Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You must own 100 shares of ClassBook three months from today. ClassBook will not pay any dividends over the next 3 months. You have

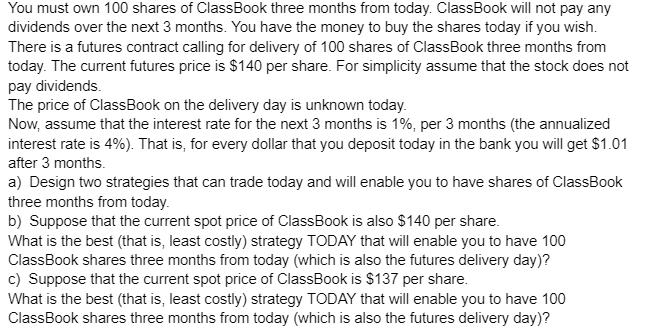

You must own 100 shares of ClassBook three months from today. ClassBook will not pay any dividends over the next 3 months. You have the money to buy the shares today if you wish. There is a futures contract calling for delivery of 100 shares of ClassBook three months from today. The current futures price is $140 per share. For simplicity assume that the stock does not pay dividends. The price of ClassBook on the delivery day is unknown today. Now, assume that the interest rate for the next 3 months is 1%, per 3 months (the annualized interest rate is 4%). That is, for every dollar that you deposit today in the bank you will get $1.01 after 3 months. a) Design two strategies that can trade today and will enable you to have shares of ClassBook three months from today. b) Suppose that the current spot price of ClassBook is also $140 per share. What is the best (that is, least costly) strategy TODAY that will enable you to have 100 ClassBook shares three months from today (which is also the futures delivery day)? c) Suppose that the current spot price of ClassBook is $137 per share. What is the best (that is, least costly) strategy TODAY that will enable you to have 100 ClassBook shares three months from today (which is also the futures delivery day)?

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The two strategies are i Purchase the 100 shares of Notebook today and carry them till 3 mo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started