Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You must show timelines, formulas with the values (numbers) included, and the final answer and you should NEVER ROUND INTERMEDIATE CALCULATIONS. Final dollar answers should

You must show timelines, formulas with the values (numbers) included, and the final answer and you should NEVER ROUND INTERMEDIATE CALCULATIONS. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. You do not need to show trailing zeros (i.e., if no non-zero digits remain, 2.5% will do instead of 2.500000%) but make certain there are none.

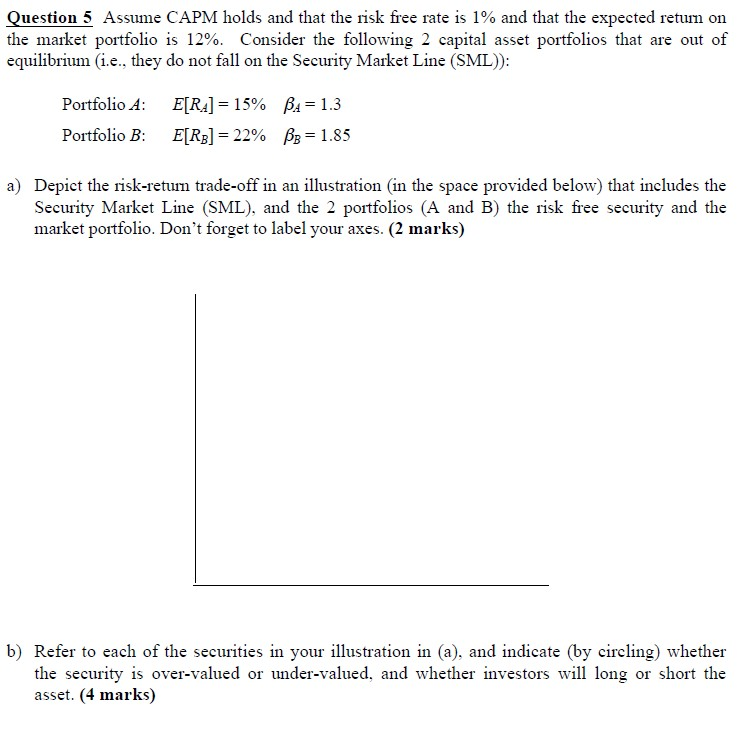

Question 5 Assume CAPM holds and that the risk free rate is 1% and that the expected retum on the market portfolio is 12%. Consider the following 2 capital asset portfolios that are out of equilibrium (i.e., they do not fall on the Security Market Line (SML)): Portfolio A: Portfolio B: E[RA] = 15% BA= 1.3 E[RB] = 22% BB = 1.85 a) Depict the risk-retum trade-off in an illustration in the space provided below) that includes the Security Market Line (SML), and the 2 portfolios (A and B) the risk free security and the market portfolio. Don't forget to label your axes. (2 marks) b) Refer to each of the securities in your illustration in (a), and indicate (by circling) whether the security is over-valued or under-valued, and whether investors will long or short the asset. (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started