Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You observe a stock price of $18.75. You expect a dividend growth rate of 5%, and the most recent dividend was$1.40. What is the required

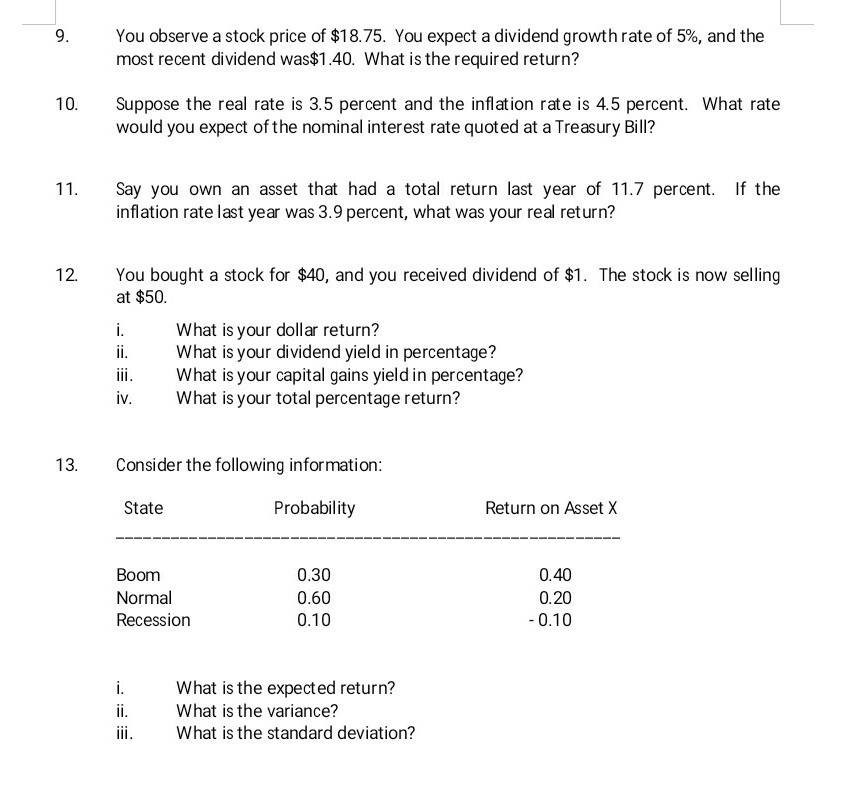

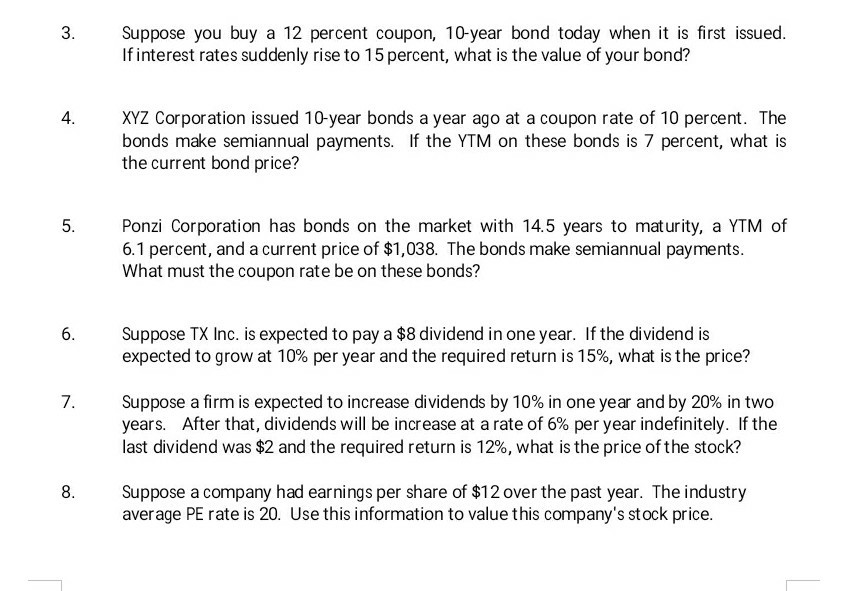

You observe a stock price of $18.75. You expect a dividend growth rate of 5%, and the most recent dividend was$1.40. What is the required return? 9. Suppose the real rate is 3.5 percent and the inflation rate is 4.5 percent. What rate would you expect of the nominal inter est rate quoted at a Treasury Bill? 10. Say you own an asset that had a total return last year of 11.7 percent. If the inflation rate last year was 3.9 percent, what was your real return? 11 You bought a stock for $40, and you received dividend of $1. The stock is now selling at $50 12. i. What is your dollar return? What is your dividend yield in percentage? What is your capital gains yield in percentage? What is your total percentage return? iii iv. Consider the following information: 13. Probability State Return on Asset X Boom 0.30 0.40 Normal 0.60 0.20 0.10 -0.10 Recession i. What is the expected return? ii. What is the variance? What is the standard deviation? iii 3. Suppose you buy If interest rates suddenly rise to 15 percent, what is the value of your bond? a 12 percent coupon, 10-year bond today when it is first issued. 4. XYZ Corporation issued 10-year bonds a year ago at a coupon rate of 10 percent. The bonds make semiannual payments. If the YTM on these bonds is 7 percent, what is the current bond price? Ponzi Corporation has bonds on the market with 14.5 years to maturity, a YTM of 6.1 percent, and a current price of $1,038. The bonds make semiannual payments What must the coupon rate be on these bonds? 5. Suppose TX Inc. is expected to pay a $8 dividend in one year. If the dividend is expected to grow at 10% per year and the required return is 15%, what is the price? 6. 7 Suppose a firm is expected to increase dividends by 10% in one year and by 20% in two years. After that, dividends will be increase at a rate of 6% per year indefinitely. If the last dividend was $2 and the required return is 12%, what is the price of the stock? Suppose a company had earnings per share of $12 over the past year. The industry average PE rate is 20. Use this information to value this company's stock price. 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started