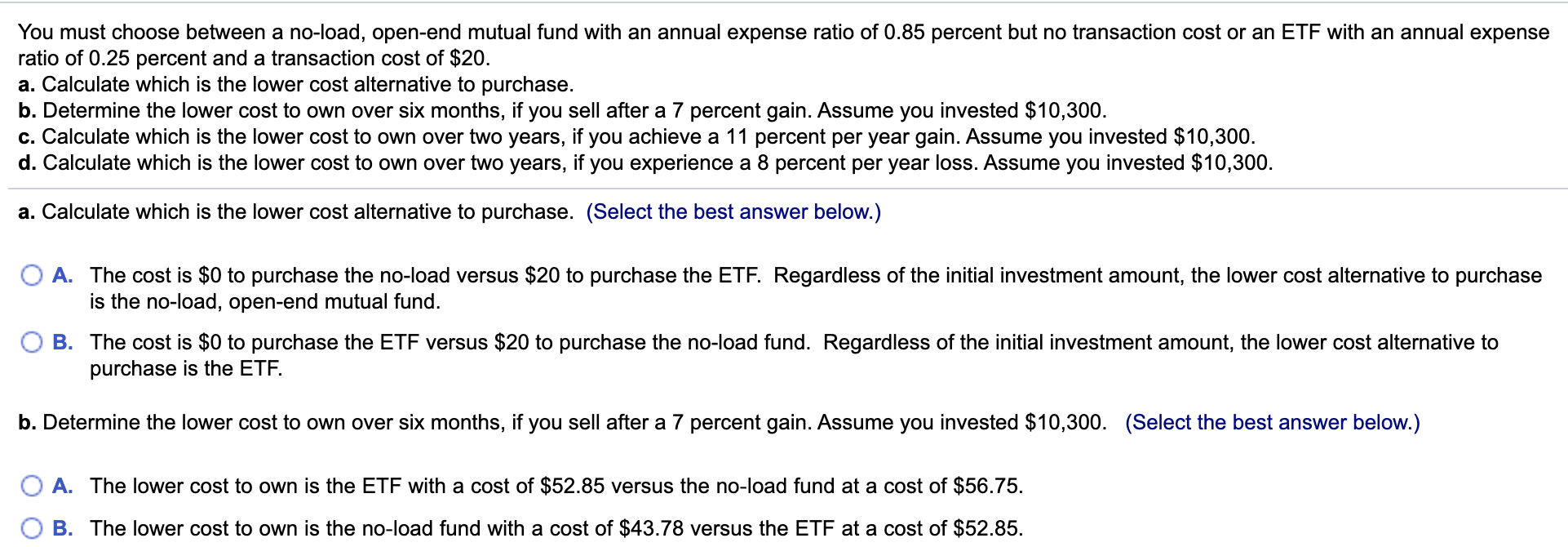

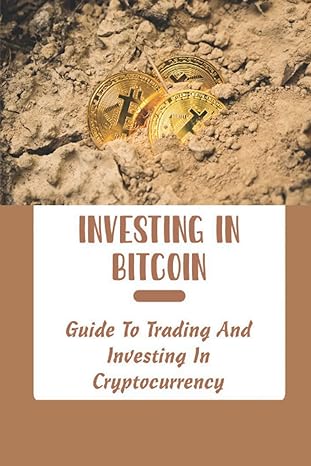

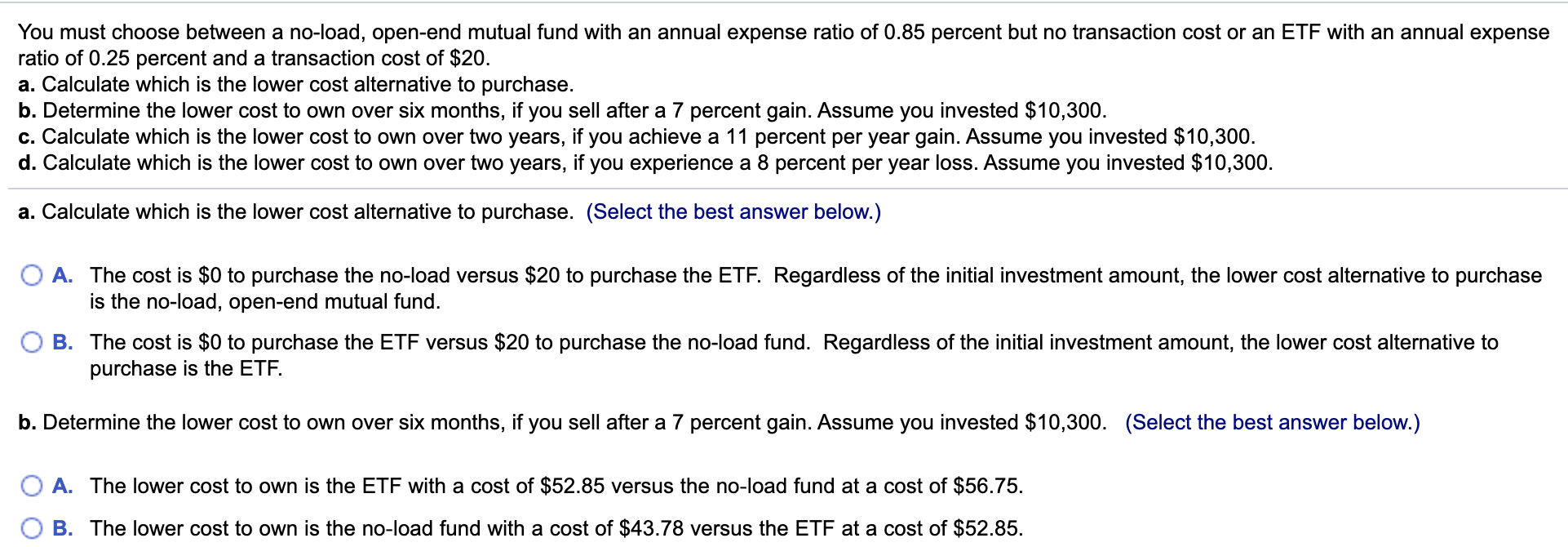

You must choose between a no-load, open-end mutual fund with an annual expense ratio of 0.85 percent but no transaction cost or an ETF with an annual expense ratio of 0.25 percent and a transaction cost of $20. a. Calculate which is the lower cost alternative to purchase. b. Determine the lower cost to own over six months, if you sell after a 7 percent gain. Assume you invested $10,300. c. Calculate which is the lower cost to own over two years, if you achieve a 11 percent per year gain. Assume you invested $10,300. d. Calculate which is the lower cost to own over two years, if you experience a 8 percent per year loss. Assume you invested $10,300. a. Calculate which is the lower cost alternative to purchase. (Select the best answer below.) O A. The cost is $0 to purchase the no-load versus $20 to purchase the ETF. Regardless of the initial investment amount, the lower cost alternative to purchase is the no-load, open-end mutual fund. B. The cost is $0 to purchase the ETF versus $20 to purchase the no-load fund. Regardless of the initial investment amount, the lower cost alternative to purchase is the ETF. b. Determine the lower cost to own over six months, if you sell after a 7 percent gain. Assume you invested $10,300. (Select the best answer below.) A. The lower cost to own is the ETF with a cost of $52.85 versus the no-load fund at a cost of $56.75. B. The lower cost to own is the no-load fund with a cost of $43.78 versus the ETF at a cost of $52.85. c. Calculate which fund is the lower cost to own over two years, if each fund experiences a 11 percent per year gain and you sell your shares at the end of the two-year period. Assume you invested $10,300. (Select the best answer below.) A. The lower cost to own is the ETF with a cost of $96.99 versus the no-load fund at a cost of $193.62. B. The lower cost to own is the no-load fund with a cost of $193.62 versus the ETF at a cost of $99.18. d. Calculate which fund is the lower cost to own over two years, if you experience a 8 percent per year lossand you sell your shares at the end of the two-year period. Assume you invested $10,300. (Select the best answer below.) A. The lower cost to own is the ETF with a cost of $87.22 versus the no-load fund at a cost of $160.35. B. The lower cost to own is the no-load fund with a cost of $160.35 versus the ETF at a cost of $193.62