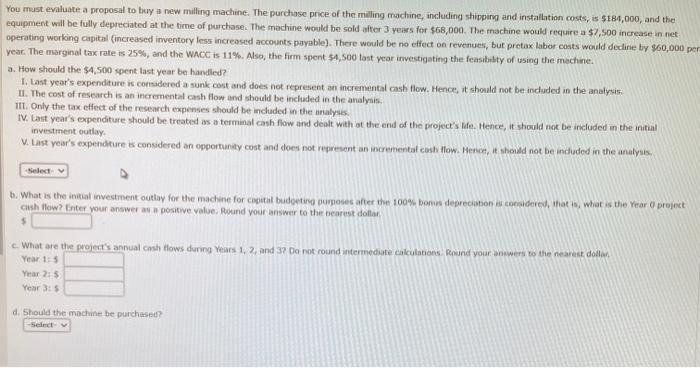

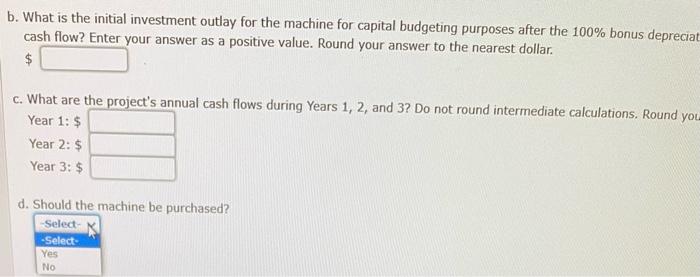

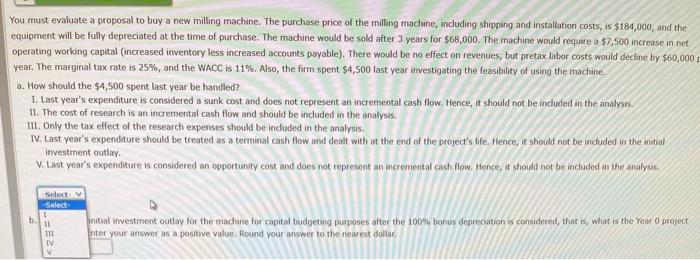

You must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation costs, is $184,000, and the equipment will be fully depreciated at the time of purchase: The machine would be sold aiter 3 years for $68,000. The machine would require a $7, 500 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor coats would decline by 460,000 yeac. The marginal tax rate is 25%, and the WACC is 11%. Also, the firm spent 54,500 tast year investigating the feasibity of using the machine. a. How should the $4,500 sent last year be handliod? 1. Last year's expenditure is consdered a sunk cost and does not represent an incremental cash flow. Hence, tt should not be inctuded in the analysis. II. The cost of research is an increnental cash flow and should be inchuded in the analyais. III. Only the tax effect of the research expenses should be included in the analysis. IV. Last year's expenditure should be treated as a terminal cash fow and dealt with ot the end of the project's lde. Hence, it should nok be included an the initial investment outlay. V. Last year's expendture E considered an opportunity cost and does not represent an ucremiental cosh flow. Hense, it should not be induded in the analysis. b. What is the inital investment outlay for the machene for cagital budgeting purposes after the 100\% bonas depreciabon is cocaidered, that is. what is the Year 0 projcet cash flow? Enter vour answer as a positive value. Pound your answer to the nearest doflar 4 c. What are the project's annual cahh flows during Years 1,2 and 32 Do not round intermediate cakculations. Rownd your anwwers to the hearect dolah Year 1:5 Year 2:5 Year 3:5 a. Should the machine be purchases? b. What is the initial investment outlay for the machine for capital budgeting purposes after the 100% bonus depreciat cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar. $ c. What are the project's annual cash flows during Years 1, 2, and 3? Do not round intermediate calculations. Round yo Year 1: $ Year 2:$ Year 3:$ d. Should the machine be purchased? You must evaluate a proposal to buy a new milling machine. The purchase price of the milling machune, including shipping and installation costs, is $184,000, and the equipment will be fully depreciated at the time of purchase. The machine would be sold after 3 years for $68,000. The machine would require a $7,500 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $60,000 year. The marginal tax rate is 25%, and the WACC is 11%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. a. How should the $4,500 spent last year be handled? I. Last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be induded in the analysis. II. The cost of research is an incremental cash flow and should be included in the analysis. 111. Only the tax effect of the research expenses should be indiaded in the analysis. IV. Last year's expenditure should be treated as a terminal cash flow and dealt with at the end of the project's life. Hence, it should not be induded in the intial investment outlay. V. Last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow, Henoe, it should not be included in the analyas. fitial investment outlay for the machine for capital budgeting purposes after the 100F bonus depreciation is considered, that is, whit is the Year 0 project ster your answer as a positive value. Round your anwwer to the nearest dollac