Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You own 30,000 ounces of silver, which you want to hedge with either forwards or futures. Silver can be borrowed or lent for a

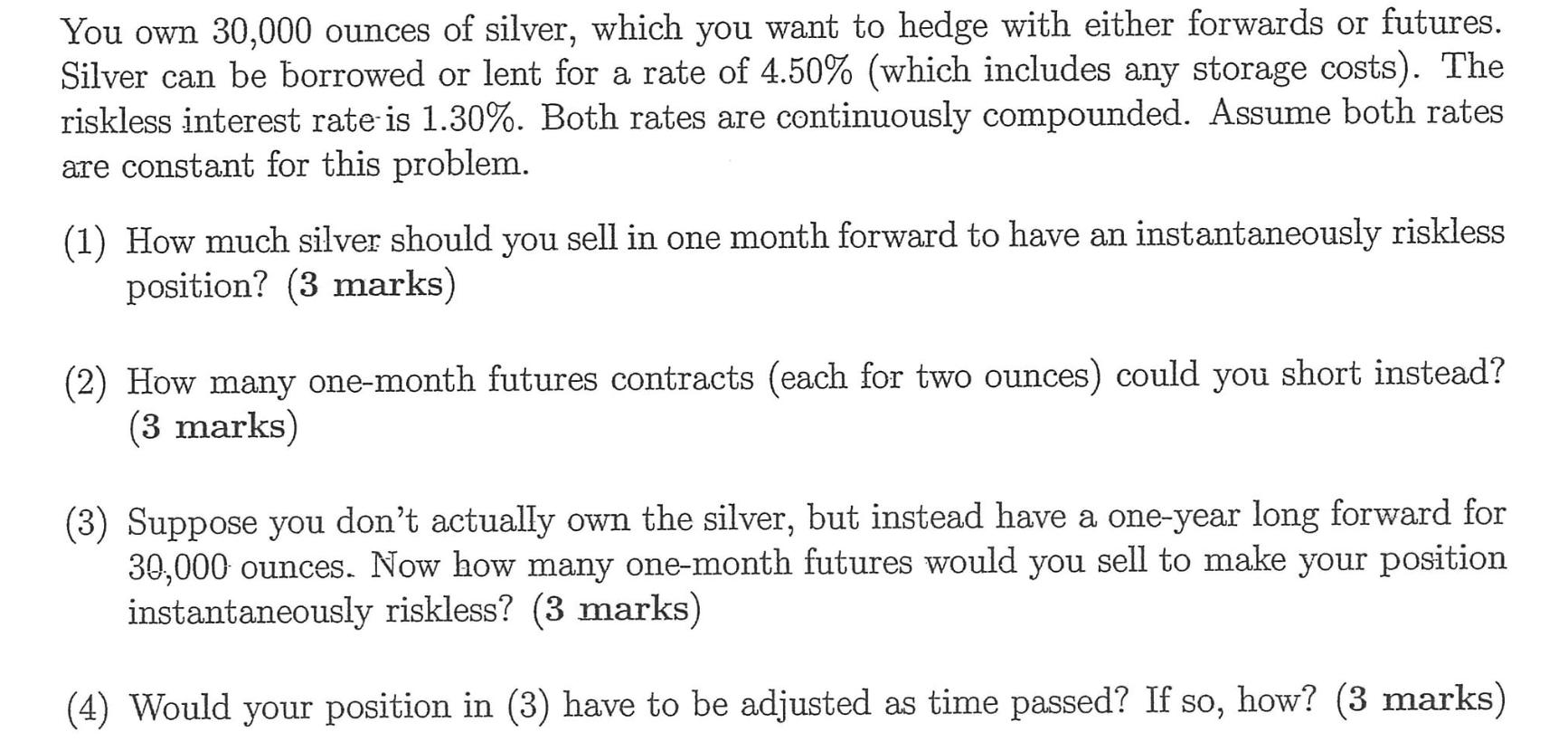

You own 30,000 ounces of silver, which you want to hedge with either forwards or futures. Silver can be borrowed or lent for a rate of 4.50% (which includes any storage costs). The riskless interest rate is 1.30%. Both rates are continuously compounded. Assume both rates are constant for this problem. (1) How much silver should you sell in one month forward to have an instantaneously riskless position? (3 marks) (2) How many one-month futures contracts (each for two ounces) could you short instead? (3 marks) (3) Suppose you don't actually own the silver, but instead have a one-year long forward for 30,000 ounces. Now how many one-month futures would you sell to make your position instantaneously riskless? (3 marks) Would your position in (3) have to be adjusted as time passed? If so, how? (3 marks)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To have an instantaneously riskless position the forward price of silver should be the present value of the expected future spot price of silver This ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started