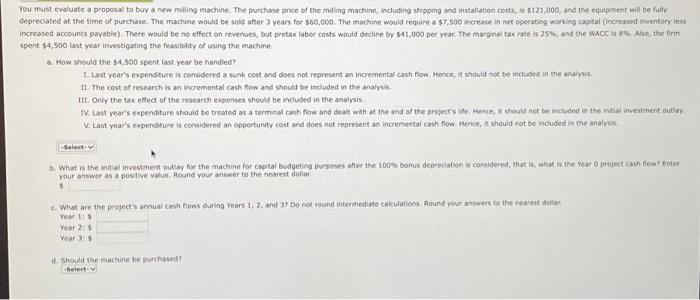

You must evaluate a proposal to buy a new miling machine. The purchase price of the miling machine, inchuding shipping and installation costs, is s121,000, and the equtpenent mit be fully depreciated at the time of purchase. The machine would be scid after 3 years for $60,000. The machine would require a $7,500 increase in net operating werking capitai (increased inventory iess increased accounts payable). There would be no effect on reverues, but pretax labor costs would decline by $41,000 per year. The marginai takrase is 25%6, and the wacC is ats. Alie, the firm spent $4,500 last year investigating the feavbity of wing the machine. a. How should the $4,500 spent last year be handied? 1. Last year's expendture is considered a sunk cost and does not represent an incremental cash fow. Hence, tt should not be inctuoet in ehe analywi. 14. The cont of research is an incremental cash flow and should be indluded in the analyus. IIt. Only the tax effect of the research expeoses should be included in the analysis IV. Last year's expenditure should be treated as a terminal cash fow and deait wath at the end of the project's lfe. Hence, is should not be included in ihe in6al investment outiay V. Last yoar's expensture is considered an opportunity cost and does not rearesent an incremental cash fow . Hence, it should not be induded in the anslivis whur answer as a postive value. Pound your anwwer to the nearest doliar. 1 C. What are the project's amual cash fows during Yoars 1, 2, and 37 Do not round intermediate caikulateons. Aound your answers to the neart dollae. Year 111 Year 215 Year 3:1 a. Shevid the machine be purchased? You must evaluate a proposal to buy a new miling machine. The purchase price of the miling machine, inchuding shipping and installation costs, is s121,000, and the equtpenent mit be fully depreciated at the time of purchase. The machine would be scid after 3 years for $60,000. The machine would require a $7,500 increase in net operating werking capitai (increased inventory iess increased accounts payable). There would be no effect on reverues, but pretax labor costs would decline by $41,000 per year. The marginai takrase is 25%6, and the wacC is ats. Alie, the firm spent $4,500 last year investigating the feavbity of wing the machine. a. How should the $4,500 spent last year be handied? 1. Last year's expendture is considered a sunk cost and does not represent an incremental cash fow. Hence, tt should not be inctuoet in ehe analywi. 14. The cont of research is an incremental cash flow and should be indluded in the analyus. IIt. Only the tax effect of the research expeoses should be included in the analysis IV. Last year's expenditure should be treated as a terminal cash fow and deait wath at the end of the project's lfe. Hence, is should not be included in ihe in6al investment outiay V. Last yoar's expensture is considered an opportunity cost and does not rearesent an incremental cash fow . Hence, it should not be induded in the anslivis whur answer as a postive value. Pound your anwwer to the nearest doliar. 1 C. What are the project's amual cash fows during Yoars 1, 2, and 37 Do not round intermediate caikulateons. Aound your answers to the neart dollae. Year 111 Year 215 Year 3:1 a. Shevid the machine be purchased