Question

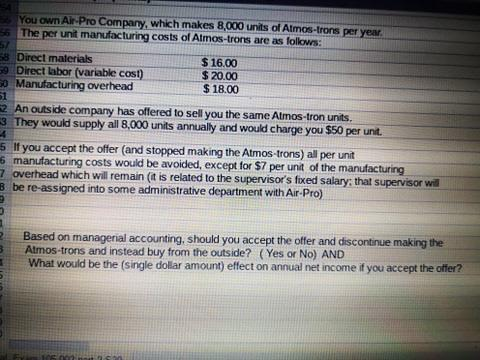

you own air-pro company, which makes 8,000 units of Atoms-Trons per year. the per unit manufacturing costs of Atoms-Trons are as follow: Direct material: $16.00

you own air-pro company, which makes 8,000 units of Atoms-Trons per year. the per unit manufacturing costs of Atoms-Trons are as follow:

Direct material: $16.00

Direct labor (variable cost): $20.00

Manufacturing overhead: $18.00

An outside company has offered to sell you the same Atom-Tron units. They will supply all 8,000 units annually and would charge you $50.00 per unit.

If you accept the offer (and stopped making the Atom-Tron) all per unit manufacturing costs would be avoided, except $7 per unit of the manufacturing

overhead which will remain (it is related to the supervisors fixed salary; that supervisor will be re-assigned into some administrative department with Air-Pro)

Based on managerial accounting, should you accept the offer and discontinue making the Atmos-Trons and instead buy the outside? (Yes or No) AND

what would be the (single dollar amount) effect on annual net income if you accept the offer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started