Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You need to purchase a new car. You want the car with the lowest lifetime total net present value cost. You have narrowed the

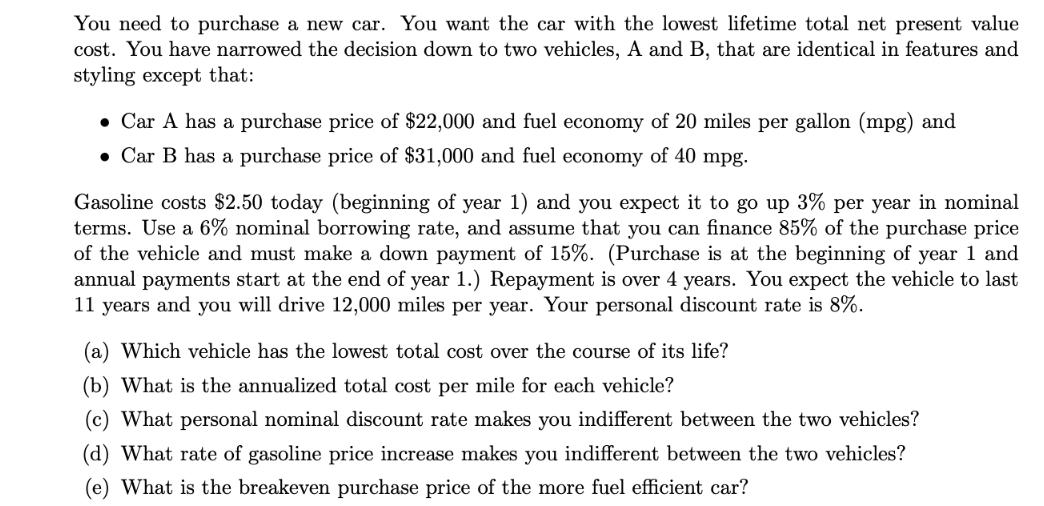

You need to purchase a new car. You want the car with the lowest lifetime total net present value cost. You have narrowed the decision down to two vehicles, A and B, that are identical in features and styling except that: Car A has a purchase price of $22,000 and fuel economy of 20 miles per gallon (mpg) and Car B has a purchase price of $31,000 and fuel economy of 40 mpg. Gasoline costs $2.50 today (beginning of year 1) and you expect it to go up 3% per year in nominal terms. Use a 6% nominal borrowing rate, and assume that you can finance 85% of the purchase price of the vehicle and must make a down payment of 15%. (Purchase is at the beginning of year 1 and annual payments start at the end of year 1.) Repayment is over 4 years. You expect the vehicle to last 11 years and you will drive 12,000 miles per year. Your personal discount rate is 8%. (a) Which vehicle has the lowest total cost over the course of its life? (b) What is the annualized total cost per mile for each vehicle? (c) What personal nominal discount rate makes you indifferent between the two vehicles? (d) What rate of gasoline price increase makes you indifferent between the two vehicles? (e) What is the breakeven purchase price of the more fuel efficient car?

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total cost of each car over its lifetime we need to consider the following costs 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started