Question

You must evaluate the purchase of a proposed spectrometer for the R&D department. The base price is $120,000, and it would cost another $30,000 to

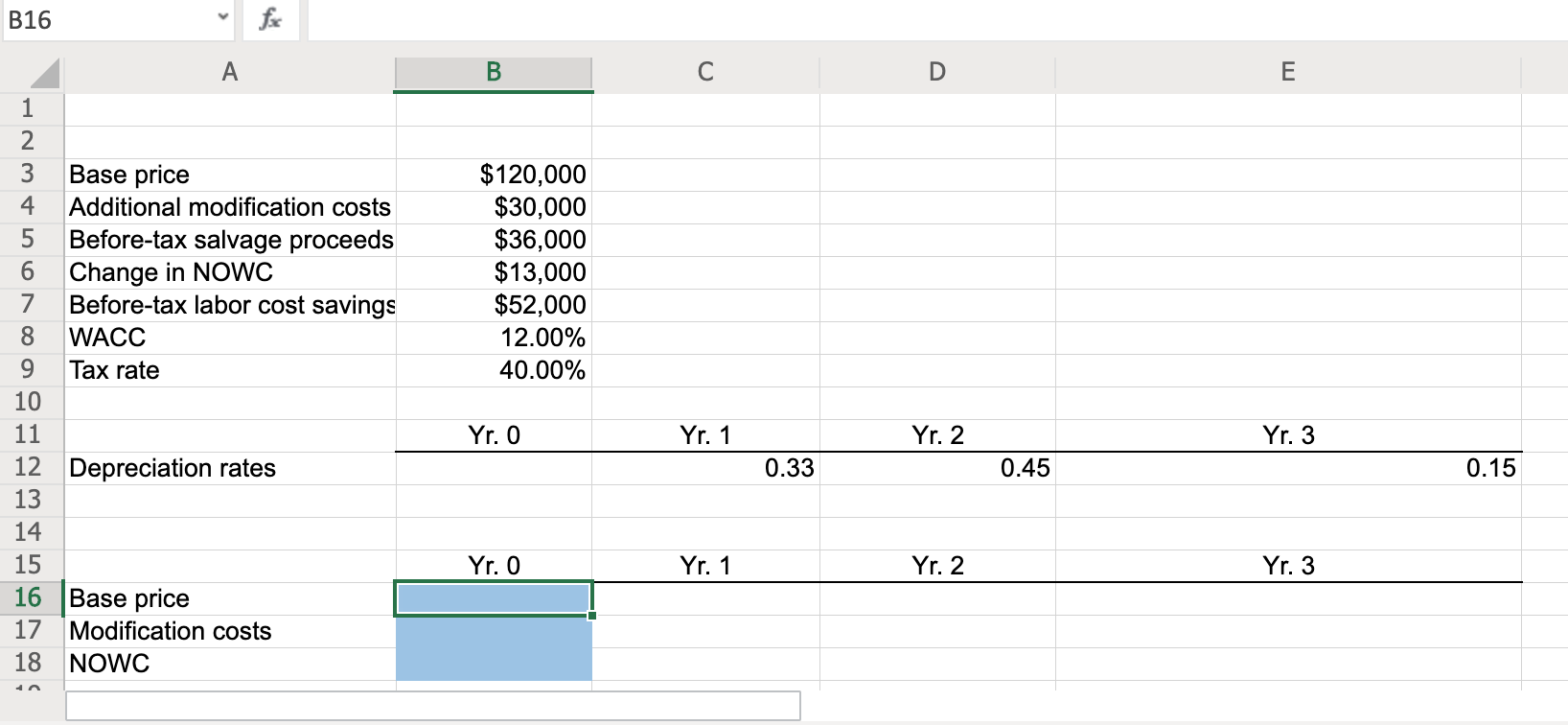

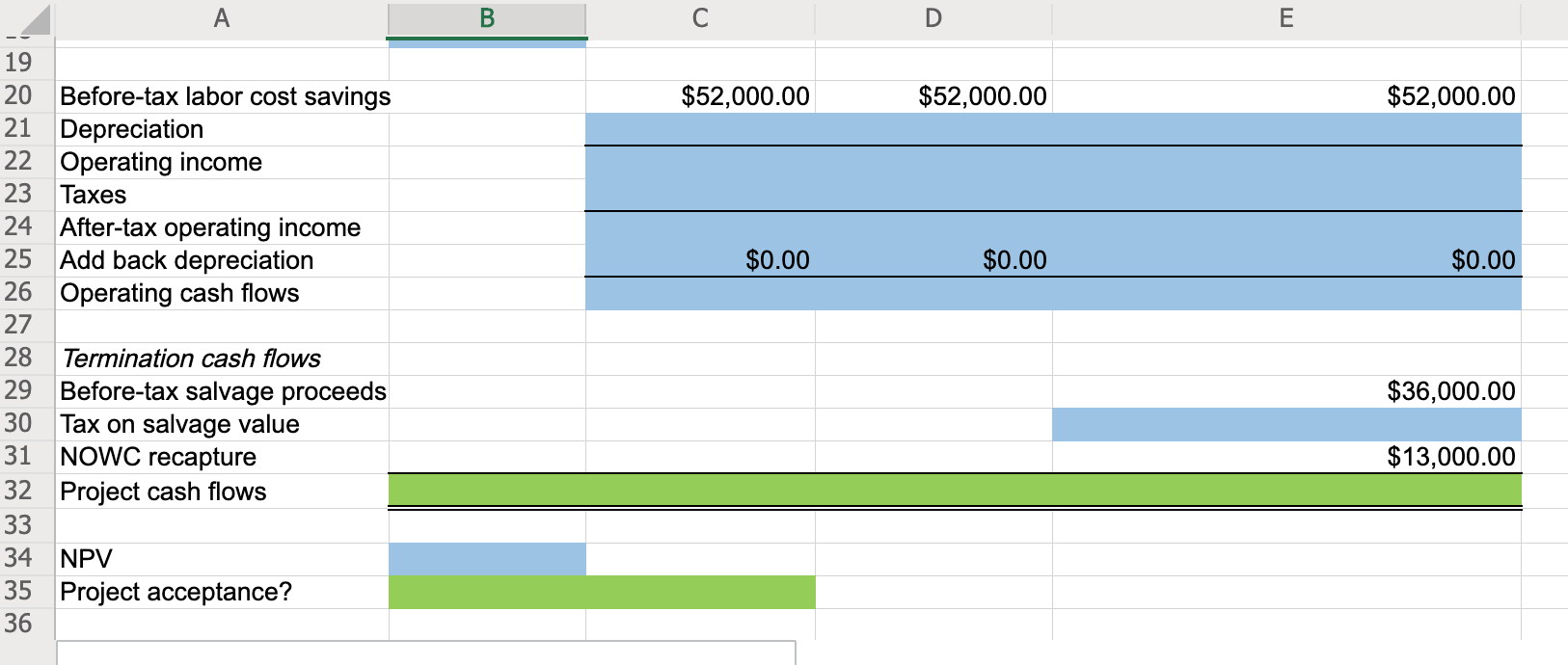

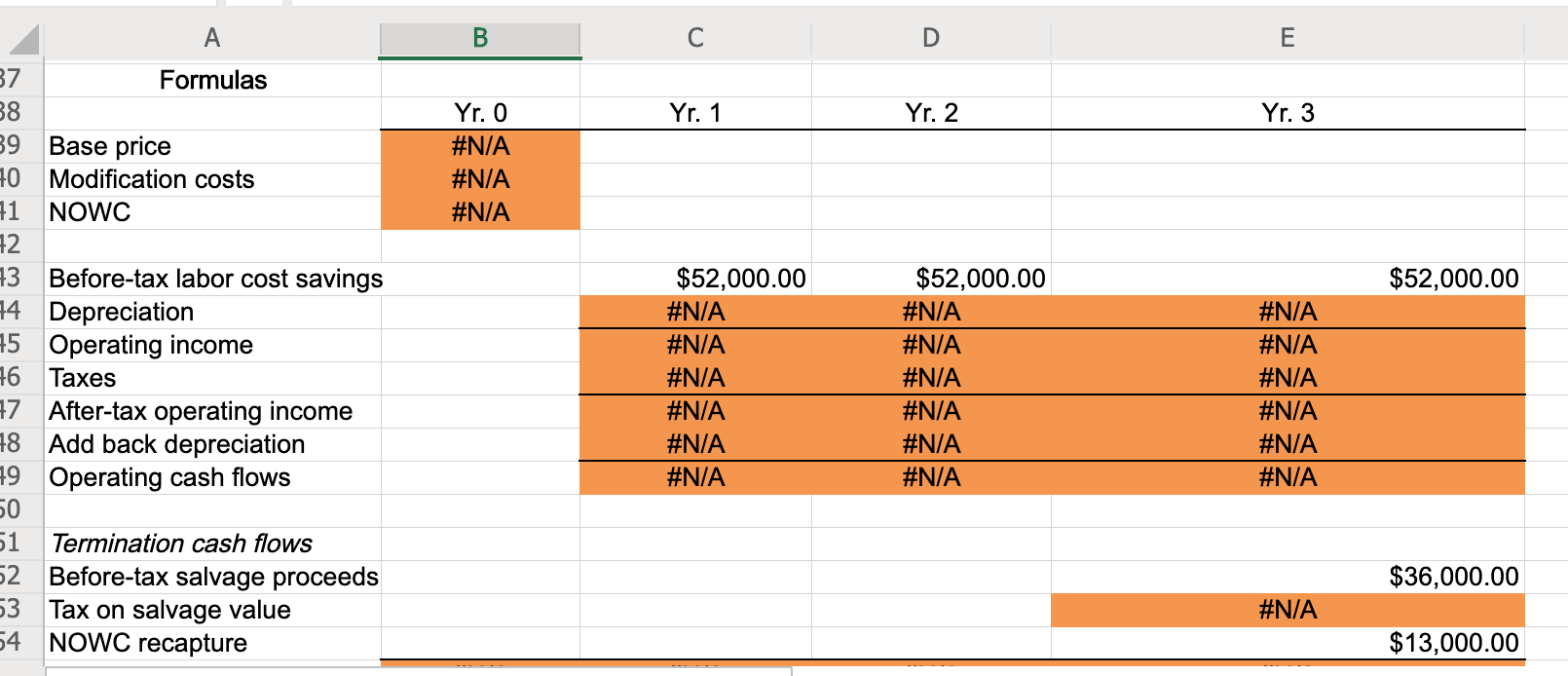

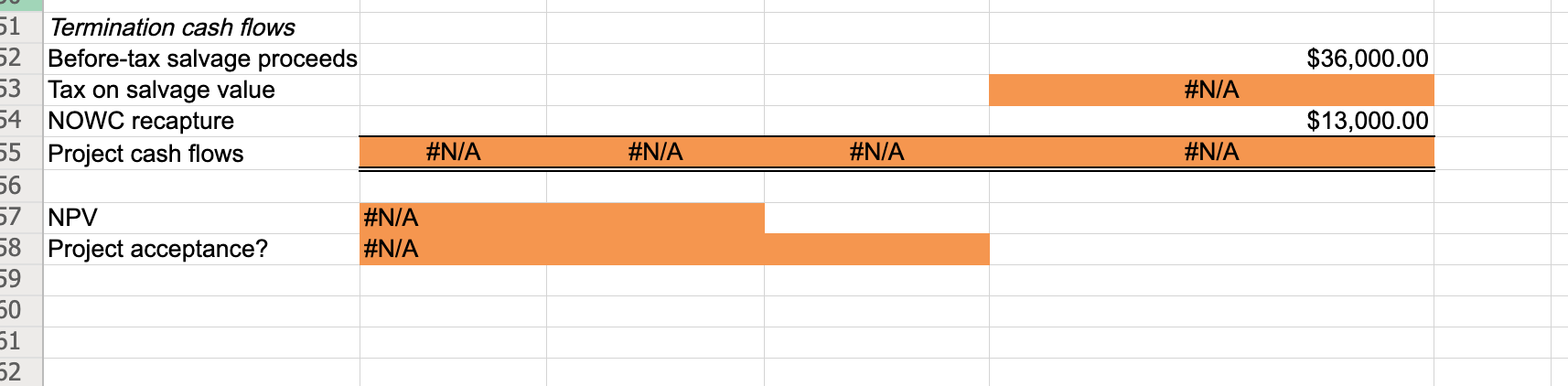

You must evaluate the purchase of a proposed spectrometer for the R&D department. The base price is $120,000, and it would cost another $30,000 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3 years for $36,000. The applicable depreciation rates are 33%, 45%, 15%, and 7%. The equipment would require an $13,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $52,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 40%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

Open spreadsheet

-

What is the initial investment outlay for the spectrometer, that is, what is the Year 0 project cash flow? Round your answer to the nearest cent. Negative amount should be indicated by a minus sign.

$

-

What are the project's annual cash flows in Years 1, 2, and 3? Round your answers to the nearest cent.

In Year 1 $

In Year 2 $

In Year 3 $

-

If the WACC is 12%, should the spectrometer be purchased?

_____Yes or No?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started