You must use the Diamond-E Framework as the basis for all your answers. You are free to use other frameworks and strategic models to supplement the Diamond-E Framework.

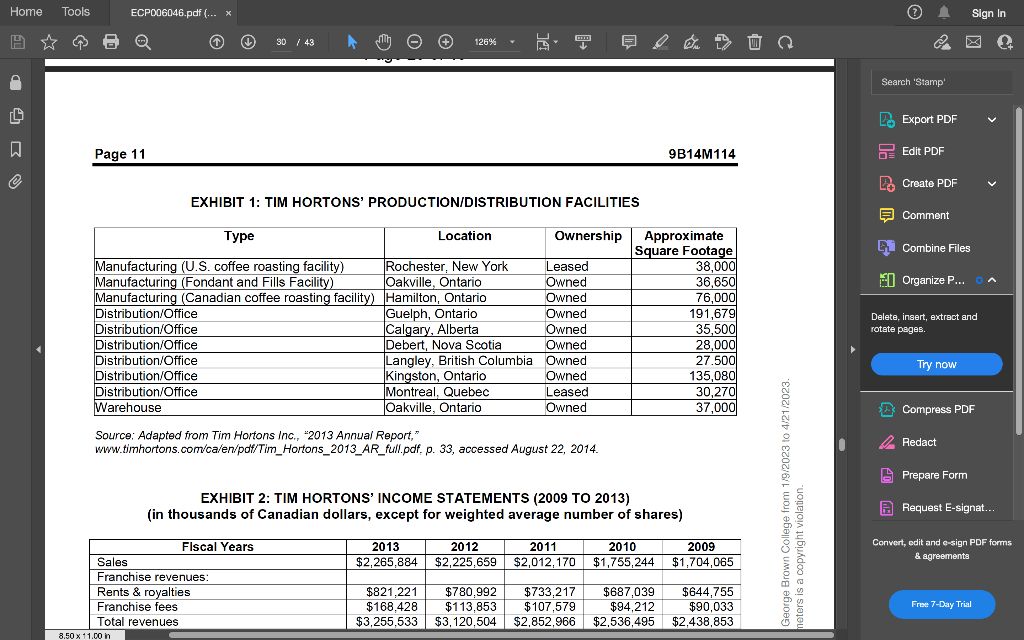

Imagine you are a consultant, hired by 3G Capital, to conduct an assessment on Tim Hortons as part of the acquisition target analysis. You have been requested to include the following questions as part of your assessment.

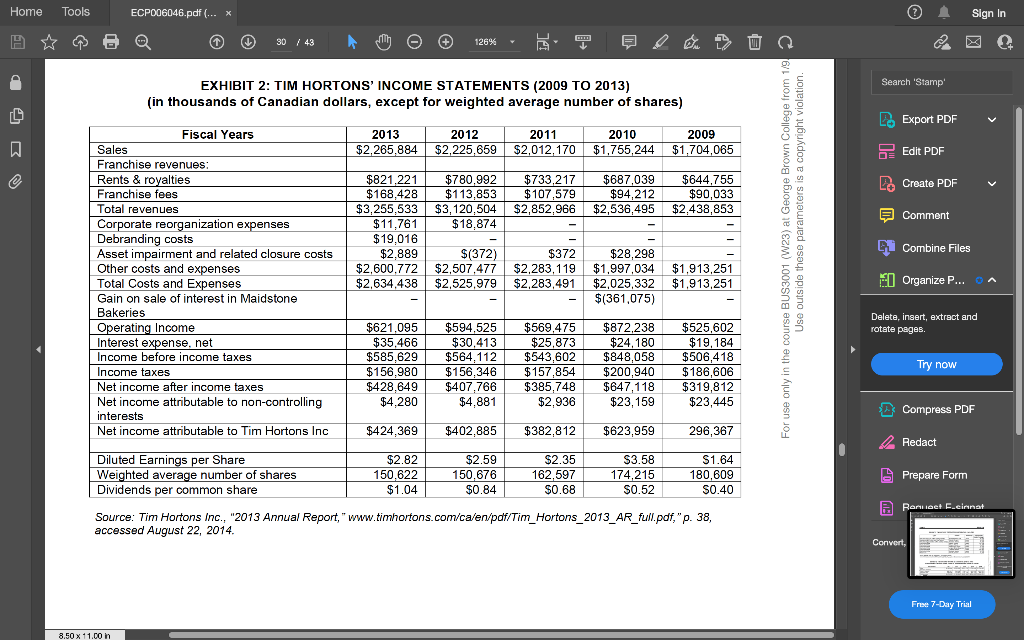

Conduct an internal analysis (strategy to resource, and strategy to organization) of Tim Hortons. Be sure to leverage frameworks learned in class and in the textbook when completing your analysis.

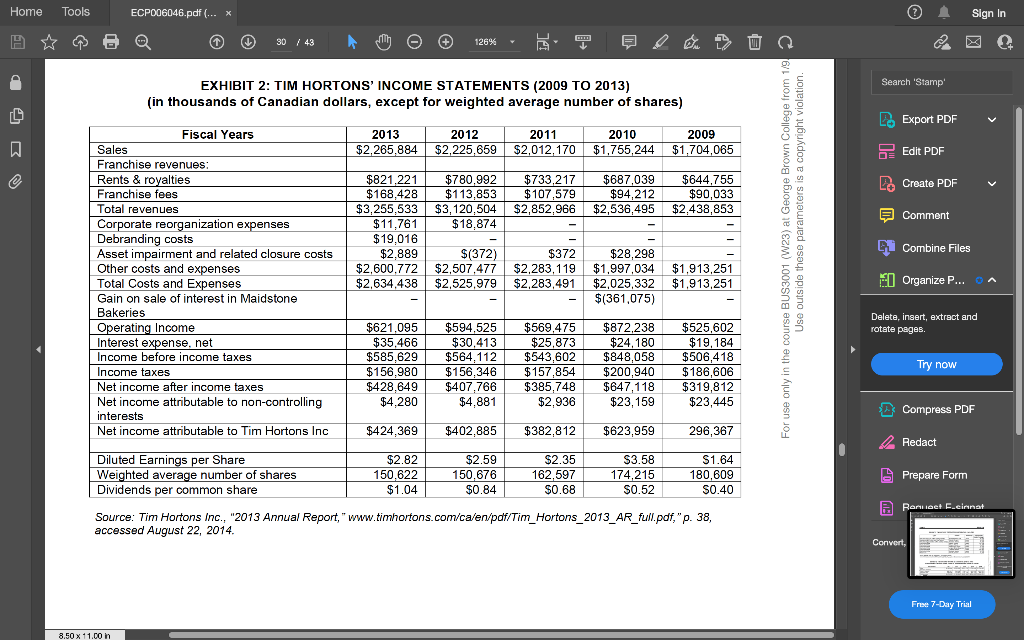

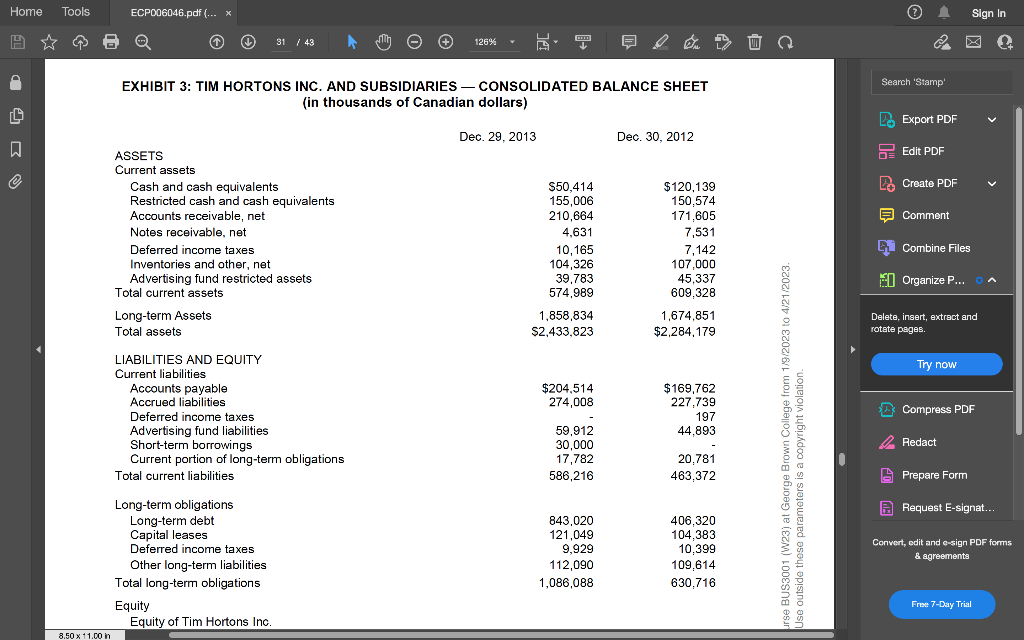

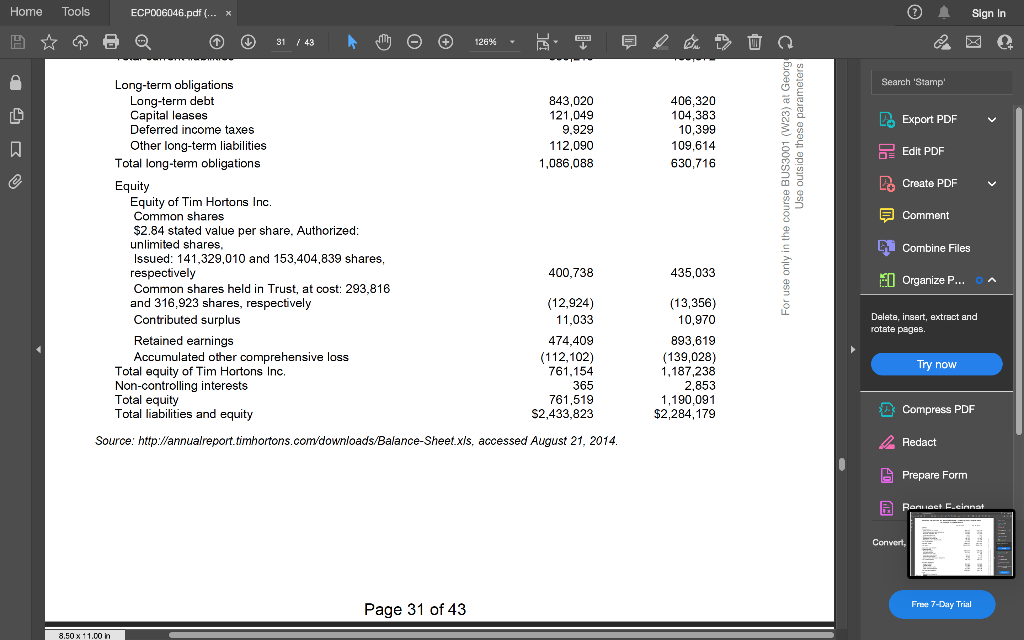

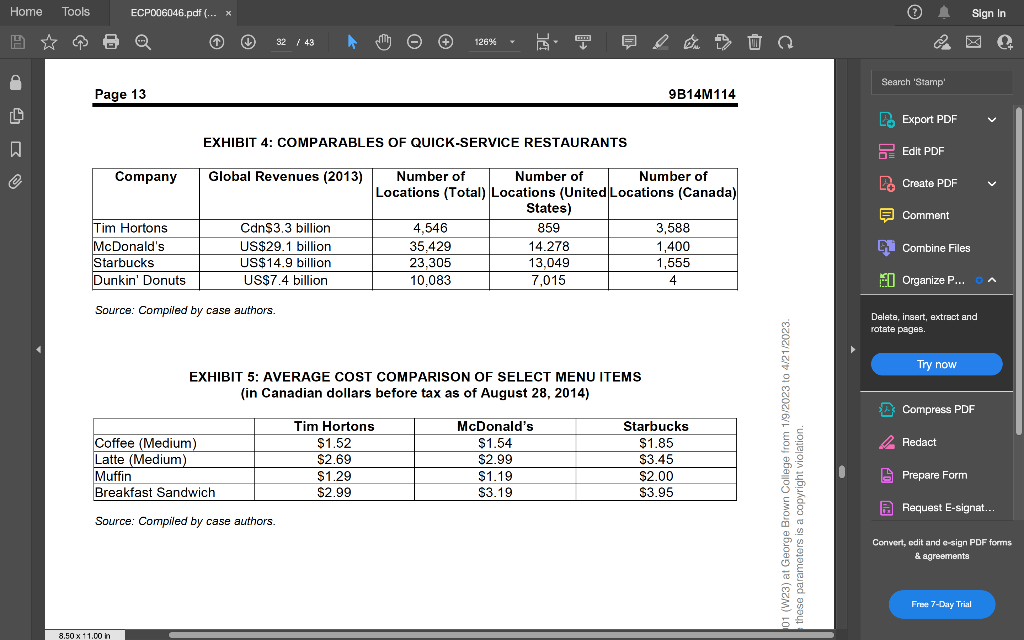

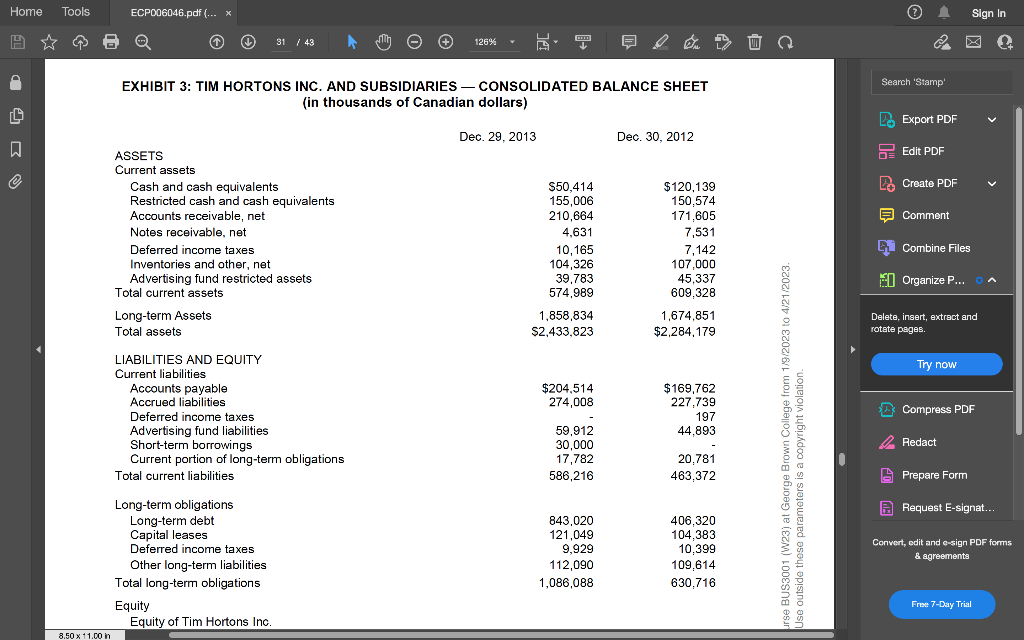

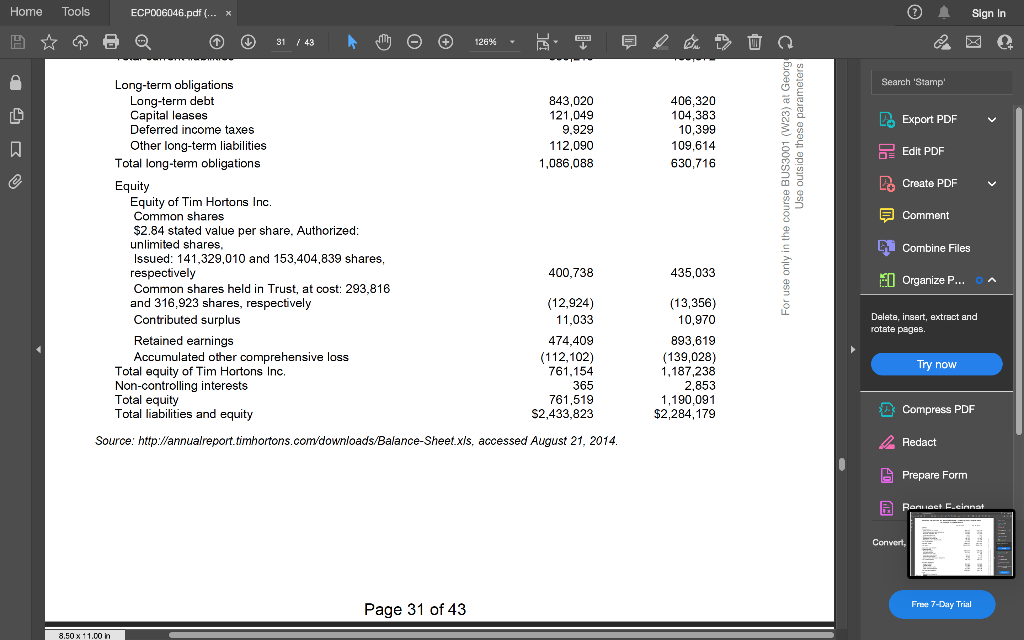

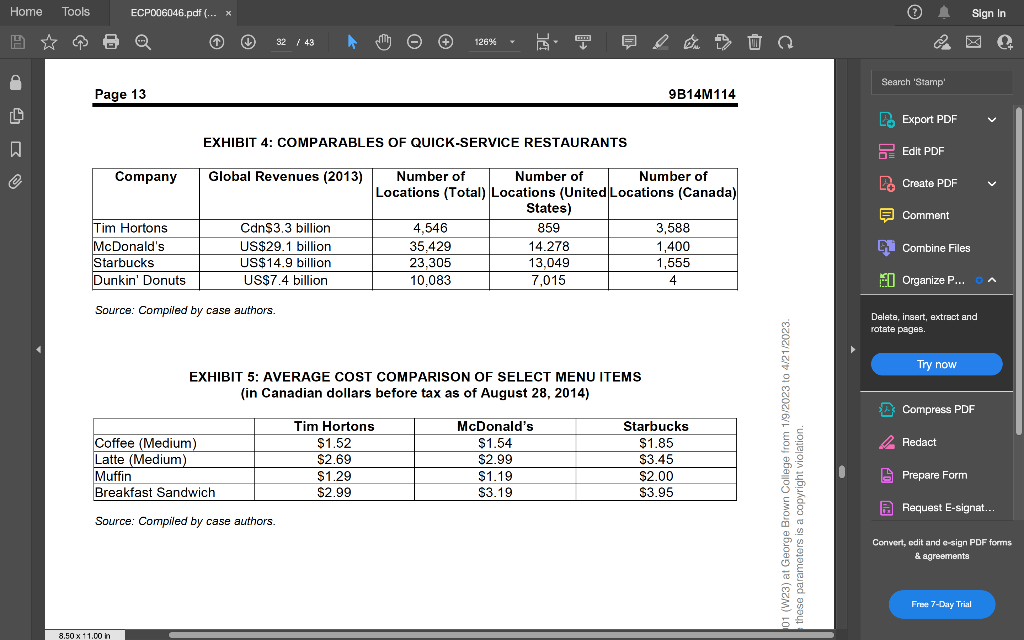

It would be a year of dramatic change for Tim Hortons Inc. On August 26, 2014, the company's board of directors had agreed to be acquired by 3G Capital, the investment firm that owned Burger King. The new company would become the third-largest fast food restaurant chain in the world with 18,000 locations in 98 countries and combined international sales of $23 billion dollars. 2 The new company would be headquartered in Oakville, Ontario, Canada and largcly operate as two separate entitics. The deal still had to be approved by Tim Hortons' shareholders and potentially by Canadian and American regulatory authorities. It was believed that this deal would help Tim Hortons with its plans for international expansion, 2013 had been an ambitious year. Tim Hortons had opened 261 new locations and refreshed more than 300 existing locations in Canada and the United States. While Tim Horlons was almost synonymous with the Canadian identity, its brand and products were far less known outside of Canada's borders; to hit ambitious growth targets, international expansion was a must, and Burger King's global experience could provide expert advice. Marc Caira, Tim Hortons' president and chicf execulive officer (CEO), commented, "We are very, very confident that we can grow much quicker in this must-win battle called the United States with our partners than we would have otherwise done on our own."? Even with the acquisition, Tim Hortons would need to make clear strategic choices to achieve its aggressive growth and financial goals. Inconsistent economic growh was fostering increased competition and consumer tastes were evolving, making menu innovation an important priority. Achieving the returns shareholders expected would be challenging. 2014 would be the 50th year of operations for Tim Hortons. Even with Burger King's help, the company would need to have clear competitive advantages and make smart strategic choices for the next 50 years to be as successful as its first half century. THE RESTAURANT INDUSTRY With over 900,000 locations, the restaurant industry in the United States was projected to reach US $683.4 billion in 2014, up 3.6 per cent from 2013.4 While this would be the fifth consecutive year of real growth, it was lower than expected for post-recession recovery. The restaurant industry's share of the overall food dollar was up to 47 per cent, almost double the 25 per cent it held in 199556 It was expected to employ 13.5 million people in 2014 . The industry was highly fragmented, with the 50 largest companies accounting for only 20 per cent of the revenuc.? In Canada, revenucs from commercial food service were projected to be $57.5 billion in 2014, an increase of 4.7 per cent over 2013 . Growth was expected to come from higher average bills rather than from additional food raflic in restaurants. " In 2012 , there were approximately 1.1 million employees in the Canadian restaurant industry at more than 81,000 restaurants, bars and catering businesses. 9 The restaurant industry in North America was divided into two categories: full-service and limitedservice. Full-service included family, casual and fine dining where patrons would be seated and food was ordered at the table. Customers paid after eating, and the average bill was the highest for any of the segments at $13.66 in 2013.10 Full-service dining restaurants incorporated all types of cuisines and included Boston Pizza, Red Lobster, and Ruth Chris' Steak House, among others. However, the majority of restaurants in this segment continued to be individual or family-owned establishments. The limited-service restaurant sector differed from full-service dining in that consumers were not waited on at the table. Instead, customers went to a central counter where they ordered, paid before receiving their food and either ate in the restaurant or had it "to go." The limited-service restaurant sector in the United States was expected to post total revenues of US\$195.4 billion in 2014, a 4.4 per cent increase over 2013. 11 Customers in this category looked for good service, good value, convenience to their home or work place, favourite types of food and healthy menu items. 12 Limited-service restaurants were divided into fast-casual restaurants and quick-service restaurants. While limited-service restaurants felt that competition was most intense within their category, fast-casual restaurants also compeled with fullservice restaurants, and quick-service restaurants competed with grocery and convenience stores. 13 Fast-casual was a growing segment in the overall restaurant market, accounting for about 5 per cent of the limited-service category. 14 in 2013, it saw an 11 per cent increase in sales 15 and was the only category to experience an increase in customer visits. 16 Fast-casual was diflerentiated from quick-service restaurants in that menu items were higher priced based on a perceived value by consumers (e.g., higher quality, customizability, handmade and/or locally sourced); as a result, average bills were higher than quickservice restaurants at $7.40 compared to $5.30, respectively. 17 Ninety-five per cent of the fast-casual segment was made up of chains, including Panera Bread, Chipotle Mexican Grill and Five Guys Burgers. Restaurants such as Tim Hortons and McDonald's fell into the quick-service category - often called "fast food." Their menu items were fast to prepare, offered at a low cost to the consumer and easy to consume. The average bill at quick-service restaurants was the lowest of all of the categories; as such, the quick-service sector was largely recession proof. There was also customer loyally, as 39 per cent of quick-service restaurant customers visited more than once a week compared to 19 per cent for fast-casual restaurants. 18 In Canada, the quick-service restaurant market represented 64,7 per cent of all meals and snacks sold in the food service industry and gencrated $22.6 billion in sales in 2013.19 The restaurant industry overall was facing challenges. The number of visits to restaurants was stagnant in the United States and Canada in the year ending June 2014. 20 Future forecasts predicted that food service industry traffic would grow at less than 1 per cent for the next few years. In addition, in the 12 months prior to July 2014, wholesale food prices rose 7.1 per cent while menu prices rose only 2.4 per cent. 21 Food and labour costs were typically the largest general cost categories for restaurants, with each accounting for approximately one-third of every sales dollar. 22 Occupancy costs were generally 5 per cent and net profits after tax from 3 per cent to 6 per cent. CONSUMER TRENDS There were a number of consumer-related trends in the food industry. From a food perspective, this included consumer preferences for locally sourced meats, seafood and produce as well as natural ingredients. Restaurants, both quick-serve and full-serve, were increasingly looking to ethnic menu items and flavours to differentiate their product offerings as consumers became more aware of ethnic cuisines. There was a desire for more gluten-free cuisine and non-wheat noodles and pasta. Finally, more attention was being placed on children's meals with a focus on catering to children's healthy nutritional needs. 23 Behavioural and demographic shifts were changing restaurant trends. In North America, the aging population was growing and consisted of individuals who were healthier and wealthier than any generation before them. They did not eat out more frequently than younger generations, but they were more likely to visit full-service restaurants. Younger generations (in particular, millennials who were 18 to 34 years old) were gaining increased purchasing power and, given their busy lifestyle, were more likely to grab food at quick-service restaurants. In particular, the morning snack, afternoon snack and evening snack were the fastest growing day segments. 21 According to Robert Carter, the executive director of food service at The NPD Group, "the overarching trend ... is that Canadians of all ages are having more sitdown meals at home and grabbing quick biles from fast food restaurants while on the go." ,25 Mobile and digital technologies were driving consumers' desire for information and offering companies new ways to attract consumer engagement. Consumers, particularly in quick-service restaurants, wanted the convenience of paying for purchases or accessing rewards through their mobile devices. 26 TIM HORTONS: A HISTORY Tim Hortons' restaurants, commonly called "Tims or Timmy's" by devoted customers, had become part of the Canadian identity. Internationally, the stores had been branded as Tim Hortons Cafe and Bake Shop. The chain was first opened in Hamilion, Canada in 1964 by hockey legend Miles G. "Tim" Horton. Ron Joyce was the franchisee of Restaurant \#1, also located in Hamilton. By 1967, he and Horton had become full partners in the company. After Horton's tragic death in a car accident in 1974, Joyce purchased Hortons' shares from his wife for $1 million, becoming the chain's sole owner. At the time, there were 40 stores, and an independent audit had appraised the business at $1.7 million. 27 Using a franchisee model ( 99.5 per cent of the stores were franchised-owned), Tim Hortons became the largest quick-service restaurant chain in Canada, specializing in coffec, baked goods, breakfasts and homestyle lunches. Its commitment to maintaining a close relationship with franchisecs and the communities where it operated generated immense guest loyalty and built the company into one of the most widely recogniced consumer brands in Canada. The company was originally incorporated as Tim Donut Ltd. Then, in 1990, it changed its name to The TLD Group Ltd. In 1995, it merged with Wendy's International Inc.; however, on September 28,2006 , it was spun off as a separate public company incorporated in Delaware, trading on the Toronto Stock Exchange and the New York Stock Exchange under TSI. Three years later, in September 2009, the company reorganized its corporate structure and became a Canadian public company named Tim Hortons Inc., effectively repatriating itself to Canada. Tim Hortons was the fourth-largest publicly traded quick-service restaurant chain in North America, based on market capitalization, and the largest in Canada. It had more than 100,000 employees, the majority of whom worked in franchised locations. The head office was in Oakville, with smaller regional offices located across Canada and in the United States. ORGANIZATIONAL STRUCTURE Tim Hortons' head office in Oakville employed more than 1,800 people who performed corporate functions in the main and regional oflices, distribution centres and manufacturing facilities. The head office buildings included Tim Hortons University (a training centre for franchisecs), corporate restaurants and an innovation centre. There were five regional offices in Canada and two in the United States. The central team supported all facets of the business, including operations, finance, human resources, information technology, legal services, research and development, training, real estate acquisitions, franchising, purchasing and marketing. Marc Caira became president and CEO in July 2013. Caira had exlensive food experience, having been the CEO of Nestle Professional and the president and CEO of Parmalat Norh America. Caira led an executive tcam of nine individuals. Tim Hortons also had a Franchisee Advisory Board made up of 16 restaurant owners from across the chain and management. This board met quarterly to discuss issues impacting the industry or the chain. 28 Mission and Vision Tim Hortons' guiding mission was "to deliver superior quality products and services for [its] guests and communities through leadership, innovation and partnerships." ,29 Its vision was "to be the quality leader in everything |it| did.,?3 Foundation Created in 1974, the Tim Hortons Children's Foundation (the Foundation) supported several charitable events, but its main focus was a summer camp program for underprivileged children. Since 1975 , more than 150,000 children and youth had attended one of six summer camps at no cost to them or their families. While donations were collected year-round through counter and drive-thru coin boxes located at Tim Hortons" stores, once a year on "Camp Day" the proceeds from coffec sales and related activities at the majority of Tim Hortons' locations were given to support the summer camp program. STORE LOCATIONS As of the end of August 2014, there were 3,588 Tim Hortons' restaurants in Canada, 859 in the United States and 38 in the Gulf Cooperation Council (GCC). 31 With a few locations in Europe, this resulted in a total of 4,546 restaurants globally. In Canada, operations originally were focused in Ontario and Atlantic Canada. This expanded over time to include Quebec and western Canada. The most unique Tim Hortons' location was the Canadian Forces (CF) operations base in Kandahar, Afghanistan. It opened on Canada Day in 2006 and served four million cups of coffee, three million donuts and half a million iced cappuccinos and bagels to over 2.5 million customers from more than 37 countrics. More than 230 Canadians travelled overscas to work at this Tim Hortons and served approximately 30,000 CF members over 11 rotations. The Kandahar Tim Hortons was operated by the Canadian Forces Personnel and Family Support Services, with proceeds benefitting military community and family support programs. Tim Hortons waived all fees and operating costs typically associated with a franchise and the Kandahar operation ended in November 2011 when all CF troops left Afghanistan. Some analysts believed that Tim Hortons had reached its saturation point in Canada. 32 In 1984, the company opened its first international store in Tonawanda. New York. During the 1990s, it expanded into other states including Ohio, Kentucky, West Virginia and Michigan. By 2004, the acquisition of 42 Bess Eaton restaurants allowed the company to gain a foothold in New England, the traditional stronghold of Dunkin' Donuts. Tim Hortons' locations in this area did not perform well, leading to the closing of 36 stores in the northeastern United States in 2010.33 U.S. locations close to the Canadian border seemed to perform the best, due to brand awareness. In 2014, Tim Hortons' locations continued to be focused in the northeastern United States with 859 stores in Michigan, Maine, Connecticut, Ohio, West Virginia, Kentucky, Pennsylvania, Rhode Island, Massachusetts and New York. 34 Tim Hortons had also expanded into the GCC. By August 2014, there were 38 stores in the United Arab Emirates, Oman, Qatar and Kuwait. 35 There were further plans for expansion into Bahrain with a goal of opening an additional 120 locations in the GCC region by 2018.36 Tim Hortons had a small number of European locations as a result of a partncrship with the Spar convenience store chain in 2007. By the end of 2013, Tim Hortons' coffee and donuts were available at approximately 255 locations in Ireland and the United Kingdom; the majority of these locations (252) were self-service kiosks. 37 PRODUCTS Tim Hortons' biggest drawing card was its legendary coffee. It was so popular that the company constantly batlled rumours that it added nicotine to make it addictive. 33 The coffee was a blend of 100 per cent Arabica beans grown in the world's coffee producing regions. To ensure the coffee was always fresh, Tim Hortons served it within 20 minutes of being brewed; after 20 minutes, it was thrown away. The premium blend was sold in tins at most Tim Hortons' locations and at supermarkets. Its coffee was also available in pods compatible with at-home single-cup coffee brewing systems such as Tassimo and Keurig. A number of Tim Hortons' locations sold branded mugs and seasonal merchandise. The chain focused on continuous product innovation-as consumer tastes grew, so did choices. The original menu included coffee and donuts but expanded to include tea, a small selection of cold beverages and baked goods (c.g., donuts, "iimbits" and pastries). Originally, the baked goods were produced instore. In 2003, the company switched from in-store preparation to preparing them centrally in Brantford, Ontario and then shipping them frozen to franchised stores to be baked and finished with fillings or glazes. This was initially controversial with franchisees and consumers, but the outrage dissipated quickly. During the 1980 s, the baked goods offering expanded to include muffins, cakes, pies and cookies. This was followed by more substantial items, including soups, chili and sandwiches. In 2006. Tim Hortons introduced breakfast options, including breakfast sandwiches on biscuits, bagels and English mullins, as well as oatmeal. These items became wildly popular with Canadian customers. According to NPD research, by May 2011, Tim Hortons held 57 per cent of the hot breakfast sandwich market in Canada compared to McDonald's 29 per cent domestic share. 39 To gain more of the lunch and dinner crowd, Tim Hortons aggressively expanded its food choices. It heavily promoted its soups, chili and cold sandwiches by offering combos, which included a traditional baked good and a coffec. It further expanded to include more hot offerings such as paninis, crispy chicken sandwiches and wraps. The company continued to invest in product innovation to keep the menu fresh and responsive to consumer trends. Consumer tastes were also shifting as almost half of all Canadians and Americans surveyed stated that their last coffec was a dark roast. 40 In order to compete with other retail outlets such as Starbucks, which offered a bolder base coffee taste, Tim Hortons officially launched a dark roast coffee in its North American stores in August 2014. "1 This was the first time in the company's history that it had offered a coffee flavour other than its original premium blend. Caira commented on the launch, saying: Tim Hortons prides itself on serving best-in-class coffee and responding to the evolving tastes of our gucsts, and our new Dark Roast blend speaks to that commitment. We know that our guests want choice when consuming their daily coffee and we applied our passion for coffee and brewing expertise to develop a superior lasting Dark Roast blend our guests will love. 42 In recent years, it had expanded its hot and cold beverage offerings to compete with McDonald's McCaf menu; this included latles, cappuccinos, iced teas and coffees, smoothies and iced lemonades, which were offered at a price point similar to or lower than McDonald's and much less than Starbucks. FRANCHISE SYSTEM The cost to acquire a Tim Hortons' franchise was approximately $500,000. This included all furniture, cquipment and signage; a seven-week training program; staff assistance opening the store; the right to use trademarks and trade names; and support from the corporate office. The corporate office assumed all of the costs associated with the development of the land and the building. Given the demands of running a franchise, Tim Hortons required franchise locations to have two partners, both of whom had to be pernanent residents of Canada. Individuals granted a Tim Hortons' franchise were not allowed to operate any other business without the written approval of the company. Licences were usually provided for 10 years with the option of extending for an additional 10 years. For the term of the licence, franchisees were obligated to provide a weekly royalty fee of 4.5 per cent of gross sales and a monthly advertising levy of 4 per cent of gross sales. They also had a monthly rental fee, which was the greater of a fixed minimum rent or 8.5 per cent of gross monthly sales. 43 Even with these stipulations, there was a high demand for Tim Hortons' franchises in Canada. While almost all of Tim Hortons' restaurants in Canada and the United States were franchised, corporately owned and operated restaurants were used for the purposes of training and product/market development. STORE OPERATIONS Most standard Tim Hortons' locations were open 24 hours. Guests could eat in the dining areas, take the food out or use the drive-thrus, which catered to consumers on the go. Additionally, the company's "we fit anywhere" strategy led to a number of non-traditional locations in gas stations, convenience stores, universities, hospitals, office buildings and airports. A number of the locations were unionized. 11 Tim Hortons also co-located with other franchise restaurants. In Canada, there were a number of combo unit locations, which housed both a Tim Hortons and a Wendy's. In 2007, Tim Hortons partnered with Cold Stone Creamery, a franchise that sold customizable, single-serve ice cream, jointly locating stores in selected Canadian locations. This partnership ended in 2014, and Cold Stone Creamery counters were removed from Tim Horlons' locations. 2014 also saw the closure of a number of underperforming locations in the United States. 45 Sourcing Tim Hortons sourced coffee from the world's coffee producing regions. In 2005, it created the Sourcing Tim Hortons sourced cofee from the world's cofee producing regions. In 2005, it created the Tim Hortons Coffee Partnership in Brazil, Guatemala, Honduras and Colombia to help local coffee farmers improve their lives economically, socially and environmentally. The program had assisted 3,400 farmers. This approach was different from Starbucks, which had aggressive targets for responsibly grown and ethically sourced coffee through its Coffee and Farmer Equity (C.A.F.E) practices. Production and Distribution Three manufacturing facilities, six warehouse distribution centres and one warehouse serviced Tim Hortons' restaurants across Canada and the United States (see Exhibit 1); corporate-owned trucks delivered food and supplies from the disuribution centres to the restaurants 46It was a highly sophisticated operation; over 50,000 to 60,000 cartons of baked goods per week were shipped worldwide from the Guelph Distribution Centre alone. 47 Marketing On a chainwide basis, Tim Hortons advertised on television, radio, outdoor (billboards, transit shelters) and in some print vehicles (magazines). On a regional or restaurant basis, Tim Hortons also utilized newspaper advertising. 18 Commercials in Canada were used to introduce new products, but a number of them also reinforced the connection between Tim Hortons and Canadian culture. Its wildly successful "Roll up the Rim to Win" promotion, which started in 1986, gave away millions of prizes, including cars, gift cards and Tim Hortons' products and was eagerly anticipated by its customer base. GOALS Tim Hortons had strong short- and long-term goals. As stated in the company's 2013 Annual Report: Our number one imperative is to deliver profitable growth, measured by same-store sales, operating profit improvement and sustainable earnings per share |EPS| growth. In 2014, while continuing our growth agenda, we plan to make transitional investments and further position our business for success. 49 From 2015 to 2018, Tim Hortons had goals of an 11 to 13 per cent compounded annual growth rate, cumulative free cash flows of approximately $2 billion, operating income generated through the U.S. segment of up to $50 million, and opening 800 or more new locations in North America and the GCC.. FINANCIAL PERFORMANCE From a financial perspective, Tim Hortons grew overall revenues by 4.7 per cent to $3.3 billion and operating income by 4.5 per cent to $621 million in 2013. It had an operating margin of 19.1 per cent and a net profit margin of 13.0 per cent. Finally, the company's dividend per share had increased for the seventh year in a row from $0.24 to $0.32,1 However, on the balance sheet were a number of issues, including a current ratio of 1.0, a quick ratio of 0.4 and a debt to equity ratio of 132.9 per cent. 52 Even though the company experienced its 22nd consecutive year of same-store sales growth in Canada and 23rd year in the United States, the growth in 2013 was very modest at 1.1 per cent in Canada and 1.8 per cent in the United States. 53 This was below the 2013 target of 2 to 4 per cent in Canada and 3 to 5 per cent in the United States. 54 While the company's EPS rose from $2.59 in 2012 to $2.82 in 2013 (an 8.9 per cent increase), it was below the targeted EPS of $2.87 to $2.97..55 As of its second quarter in June 2014, Tim Hortons was tracking well on a number of key financial indicators. 58 It had a return on assets of 20.5 per cent, a return on equity of 53.0 per cent and a return on invested capital of 24.9 per cent. The debt to equity ratio had also improved to 3.7 per cent. Exhibits 2 and 3 provide additional details. THE COMPETITION In Canada, Tim Hortons led its competition with 27 per cent share of dollars and 42 per cent share of traffic in the quick-service industry: this was more than the next 15 chains combined. 57 However. In Canada, Tim Hortons led its competition with 27 per cent share of dollars and 42 per cent share of traffic in the quick-service industry; this was more than the next 15 chains combined. 57 However, compctition was heating up in all categorics, particularly at breakfast, as noted by Canaccord Genuity analyst Derek Dley who stated, "Now you've got a number of chains in the breakfast category all looking to capture more market share. Where is that going to come from? Well, it's going to be Tims." Tim Hortons had traditionally competed with the typical coffec and baked goods chains. However, with its stronger presence in the breakfast and lunch market, it faced increasing competition with restaurants in the broader quick-service category (e.g., hamburgers, submarine sandwiches, pizzas and tacos). Its main competition in Canada and the United States came from Starbucks, McDonald's and Dunkin' Donuts. McDonald's McDonald's was founded in 1955 in Des Plaines, Illinois by Ray Kroc. The company went public in 1965 with 700 restaurants. In 1967, the first international location opened in Richmond, British Columbia. McDonald's quickly became the world's leading quick-service retailer with more than 35,000 local restaurants in over 119 countrics. At the end of 2013,80 per cent of these stores were franchiseowned. There were approximately 1,400 McDonald's restaurants in Canada; 80 per cent were franchise stores. Franchise/licence agreements were generally for a 20 -year term. McDonald's products included distinct breakfast and lunch/dinner options. Menu items included eggbased sandwiches, muflins, hamburgers, French fries, salads, wraps and ice-cream-based desserts along with beverages such as soda, milkshakes, fruit-based smoothics and coffec. McDonald's was very aware of the competition in the coffee category. In 2011, it launched McCaf, an espresso-based beverage to compete with Starbucks. McCaf was offered at a much lower price than Starbucks beverages, but they were not as customizable. From a strategy perspective, McDonald's was focused on balancing core menu items with new product innovation, improving customer service and strenghhening its value platform. In 2013, McDonald's globally increased its revenucs by 3 per cent in constant currencics to USS28.1 billion and experienced a 0.4 per cent growth in comparable store sales. It also increased operating income by 3 per cent in constant currencies and its EPS by 4 per cent. 59 The company's financial performance in 2013 just met its system-wide sales growth target of 3 to 5 per cent but did not meet its operating income growth target of 6 to 7 per cent. 60 In addition, its return on incremental invested capital (ROIIC) of 11.4 per cent in 2013 did not meet its target of achieving a ROIIC in the high teens. The U.S. market had revenues of US $8.8 billion in 2013, roughly the same as the previous year. Starbucks Starbucks was founded in 1971 with a single location at Scatlle's Pike Place Market. It incorporated in 1985 and went public in 1992. By June 2014, there were approximately 23,305 locations in 62 countries. This included 13,493 stores in the Americas (United States, Canada and Latin America), of which 8,078 were company-owned and 5,415 were licensed. Worldwide, Starbucks employed approximately 182,000 people in 2013, with 13,000 of the employees working in the United States. 61 The majority of Starbucks' employees were not represented by a union. The company owned its own roasting facilities and leased the majority of its warehouse and distribution centres. Starbucks' products included more than 30 blends and single-origin coffees; blended, cuslomizable beverages; fresh food (sandwiches, pastries, salads, oatmeal, yogurt and fresh fruit); consumer products, including ready-to-drink cofrees, teas and juices; and merchandise including mugs, music, books and seasonal products. Starbucks was committed to cthical sourcing, environmental stewardship and community involvement. It offered generous compensation packages and supplementary benefits to its employees and invested in ongoing employec training. In 2013, Starbucks had global revenues of US $14.9 billion, a 12 per cent increase over 2012 revenuc. This was driven by a 7 per cent increase in global comparable store sales; the 7 per cent increase was also achieved in the U.S. market. 62 It was believed that this increase was due to a 5 per cent increase in the number of transactions and a 2 per cent increase in the average bill. Globally, Starbucks achicved a nonGAAP operating margin of 16.5 per cent based on a non-GAAP operating income of US $2.5 billion. However, due to the conclusion of litigation with Kraft Foods Global, Inc., Starbucks globally ended fiscal 2013 with an operating margin of 2.2 per cent as compared to 15 per cent in 2012. Dunkin' Donuts Founded in 1951 in Quincy, Massachuselts, Dunkin' Donuts franchises were established across the United States by 1955. By 2012, it had 10,083 in 32 countries worldwide, including 7,015 franchised restaurants in the United States and over 3,100 stores in international locations. The typical franchise agreement in the United States had a 20 -year term, and initial franchise fees ranged from USS25,000 to USS 100,000 , depending on the location. 63 From a product perspective, it offered 52 varieties of donuts as well as coffec, baked goods and breakfast sandwiches. The majority of stores were franchisee-owned, predominately located in the northeastern United States. It had expanded into Canada, but by the early 2000s, it had largely exited the Canadian market except for four locations in Quebec. Dunkin' Donuts was a wholly owned subsidiary of Dunkin' Brands, which also included Baskin Robbins. For the full year 2013, Dunkin' Donuts' restaurants had global franchisee-reported sales of approximately USS7.4 billion. 61 This was driven by revenues in the United States of USS6.7 billion. 65 Dunkin' Donuts United States experienced a 3.4 per cent comparable store sales growth in 2013, down from 4.3 per cent in 2012. Dunkin' Donuts International experienced a comparable store sales decline of 0.4 per cent in 2013. It planned to aggressively expand in the westem United States, targeting California, and in Europe (in particular, Germany and the United Kingdom), the Middle East and Southeast Asia. Exhibits 4 and 5 provide a comparison of Tim Hortons, McDonald's, Starbucks and Dunkin' Donuts. TIM HORTONS' STRATEGIC PLAN 2014 TO 2018 Tim Hortons was facing tough competition domestically and internationally. In 2014, the company had unveiled a five-ycar stratcgic plan called "Winning in the New Era." Caira stated: We envision a rejuvenated Canadian business that is the growth engine during our Strategic Plan time period. By 2018, we are working to have a profitable U.S. business that is ready to be aggressively scaled. We are looking to build on our established, growing international presence. We are building new capabilities and talent to execule flawlessly against our plans, and we are working to create above-market-average total shareholder returns. 6 The plan focused on four core ideas: (i) driving same-store sales by targeting specific segments of the day category and marketing opportunities, (ii) investing to build scale and brand in new and existing markets, (iii) growing in new ways, and (iv) leveraging its corc business strengths and franchise system. (i) Same-store growth was not performing as well as had been forecasted. There was a desire to grow the hot and cold beverage category and market share, as well as to take advantage of the growing trend of snacking between meals. In addition, Tim Hortons was branded differently in the United States than in Canada; there was an opportunity to use product innovation to further differentiate the company in the U.S. markel. This could involve new advertising and marketing campaigns. (ii) While Tim Hortons was primarily located in Canada, there were still growth opportunities in western Canada, Quebec and major urban markets. Strategically, the U.S. market was considered to be a must win battle which would require aggressive and rapid expansion. (iii) Tim Hortons had been considering changing the standard design of its restaurants to increase capacity and throughpul. This could involve different interior and exterior features, equipment and menu items. The goal was to maximize throughput and not have patrons linger in the store. This was different than the Starbucks model of creating a third living space for customers outside of their homes and oflices. (iv) The franchise system worked very well for Tim Hortons, and there was an opportunity to build on (iv) The franchise system worked very well for Tim Hortons, and there was an opportunity to build on the success of the system. Over the nexi five years, the company could pursue additional vertical integration and supply-chain opportunities to maintain control over more facets of the business. ACQUISITION The strategic plan was now linked to the likely acquisition of Tim Hortons by 3G Capital, a Brazilian private equity firm that was Burger King's majority owner. The deal, announced in August 2014, would pay current Tim Hortons' sharcholders approximately $94 a sharc, structured as $65.50 cash for cach cxisting Tim Hortons' share in addition to 0.8025 shares in the new company for cach Tim Hortons' share. . Shareholders had the flexibility to select an all-share or all-cash option. The $94 share price was 39 per cent higher than the average price Tim Hortons' shares had traded at in the month prior to the announcement of the merger. 3G Capital would own 51 per cent of the combined company in the $12.5 billion merger, which would create the world's third largest quick-service restaurant company; \$3 billion of preferred equity financing for the deal was to come from Warren Buffet's Berkshire Hathaway. 3G Capital owned two-thirds of Burger King and the deal had already been approved by its board and had been unanimously accepted by Tim Hortons' board. However, it still had to be approved by Tim Hortons' shareholders and likely Canadian and U.S. regulators. The new company would be headquartered in Oakville, Ontario along with Tim Hortons' corporate office. Burger King's head offices would continue to be in Miami, Florida. It was expected that Tim Hortons and Burger King would continue to operate as separate organizations and that the franchisee relationships would be managed independently by the separate brands. 68 Financial analysts felt this move benefitted both partics in that the location of the company headquarters in Canada allowed the new company to take advantage of Canada's lower corporate tax rates while Tim Hortons would benefit from Burger King's global expansion experience. Caira was very positive about the growlh potential this merger offered for Tim Horlons, stating: "As an independent brand within the new company, this transaction will enable us to move more quickly and efficiently to bring Tim Hortons' iconic Canadian brand to a new global customer base," ", PATH FORWARD: STRATEGIC CHOICES While the merger talks were exciting, Tim Hortons had to continue implementing its strategic plan. There were important options to consider. Its recent crispy chicken sandwich was beginning to resemble products found at McDonald's. Menu innovations to target the dinner markel could include more complex items. This would change the food operation of the kitchen and the length of time required to prepare the food. Were there other menu innovations Tim Horlons should consider to drive customer traffic to stores? Geographic expansion opportunities seemed limitless. Canadian and U.S. expansion were a priority, but where should it occur and in what order? All of Tim Hortons' competitors were either already present or were expanding into Europe; should this market share just be ceded to them? Tim Hortons had a different brand presence in each of its three existing jurisdictions - Canada, the United States and the GCC. Should the company be positioned the same way in each area with the same marketing, menu and pricing? And how could the partnership with Burger King help with this expansion? Finally, how could Tim Hortons take advantage of food trends? Food trucks were becoming popular, and Starbucks was experimenting with coflee trucks on university and college campuses. Tim Hortons had experience using semi-mobile retail space while stores were undergoing renovations. Was this type of alternative store format something it should try, recognizing that it was outside the franchise model? To have an international presence, Tim Hortons would need financial resources, organizational capabilities, store saturation, product innovation and brand recognition to compete with some of the world's largest and best known quick-service companies. The potential merger with Burger King would Finally, how could Tim Hortons take advantage of food trends? Food trucks were becoming popular, and Starbucks was experimenting with coflee trucks on university and college campuses. Tim Hortons had experience using semi-mobilc retail space while stores were undergoing renovations. Was this type of alternative store format something it should try, recognizing that it was outside the franchise model'? To have an international presence, Tim Hortons would need financial resources, organizational capabilities, store saturation, product innovation and brand recognition to compete with some of the world's largest and best known quick-service companies. The potential merger with Burger King would help, but would it be enough to create a competitive advantage on a global scale? EXHIBIT 1: TIM HORTONS' PRODUCTION/DISTRIBUTION FACILITIES Source: Adapted from Tim Hortons Inc., "2013 Annual Report," www.timhortons.com/ca/en/pdf/Tim_Hortons_2013_AR_full.pdf.p. 33, accessed August 22, 2014. EXHIBIT 2: TIM HORTONS' INCOME STATEMENTS (2009 TO 2013) (in thousands of Canadian dollars, except for weighted average number of shares) EXHIBIT 2: TIM HORTONS' INCOME STATEMENTS (2009 TO 2013) (in thousands of Canadian dollars, except for weighted average number of shares) Source: Tim Hortons Inc., "2013 Annual Report," www.timhortons.com/ca/en/pdf/Tim_Hortons_2013_AR_full.pdf," p. 38, accessed August 22, 2014. EXHIBIT 3: TIM HORTONS INC. AND SUBSIDIARIES - CONSOLIDATED BALANCE SHEET (in thousands of Canadian dollars) Source: http.//annualreport.timhortons.com/downloads/Balance-Sheet.x/s, accessed August 21,2014. EXHIBIT 4: COMPARABLES OF QUICK-SERVICE RESTAURANTS Source: Compiled by case authors. EXHIBIT 5: AVERAGE COST COMPARISON OF SELECT MENU ITEMS (in Canadian dollars before tax as of August 28, 2014) Source: Compiled by case authors