Answered step by step

Verified Expert Solution

Question

1 Approved Answer

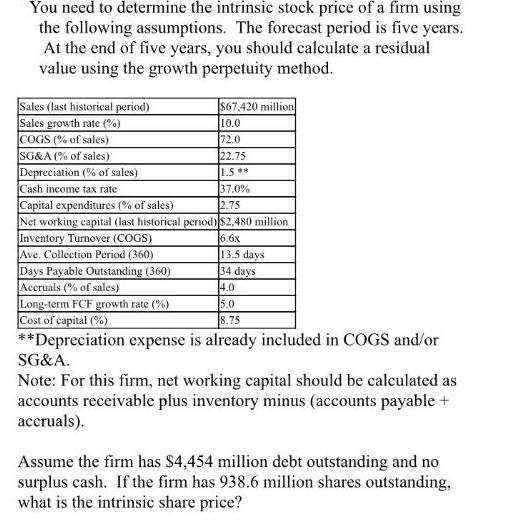

You need to determine the intrinsic stock price of a firm using the following assumptions. The forecast period is five years. At the end

You need to determine the intrinsic stock price of a firm using the following assumptions. The forecast period is five years. At the end of five years, you should calculate a residual value using the growth perpetuity method. Sales (last historical period) Sales growth rate (%) COGS (% of sales) 22.75 SG&A (% of sales) Depreciation (% of sales) 1.5** Cash income tax rate 37.0% Capital expenditures (% of sales) 2.75 Net working capital (last historical period) $2,480 million Inventory Turnover (COGS) 6.6x $67,420 million 10.0 72.0 13.5 days 34 days 4.0 Ave. Collection Period (360) Days Payable Outstanding (360) Accruals (% of sales) 5.0 Long-term FCF growth rate (%) Cost of capital (%) 8.75 **Depreciation expense is already included in COGS and/or SG&A. Note: For this firm, net working capital should be calculated as accounts receivable plus inventory minus (accounts payable + accruals). Assume the firm has $4,454 million debt outstanding and no surplus cash. If the firm has 938.6 million shares outstanding, what is the intrinsic share price?

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the intrinsic share price we can use the free cash flow to the firm FCFF and the growth ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started