Question

You obtained a partially amortizing CRE loan for 12,000,000 at 4.5% on August 1, 2015. It is amortized on a 25 year schedule, with

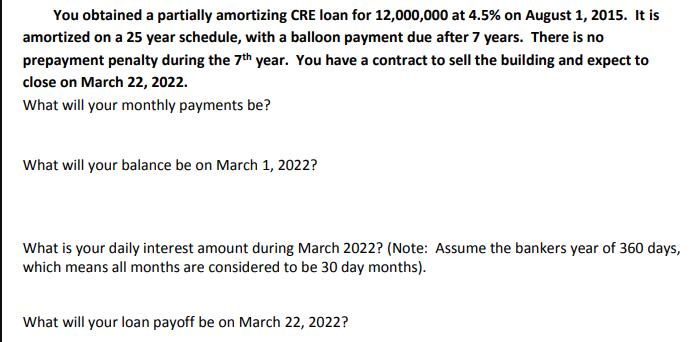

You obtained a partially amortizing CRE loan for 12,000,000 at 4.5% on August 1, 2015. It is amortized on a 25 year schedule, with a balloon payment due after 7 years. There is no prepayment penalty during the 7th year. You have a contract to sell the building and expect to close on March 22, 2022. What will your monthly payments be? What will your balance be on March 1, 2022? What is your daily interest amount during March 2022? (Note: Assume the bankers year of 360 days, which means all months are considered to be 30 day months). What will your loan payoff be on March 22, 2022?

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the monthly payments well use the formula for the monthly payment on an amortized loan which is given by P Pri 1 1 in where P is the mo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App