Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You plan to invest in bonds that pay 5.0%, compounded annually. If you invest $10,000 today, how many years will it take for yourinvestment to

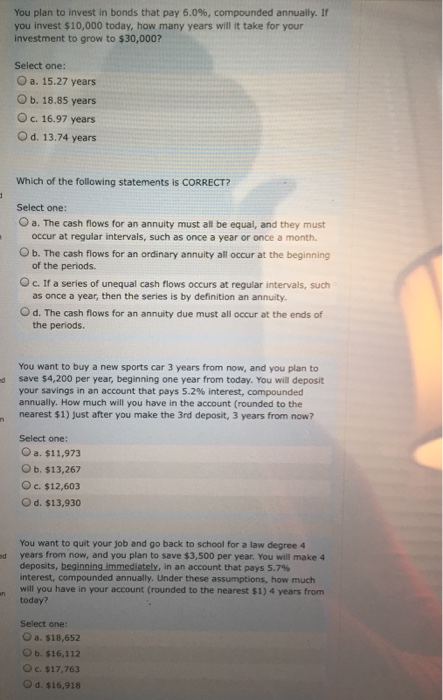

You plan to invest in bonds that pay 5.0%, compounded annually. If you invest $10,000 today, how many years will it take for yourinvestment to grow to $30,000? Select one: a. 15.27 years b. 18.85 years c. 16.97 years d. 13.74 years Which Of the following statements is CORRECT? Select one: a. The cash flows for an annuity must all be equal, and they must occur at regular intervals, such as once a year or once a month b. The cash flows for an ordinary annuity all occur at the beginning of the periods. c If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity. d. The cash flows for an annuity due must all occur at the ends of the periods. You want to buy a new sports car 3 years from now. and you plan to a save $4, 200 per year, beginning one year from today. You will deposityour savings in an account that pays 5.2% interest, compoundedannually. How much will you have in the account (rounded to the, nearest $1) Just after you make the 3rd deposit, 3 years from now? Select one: a. $11, 973 b. $13, 267 c. $12, 603 d. $13, 930 You want to quit your job and go back to school for a law degree 4 years from now, and you plan to save $3, 500 per year. You will make 4deposits, beginning immediately, in an account that pays 5.7%interest, compounded annually. Under these assumptions, how much will you have in your account (rounded to the nearest $1) 4 years fromtoday? Select one: a. $18, 652 b. $16, 112 c. $17, 763 d. $16, 918

You plan to invest in bonds that pay 5.0%, compounded annually. If you invest $10,000 today, how many years will it take for yourinvestment to grow to $30,000? Select one: a. 15.27 years b. 18.85 years c. 16.97 years d. 13.74 years Which Of the following statements is CORRECT? Select one: a. The cash flows for an annuity must all be equal, and they must occur at regular intervals, such as once a year or once a month b. The cash flows for an ordinary annuity all occur at the beginning of the periods. c If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity. d. The cash flows for an annuity due must all occur at the ends of the periods. You want to buy a new sports car 3 years from now. and you plan to a save $4, 200 per year, beginning one year from today. You will deposityour savings in an account that pays 5.2% interest, compoundedannually. How much will you have in the account (rounded to the, nearest $1) Just after you make the 3rd deposit, 3 years from now? Select one: a. $11, 973 b. $13, 267 c. $12, 603 d. $13, 930 You want to quit your job and go back to school for a law degree 4 years from now, and you plan to save $3, 500 per year. You will make 4deposits, beginning immediately, in an account that pays 5.7%interest, compounded annually. Under these assumptions, how much will you have in your account (rounded to the nearest $1) 4 years fromtoday? Select one: a. $18, 652 b. $16, 112 c. $17, 763 d. $16, 918

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started