Answered step by step

Verified Expert Solution

Question

1 Approved Answer

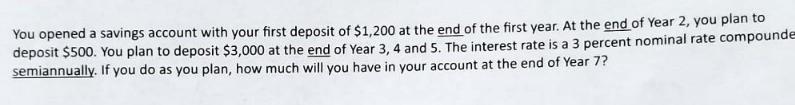

You opened a savings account with your first deposit of $1,200 at the end of the first year. At the end of Year 2,

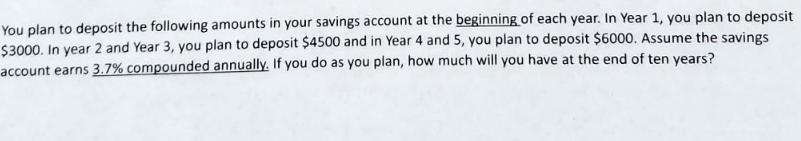

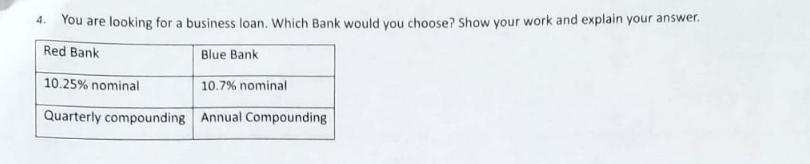

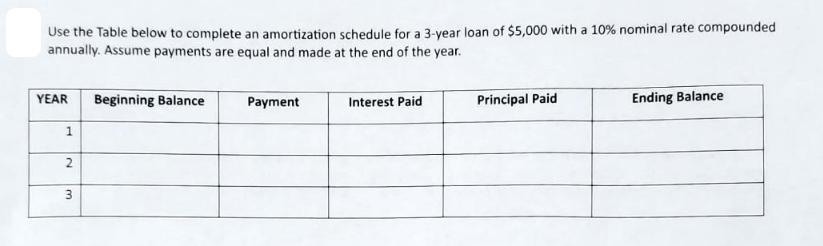

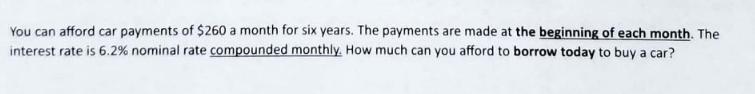

You opened a savings account with your first deposit of $1,200 at the end of the first year. At the end of Year 2, you plan to deposit $500. You plan to deposit $3,000 at the end of Year 3, 4 and 5. The interest rate is a 3 percent nominal rate compounde semiannually. If you do as you plan, how much will you have in your account at the end of Year 7? You plan to deposit the following amounts in your savings account at the beginning of each year. In Year 1, you plan to deposit $3000. In year 2 and Year 3, you plan to deposit $4500 and in Year 4 and 5, you plan to deposit $6000. Assume the savings account earns 3.7% compounded annually. If you do as you plan, how much will you have at the end of ten years? 4. You are looking for a business loan. Which Bank would you choose? Show your work and explain your answer. Red Bank Blue Bank 10.25% nominal Quarterly compounding 10.7% nominal Annual Compounding Use the Table below to complete an amortization schedule for a 3-year loan of $5,000 with a 10% nominal rate compounded annually. Assume payments are equal and made at the end of the year. YEAR 1 2 3 Beginning Balance Payment Interest Paid Principal Paid Ending Balance You can afford car payments of $260 a month for six years. The payments are made at the beginning of each month. The interest rate is 6.2% nominal rate compounded monthly. How much can you afford to borrow today to buy a car?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the future value of the savings account at the end of Year 7 we need to calculate the future value of each individual deposit and sum them up Given Initial deposit at the end of Year 1 12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started