Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You ordered a machine for your business on 15 October 2020 from American Machines (Pty) Ltd, a supplier situated in the USA. The following information

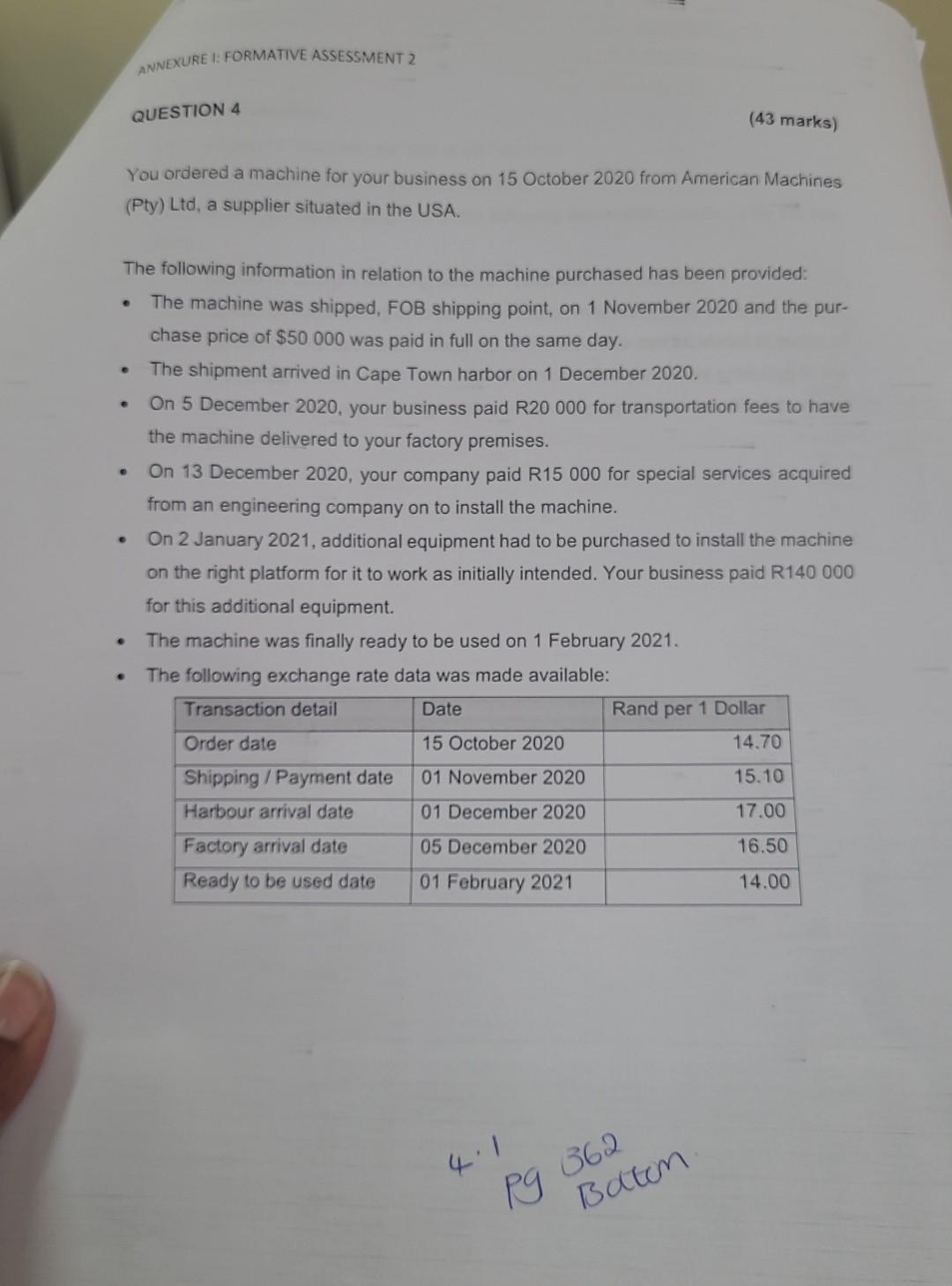

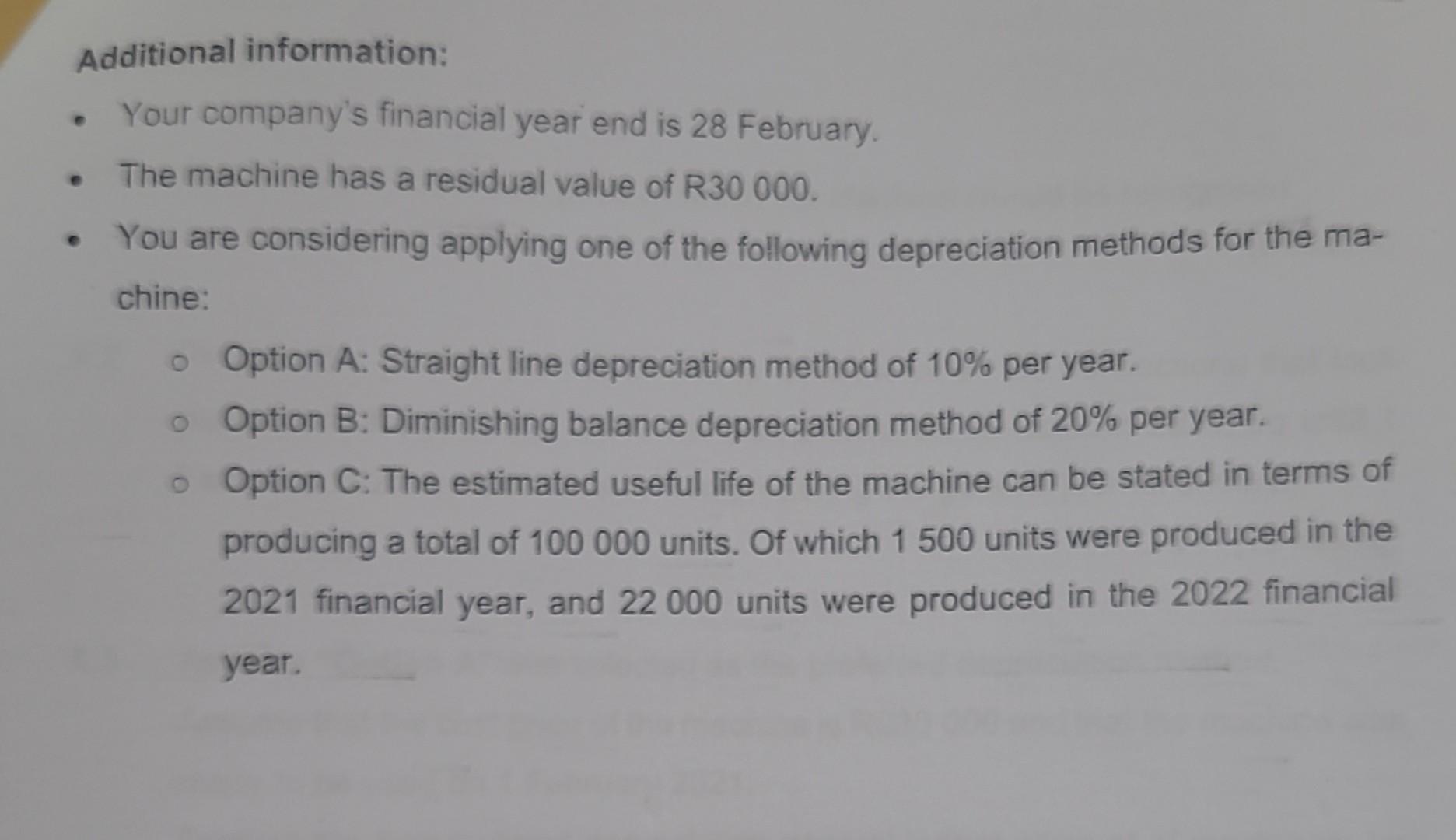

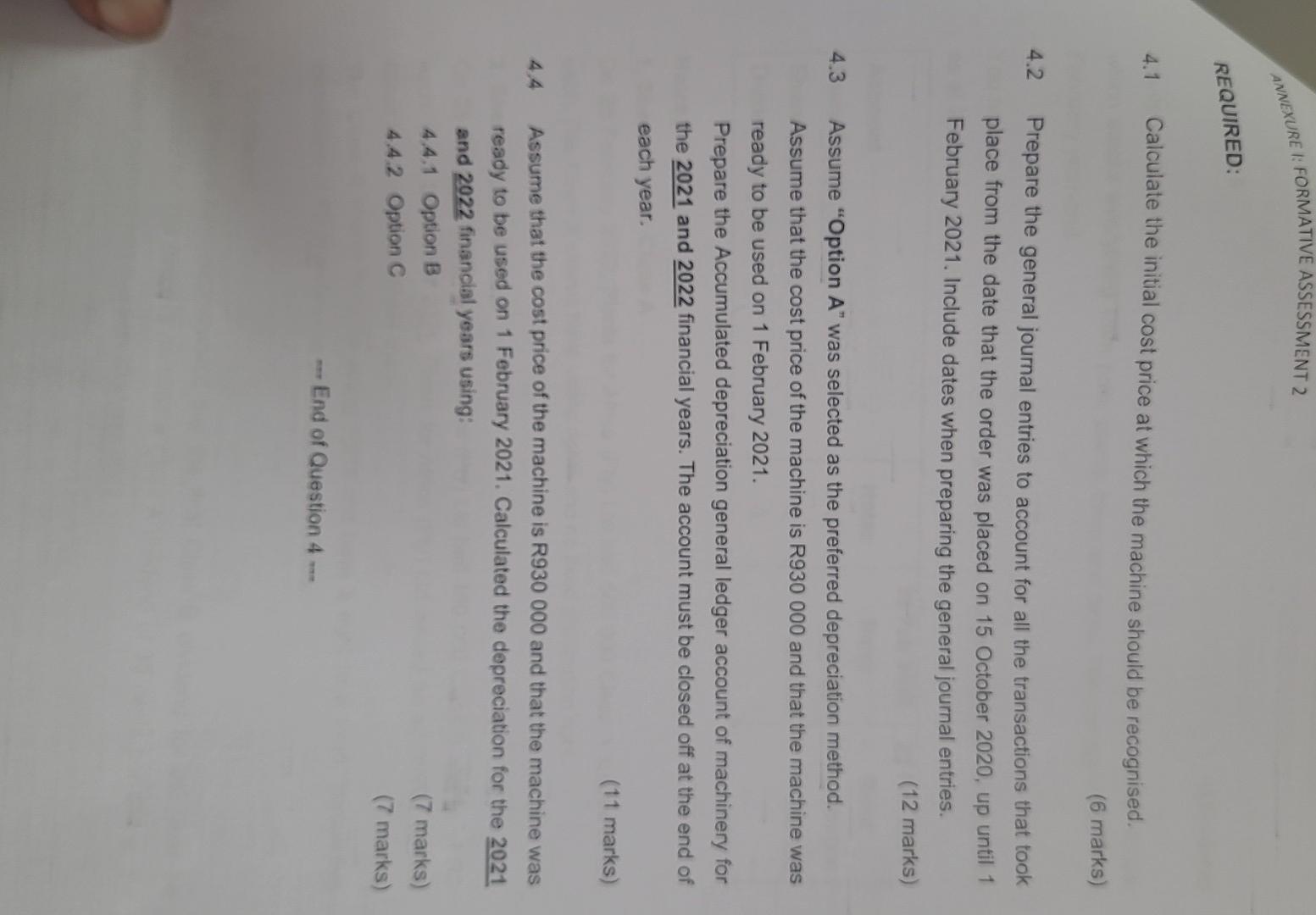

You ordered a machine for your business on 15 October 2020 from American Machines (Pty) Ltd, a supplier situated in the USA. The following information in relation to the machine purchased has been provided: - The machine was shipped, FOB shipping point, on 1 November 2020 and the purchase price of $50000 was paid in full on the same day. - The shipment arrived in Cape Town harbor on 1 December 2020. - On 5 December 2020, your business paid R20 000 for transportation fees to have the machine delivered to your factory premises. - On 13 December 2020, your company paid R15 000 for special services acquired from an engineering company on to install the machine. - On 2 January 2021, additional equipment had to be purchased to install the machine on the right platform for it to work as initially intended. Your business paid R140 000 for this additional equipment. - The machine was finally ready to be used on 1 February 2021. - The following exchange rate data was made available: Additional information: Your company's financial year end is 28 February. The machine has a residual value of R30000. You are considering applying one of the following depreciation methods for the machine: Option A: Straight line depreciation method of 10% per year. Option B: Diminishing balance depreciation method of 20% per year. Option C: The estimated useful life of the machine can be stated in terms of producing a total of 100000 units. Of which 1500 units were produced in the 2021 financial year, and 22000 units were produced in the 2022 financial year. 4.1 Calculate the initial cost price at which the machine should be recognised. ( 6 marks) 4.2 Prepare the general journal entries to account for all the transactions that took place from the date that the order was placed on 15 October 2020, up until 1 February 2021. Include dates when preparing the general journal entries. (12 marks) 4.3 Assume "Option A" was selected as the preferred depreciation method. Assume that the cost price of the machine is R930 000 and that the machine was ready to be used on 1 February 2021. Prepare the Accumulated depreciation general ledger account of machinery for the 2021 and 2022 financial years. The account must be closed off at the end of each year. (11 marks) 4.4 Assume that the cost price of the machine is R930 000 and that the machine was ready to be used on 1 February 2021. Calculated the depreciation for the 2021 and 2022 financial years using: 4.4.1 Option B (7 marks) 4.4.2 Option C (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started