Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You need $ 4 0 0 , 0 0 0 to buy a house. You decide to borrow money from the bank to finance your

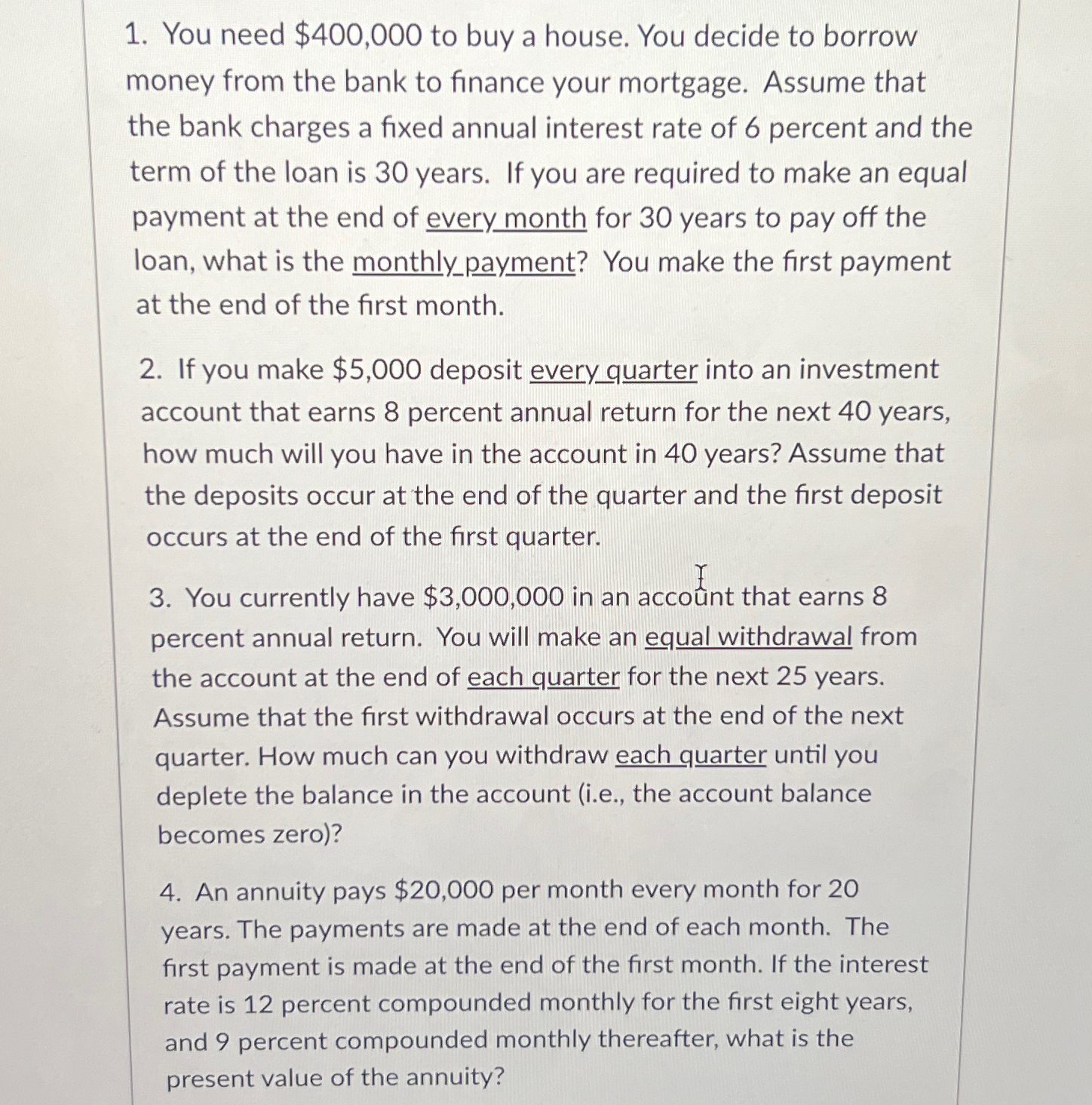

You need $ to buy a house. You decide to borrow money from the bank to finance your mortgage. Assume that the bank charges a fixed annual interest rate of percent and the term of the loan is years. If you are required to make an equal payment at the end of every month for years to pay off the loan, what is the monthly payment? You make the first payment at the end of the first month.

If you make $ deposit everyquarter into an investment account that earns percent annual return for the next years, how much will you have in the account in years? Assume that the deposits occur at the end of the quarter and the first deposit occurs at the end of the first quarter.

You currently have $ in an accout that earns percent annual return. You will make an equal withdrawal from the account at the end of each quarter for the next years. Assume that the first withdrawal occurs at the end of the next quarter. How much can you withdraw each quarter until you deplete the balance in the account ie the account balance becomes zero

An annuity pays $ per month every month for years. The payments are made at the end of each month. The first payment is made at the end of the first month. If the interest rate is percent compounded monthly for the first eight years, and percent compounded monthly thereafter, what is the present value of the annuity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started