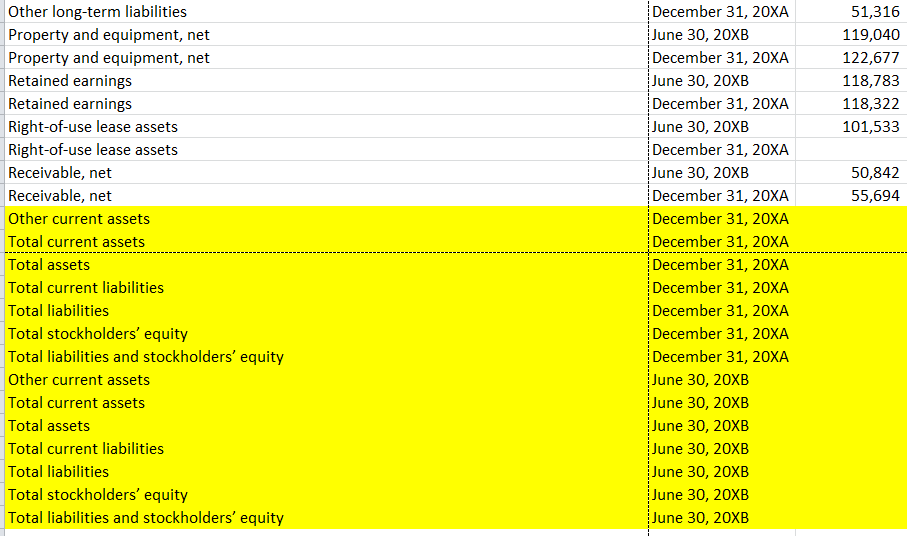

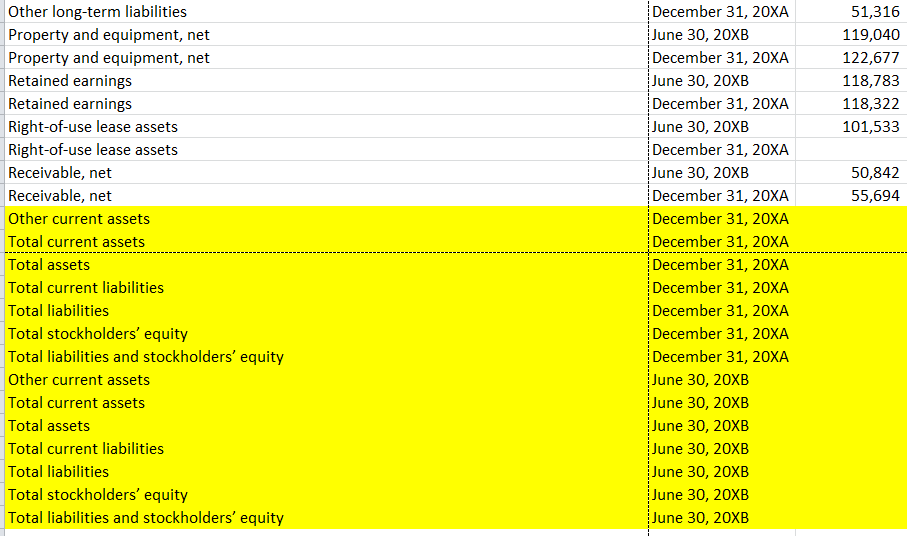

You need to calculate the missing Balance sheet amount

Create an Excel worksheet that contains the firms balance sheet and income statement. You will be required to use formulas and/functions to recreate the firms financial statements, such as the items in YELLOW

80,085 85,979 266 32 1,304,170 1,306,653 $ 352,387 $311,732 219 217 Accounts payable and accrued expenses Accounts payable and accrued expenses Accumulated other comprehensive income Accumulated other comprehensive income Additional paid-in capital Additional paid-in capital Cash and cash equivalents Cash and cash equivalents Common stock, par value $0.01 Common stock, par value $0.01 Contract liabilities Contract liabilities Deferred income tax liabilities Deferred income tax liabilities Goodwill Goodwill Income taxes payable Income taxes payable Intangible assets, net Intangible assets, net Lease liabilities, current Lease liabilities, current Lease liabilities, non-current Lease liabilities, non-current Marketable securities, current Marketable securities, current Marketable securities, non-current Marketable securities, non-current Other assets Other assets Other current assets Other current assets Other long-term liabilities June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB 40,826 38,733 70,298 59,358 732,799 732,540 6,144 419 314,511 328,344 26,462 90,501 36,486 37,121 31,866 37,678 19,052 19,429 16,874 15,814 37,636 51,316 119,040 122,677 118,783 118,322 101,533 50,842 55,694 Other long-term liabilities Property and equipment, net Property and equipment, net Retained earnings Retained earnings Right-of-use lease assets Right-of-use lease assets Receivable, net Receivable, net Other current assets Total current assets Total assets Total current liabilities Total liabilities Total stockholders' equity Total liabilities and stockholders' equity Other current assets Total current assets Total assets Total current liabilities Total liabilities Total stockholders' equity Total liabilities and stockholders' equity December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA June 30, 20XB June 30, 20XB June 30, 20XB June 30, 20XB June 30, 20XB June 30, 20XB June 30, 20XB 80,085 85,979 266 32 1,304,170 1,306,653 $ 352,387 $311,732 219 217 Accounts payable and accrued expenses Accounts payable and accrued expenses Accumulated other comprehensive income Accumulated other comprehensive income Additional paid-in capital Additional paid-in capital Cash and cash equivalents Cash and cash equivalents Common stock, par value $0.01 Common stock, par value $0.01 Contract liabilities Contract liabilities Deferred income tax liabilities Deferred income tax liabilities Goodwill Goodwill Income taxes payable Income taxes payable Intangible assets, net Intangible assets, net Lease liabilities, current Lease liabilities, current Lease liabilities, non-current Lease liabilities, non-current Marketable securities, current Marketable securities, current Marketable securities, non-current Marketable securities, non-current Other assets Other assets Other current assets Other current assets Other long-term liabilities June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB 40,826 38,733 70,298 59,358 732,799 732,540 6,144 419 314,511 328,344 26,462 90,501 36,486 37,121 31,866 37,678 19,052 19,429 16,874 15,814 37,636 51,316 119,040 122,677 118,783 118,322 101,533 50,842 55,694 Other long-term liabilities Property and equipment, net Property and equipment, net Retained earnings Retained earnings Right-of-use lease assets Right-of-use lease assets Receivable, net Receivable, net Other current assets Total current assets Total assets Total current liabilities Total liabilities Total stockholders' equity Total liabilities and stockholders' equity Other current assets Total current assets Total assets Total current liabilities Total liabilities Total stockholders' equity Total liabilities and stockholders' equity December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA June 30, 20XB December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA December 31, 20XA June 30, 20XB June 30, 20XB June 30, 20XB June 30, 20XB June 30, 20XB June 30, 20XB June 30, 20XB