200,000 $ 400,000 $ 240,000 $ 860,000 $10,000 $2,800,000 $1,500,000 $ 600.000 $ 500,000 $ 110,000 John Inc. $2,800,000 $300,000 $ 64,000 $ 80,000 $256,000 $ 20,000 $720,000 $300,000 $240,000 $ 60,000 $120,000 $720,000 Required: Calculate the following balances on the date of acquisition for the following accounts, that would appear on the consolidated Balance Sheet, given the following information below: On August 31 2021, Jean's date of acquisition, Jean Inc. purchased 90% of John Inc. for a cash consideration of $400,000. You were given the following fair values for John Inc. on the date of acquisition: Inventory - $60,000 Plant & Equipment - $350,000 Bonds Payable $210,000 Here are the accounts to calculate the balance for (given information above). Goodwill (18 marks) Non-controlling interest (3 marks). Common Shares (2 marks) . .. . Cash (2 marks)

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started