Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You place 32% of your savings in Fund A and the remaining in Fund B. The investments of each of these funds are as

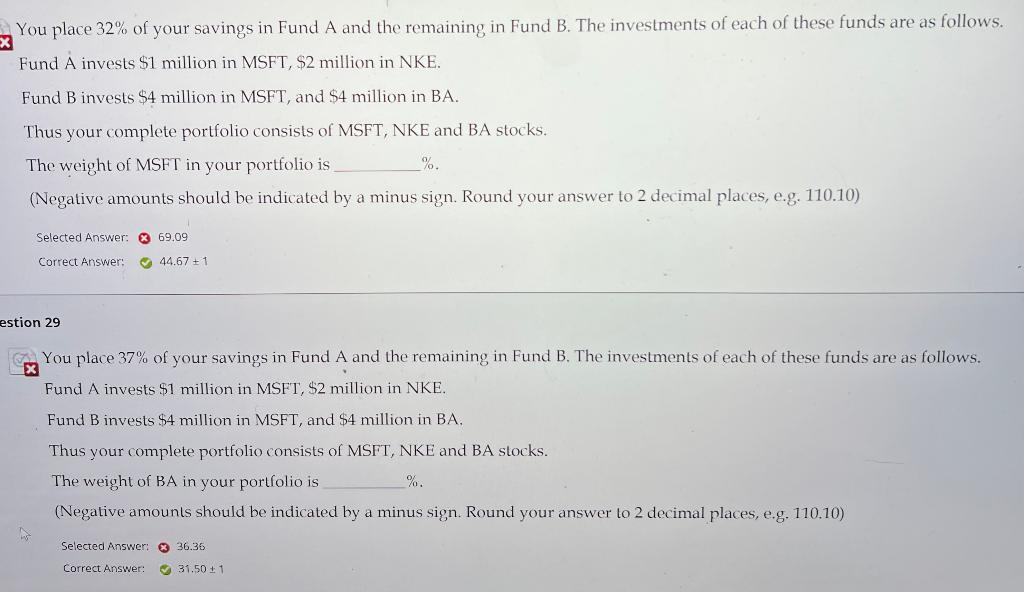

You place 32% of your savings in Fund A and the remaining in Fund B. The investments of each of these funds are as follows. Fund A invests $1 million in MSFT, $2 million in NKE. Fund B invests $4 million in MSFT, and $4 million in BA. Thus your complete portfolio consists of MSFT, NKE and BA stocks. The weight of MSFT in your portfolio is %. (Negative amounts should be indicated by a minus sign. Round your answer to 2 decimal places, e.g. 110.10) Selected Answer: 69.09 Correct Answer: 44.67 +1 estion 29 You place 37% of your savings in Fund A and the remaining in Fund B. The investments of each of these funds are as follows. Fund A invests $1 million in MSFT, $2 million in NKE. Fund B invests $4 million in MSFT, and $4 million in BA. Thus your complete portfolio consists of MSFT, NKE and BA stocks. The weight of BA in your portfolio is %. (Negative amounts should be indicated by a minus sign. Round your answer to 2 decimal places, e.g. 110.10) Selected Answer: Correct Answer: 36.36 31.50 +1

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

We must first estimate the portfolio s overall value before figuring out what proportion of each sto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started