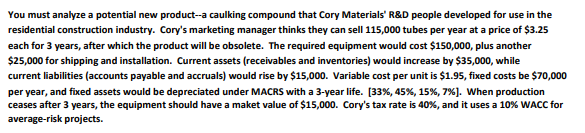

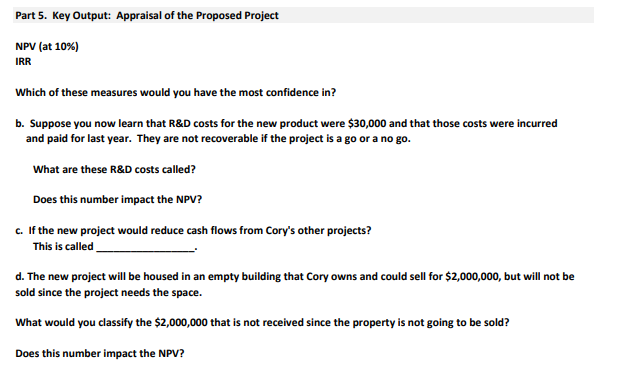

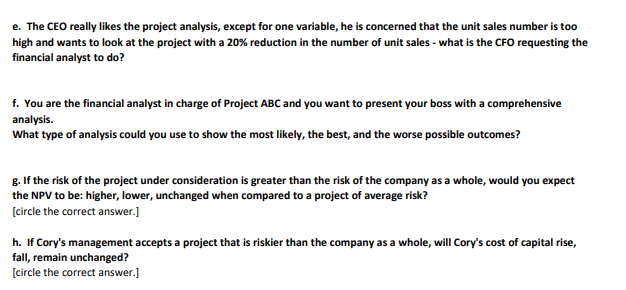

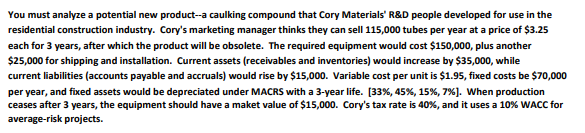

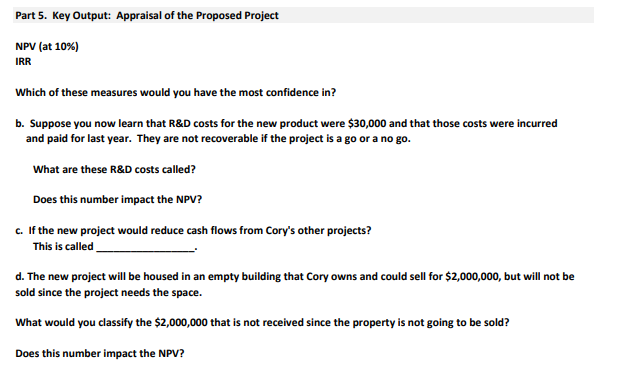

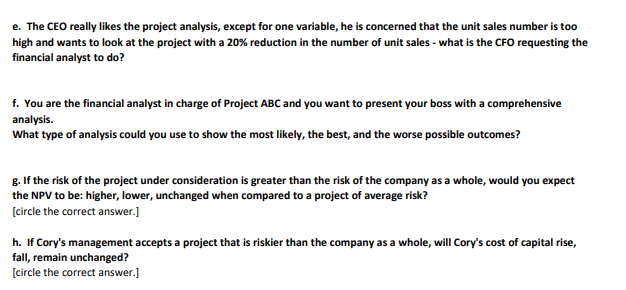

You must analyze a potential new product-a caulking compound that Cory Materials' R&D people developed for use in the residential construction industry. Cory's marketing manager thinks they can sell 115,000 tubes per year at a price of $3.25 each for 3 years, after which the product will be obsolete. The required equipment would cost $150,000, plus another $25,000 for shipping and installation. Current assets (receivables and inventories) would increase by $35,000, while current liabilities (accounts payable and accruals) would rise by $15,000. Variable cost per unit is $1.95, fixed costs be $70,000 per year, and fixed assets would be depreciated under MACRS with a 3-year life. [33%, 45%, 15%, 7%), when production ceases after 3 years, the equipment should have a maket value of $15,000. Cory's tax rate is 40%, and it uses a 10% WACC for average-risk projects. Part 5. Key Output: Appraisal of the Proposed Project NPV (at 10%) IRR Which of these measures would you have the most confidence in? b. Suppose you now learn that R&D costs for the new product were $30,000 and that those costs were incurred and paid for last year. They are not recoverable if the project is a go or a no go. What are these R&D costs called? Does this number impact the NPV? c. If the new project would reduce cash flows from Cory's other projects? This is called d. The new project will be housed in an empty building that Cory owns and could sell for $2,000,000, but will not be sold since the project needs the space. What would you classify the $2,000,000 that is not received since the property is not going to be sold? Does this number impact the NPV? e. The CEO really likes the project analysis, except for one variable, he is concerned that the unit sales number is too high and wants to look at the project with a 20% reduction in the number of unit sales . what is the CFO requesting the financial analyst to do? f. You are the financial analyst in charge of Project ABC and you want to present your boss with a comprehensive analysis. What type of analysis could you use to show the most likely, the best, and the worse possible outcomes? g. If the risk of the project under consideration is greater than the risk of the company as a whole, would you expect the NPV to be: higher, lower, unchanged when compared to a project of average risk? [circle the correct answer.] h. If Cory's management accepts a project that is riskier than the company as a whole, will Cory's cost of capital rise, fall, remain unchanged? [circle the correct answer.]