You own two lots of BHM stock which you bought two years ago. Now, it is...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

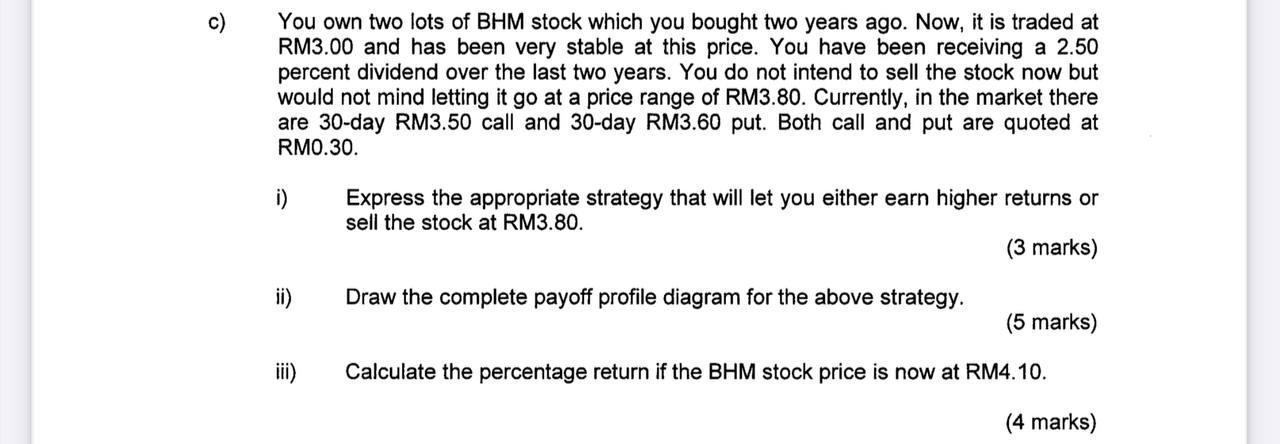

You own two lots of BHM stock which you bought two years ago. Now, it is traded at RM3.00 and has been very stable at this price. You have been receiving a 2.50 percent dividend over the last two years. You do not intend to sell the stock now but would not mind letting it go at a price range of RM3.80. Currently, in the market there are 30-day RM3.50 call and 30-day RM3.60 put. Both call and put are quoted at RM0.30. i) ii) Express the appropriate strategy that will let you either earn higher returns or sell the stock at RM3.80. (3 marks) Draw the complete payoff profile diagram for the above strategy. (5 marks) iii) Calculate the percentage return if the BHM stock price is now at RM4.10. (4 marks) You own two lots of BHM stock which you bought two years ago. Now, it is traded at RM3.00 and has been very stable at this price. You have been receiving a 2.50 percent dividend over the last two years. You do not intend to sell the stock now but would not mind letting it go at a price range of RM3.80. Currently, in the market there are 30-day RM3.50 call and 30-day RM3.60 put. Both call and put are quoted at RM0.30. i) ii) Express the appropriate strategy that will let you either earn higher returns or sell the stock at RM3.80. (3 marks) Draw the complete payoff profile diagram for the above strategy. (5 marks) iii) Calculate the percentage return if the BHM stock price is now at RM4.10. (4 marks)

Expert Answer:

Answer rating: 100% (QA)

Answer i To achieve higher returns or sell the stock at RM380 you can ... View the full answer

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Posted Date:

Students also viewed these finance questions

-

Following are the prices of toothpaste (9 oz.), shampoo (7 oz.), cough tablets (package of 100), and antiperspirant (2 oz.) for August 2010 and August 2018. Also included are the quantity purchased....

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

A. What is the expected dividend in two years? Suppose NI = $85,000 B. What is Samsung's WACC? Samsung's capital structure is 65% ordinary equity and 35% debt. He has operating assets equal to...

-

If a standard medication cures about 70% of patients with a certain disease and a new medication cured 148 of the first 200 patients on whom it was tried, can we conclude that the new medication is...

-

Which of the following would not affect the operating expenses to sales ratio? (Assume sales remains constant.) (a) An increase in advertising expense. (b) A decrease in depreciation expense. (c) An...

-

What are the factors that explain the difference in yields to maturity between long-term and short-term bonds?

-

Milano Pizza is a small neighborhood pizzeria that has a small area for in- store dining as well as offering take-out and free home delivery services. The pizzerias owner has determined that the shop...

-

Brad is reviewing his control chart and discovers that he has 15 points in a row that are above the mean, but under the UCL. This would be an example of _________ that would need to be further...

-

The module for this chapter focuses on interpersonal skills. The concepts segment discusses the Competing Values Framework, and identifies the broad range of skills managers need to lead their...

-

how can Netflix use viewership data to reduce the cost of doing business (licensing fees, content creation, etc.)?

-

A lid is put on a box that is 1 9. 0 cm long, 1 6. 0 cm wide, and 9 . 0 0 cm tall, and the box is then evacuated until its inner pressure is 0 . 7 1 2 x 1 0 ^ 5 Pa . Atmospheric pressure is 1 . 0 1 3...

-

Fund A Fund B Expected Ret. - E(r) 12.9% 7.9% Standard Deviation - 18.9% 14.3% The table above contains expected annual returns for funds A and B. Assuming that the risk free rate is 1.69% and that...

-

1. Assume that you have a special routine that, given an array of size n, uses no comparisons to return the index of a random element whose value is in the middle third of the array. So the value of...

-

A spring with k = 49 N/m hangs vertically next to a ruler. The end of the spring is next to the 16-cm mark on the ruler. Part A If a 2.5-kg mass is now attached to the end of the spring, and the mass...

-

Just-in-time systems allow for maintaining a level of inventory that will tide a firm over in the case of shortages brought about by disruption among suppliers. 1. True 2.False

-

The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Lamp Kit: Direct Labor: Variable Overhead:...

-

Dan and Diana file a joint return. Dan earned $31,000 during the year before losing his job. Diana received Social Security benefits of $5,000. a. Determine the taxable portion of the Social Security...

-

Explain how the price-earnings ratio is related to the pricing of a new security issue and the dilution effect.

-

Shawn Pen & Pencil Sets Inc. has fixed costs of $80,000. Its product currently sells for $5 per unit and has variable costs of $2.50 per unit. Mr. Bic, the head of manufacturing, proposes to buy new...

-

The Jagged Pill Ltd. has placed a $60,000 nonrefundable deposit on a new venture. The deposit can be expensed immediately. This has entitled Jagged Pill to additional information (of a trade-secret...

-

In monopoly, the market demand curve may be regarded as the demand curve for the _________ because it is the market for that particular product.

-

The monopolist, like the perfect competitor, will maximize profits at that output where _________ = MC.

-

A barrier to entry is control over an important _________, such as Alcoas control over bauxite in the 1940s and De Beerss control over much of the worlds output of diamonds.

Study smarter with the SolutionInn App