Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You need a bond investment to fund an expected cash flow of 1931 in 10 years. You buy a 20 year, 7% bond to fund

You need a bond investment to fund an expected cash flow of 1931 in 10 years. You buy a 20 year, 7% bond to fund this liability because it is a duration of 10 years.

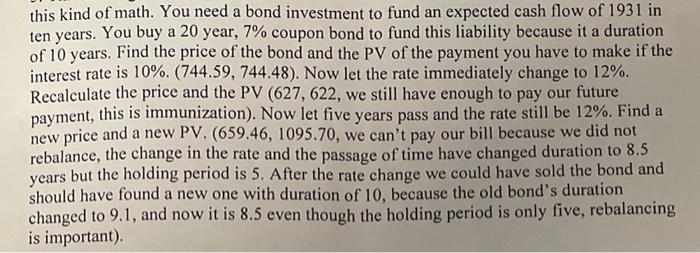

this kind of math. You need a bond investment to fund an expected cash flow of 1931 in ten years. You buy a 20 year, 7% coupon bond to fund this liability because it a duration of 10 years. Find the price of the bond and the PV of the payment you have to make if the interest rate is 10%. (744.59, 744.48). Now let the rate immediately change to 12%. Recalculate the price and the PV (627, 622, we still have enough to pay our future payment, this is immunization). Now let five years pass and the rate still be 12%. Find a new price and a new PV. (659.46, 1095.70, we can't pay our bill because we did not rebalance, the change in the rate and the passage of time have changed duration to 8.5 years but the holding period is 5. After the rate change we could have sold the bond and should have found a new one with duration of 10, because the old bond's duration changed to 9.1, and now it is 8.5 even though the holding period is only five, rebalancing is important) A. Find the price of the bond and the PV of the payment you have to make if the interest rate is 10%

B. Now let the rate immediately change to 12%. Re-calculate the price and the PV.

C. Now let five years pass and the rate still be 12%. Find a new price and a new PV.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started