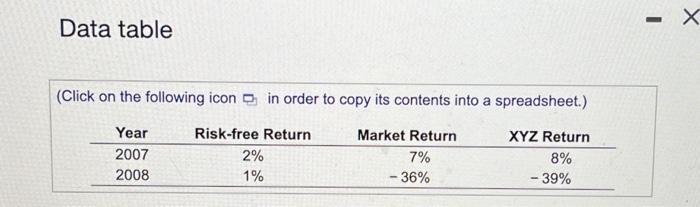

You need to estimate the equity cost of capital for XYZ Corp. You have the following data available regarding past returns: a. What was XYZ 's average historical return? b. Compute the market's and XYZ 's excess returns for each year. Estimate XYZ 's beta. c. Estimate XYZ 's historical alpha. d. Suppose the current risk-free rate is 3%, and you expect the market's return to be 8%. Use the CAPM to estimate an expected return for XYZ Corp.'s stock. e. Would you base your estimate of XYZ 's equity cost of capital on your answer in part (a) or in part (d)? a. What was XYZ 's average historical return? XYZ's average historical return was \%. (Round to one decimal place.) b. Compute the market's and XYZ's excess returns for each year. The market's excess return for 2007 was \%. (Round to the nearest integer.) The market's excess return for 2008 was \%. (Round to the nearest XYZ's excess return for 2008 was \%. (Round to the nearest integer.) Estimate XYZ 's beta. XYZ 's beta is (Round to two decimal places.) c. Estimate XYZ 's historical alpha. XYZ 's historical alpha was \%. (Round to two decimal places.) d. Suppose the current risk-free rate is 3%, and you expect the market's return to be 8%. Use the CAPM to estimate an expected return for XYZ d. Suppose the current risk-free rate is 3%, and you expect the market's return to be 8%. Use the CAPM to estimate an expected return for XYZ Corp.'s stock. The expected return for XYZ Corp.'s stock was \%. (Round to two decimal places.) e. Would you base your estimate of XYZ 's equity cost of capital on your answer in part (a) or in part (d)? (Select the best choice below.) A. Part (a) because the CAPM provides a better estimate of Part (a) because the CAPM provides a better estimate of expected returns. 3. Part (a) because the average past returns provides a better estimate of expected returns. . Part (d) because the average past returns provides a better estimate of expected returns. P. Part (d) because the CAPM provides a better estimate of expected returns. Data table (Click on the following icon in order to copy its contents into a spreadsheet.)