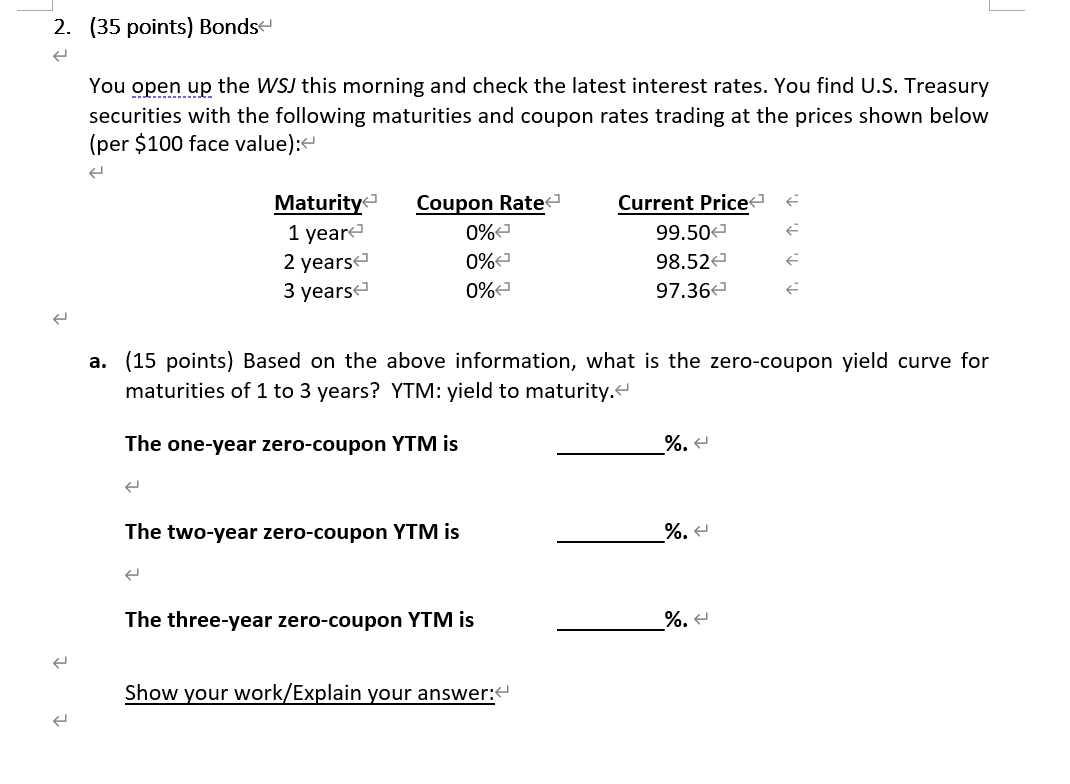

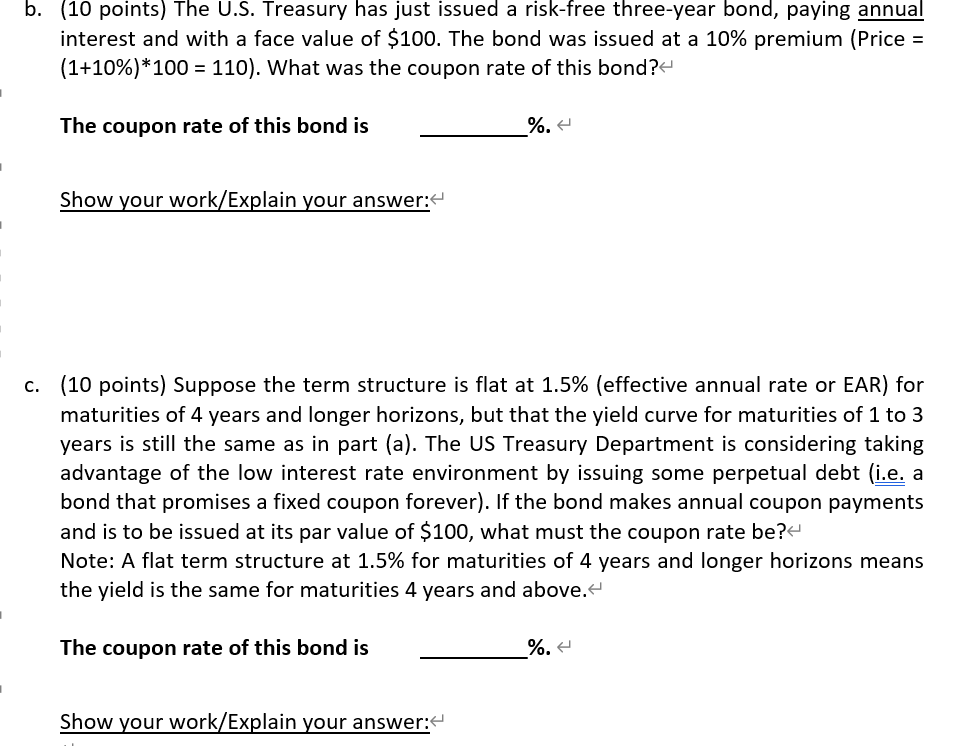

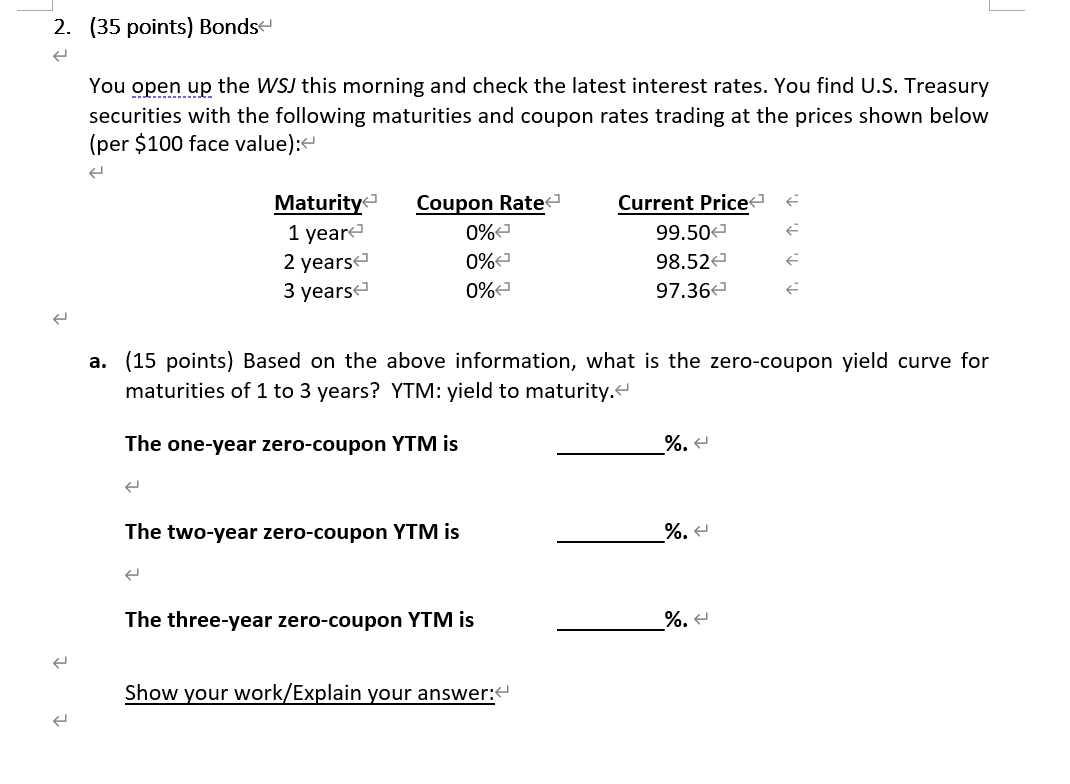

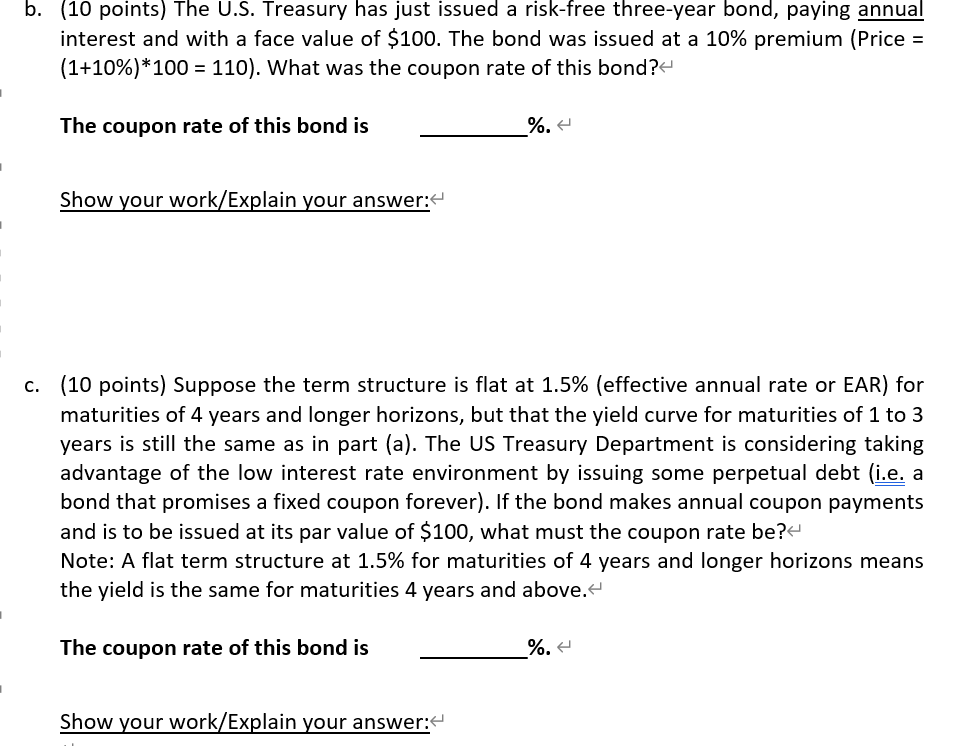

You open up the WSJ this morning and check the latest interest rates. You find U.S. Treasury securities with the following maturities and coupon rates trading at the prices shown below (per \$100 face value): a. (15 points) Based on the above information, what is the zero-coupon yield curve for maturities of 1 to 3 years? YTM: yield to maturity. The one-year zero-coupon YTM is \%. The two-year zero-coupon YTM is \%. The three-year zero-coupon YTM is \%. Show your work/Explain your answer: (10 points) The U.S. Treasury has just issued a risk-free three-year bond, paying annual interest and with a face value of $100. The bond was issued at a 10% premium (Price = (1+10%100=110). What was the coupon rate of this bond? The coupon rate of this bond is \%. Show your work/Explain your answer: (10 points) Suppose the term structure is flat at 1.5\% (effective annual rate or EAR) for maturities of 4 years and longer horizons, but that the yield curve for maturities of 1 to 3 years is still the same as in part (a). The US Treasury Department is considering taking advantage of the low interest rate environment by issuing some perpetual debt (i.e. a bond that promises a fixed coupon forever). If the bond makes annual coupon payments and is to be issued at its par value of $100, what must the coupon rate be? Note: A flat term structure at 1.5% for maturities of 4 years and longer horizons means the yield is the same for maturities 4 years and above. The coupon rate of this bond is \%. Show your work/Explain your answer: You open up the WSJ this morning and check the latest interest rates. You find U.S. Treasury securities with the following maturities and coupon rates trading at the prices shown below (per \$100 face value): a. (15 points) Based on the above information, what is the zero-coupon yield curve for maturities of 1 to 3 years? YTM: yield to maturity. The one-year zero-coupon YTM is \%. The two-year zero-coupon YTM is \%. The three-year zero-coupon YTM is \%. Show your work/Explain your answer: (10 points) The U.S. Treasury has just issued a risk-free three-year bond, paying annual interest and with a face value of $100. The bond was issued at a 10% premium (Price = (1+10%100=110). What was the coupon rate of this bond? The coupon rate of this bond is \%. Show your work/Explain your answer: (10 points) Suppose the term structure is flat at 1.5\% (effective annual rate or EAR) for maturities of 4 years and longer horizons, but that the yield curve for maturities of 1 to 3 years is still the same as in part (a). The US Treasury Department is considering taking advantage of the low interest rate environment by issuing some perpetual debt (i.e. a bond that promises a fixed coupon forever). If the bond makes annual coupon payments and is to be issued at its par value of $100, what must the coupon rate be? Note: A flat term structure at 1.5% for maturities of 4 years and longer horizons means the yield is the same for maturities 4 years and above. The coupon rate of this bond is \%. Show your work/Explain your