Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you must come up with result of stock value per share = 19.09 show how to plugin the numbers in the formula 1. earnings per

you must come up with result of stock value per share = 19.09

show how to plugin the numbers in the formula

1. earnings per share = 1.67

2. growth rate of = 5%

3. 3 years

4. discount rate= 10%

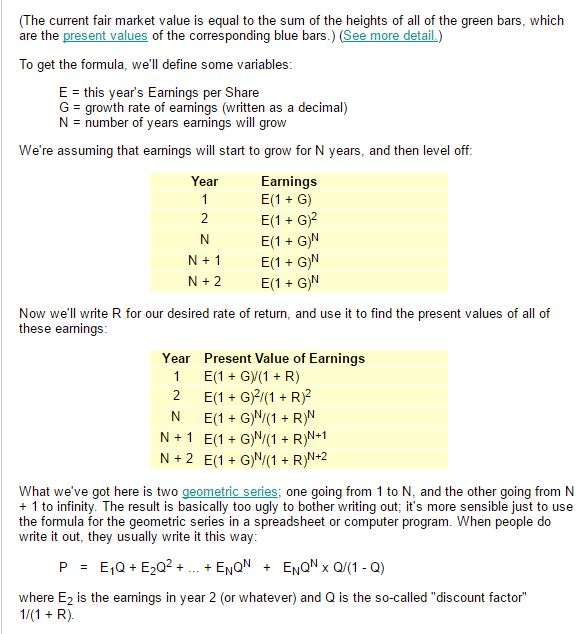

he current fair market value is equal to the sum of the heights of all of the green bars, which are the present values of the corresponding blue bars (See more detail.) To get the formula, we'll define some variables E this year's Earnings per Share G growth rate of earnings (written as a decimal) N number of years earnings will grow We're assuming that earnings will start to grow for N years, and then level off Year Earnings E(1 G E(1 G? E(1 G) N 1 E(1 G) N 2 E(1 G N Now we'll write R for our desired rate of return, and use it to find the present values of a of these earnings: Year Present value of Earnings 1 E(1 Gy(1 R G)2/(1 R E(1 E(1 G) /(1 R N+ N+2 What we've got here is two geometric series; one going from 1 to N, and the other going from N 1 to infinity. The result is basically too ugly to bother writing out, it's more sensible just to use the formula for the geometric series in a spreadsheet or computer program When people do write it out, they usually write it this way where E2 is the earnings in year 2 (or whatever) and Q is the so-called "discount factor 1/(1 R)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started