Question

You observe the following information about bonds A and B, both of which make semiannual coupon payments (with payments occurring at the end of

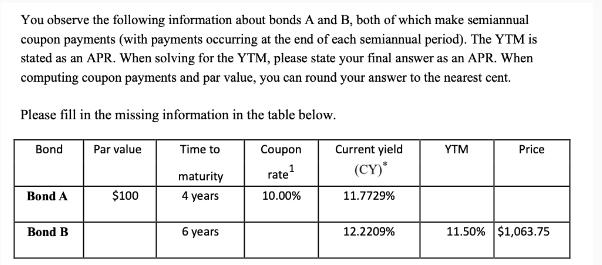

You observe the following information about bonds A and B, both of which make semiannual coupon payments (with payments occurring at the end of each semiannual period). The YTM is stated as an APR. When solving for the YTM, please state your final answer as an APR. When computing coupon payments and par value, you can round your answer to the nearest cent. Please fill in the missing information in the table below. Coupon rate 1 10.00% Bond Bond A Bond B Par value $100 Time to maturity 4 years 6 years Current yield (CY)* 11.7729% 12.2209% YTM Price 11.50% $1,063.75

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Given A 12 B 5 1 Add A and B A B 12 5 17 2 Subtract B from the result of step 1 17 B 17 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Corporate Finance

Authors: Laurence Booth, Sean Cleary

3rd Edition

978-1118300763, 1118300769

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App