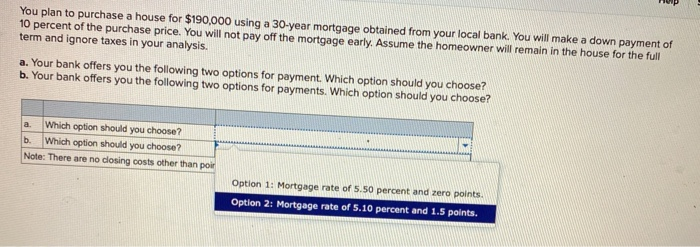

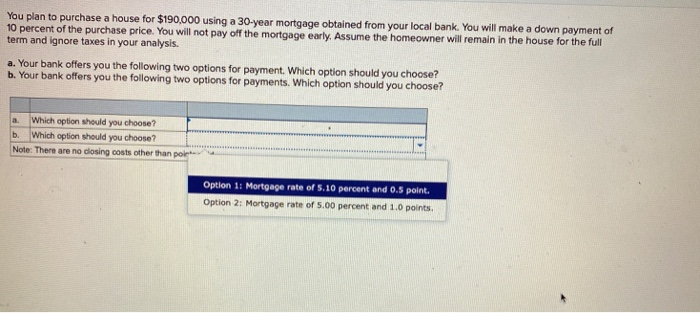

You plan to purchase a house for $190,000 using a 30-year mortgage obtained from your local bank. You will make a down payment of 10 percent of the purchase price. You will not pay off the mortgage early. Assume the homeowner will remain in the house for the full term and ignore taxes in your analysis. a. Your bank offers you the following two options for payment. Which option should you choose? b. Your bank offers you the following two options for payments. Which option should you choose? Which option should you choose? b. Which option should you choose? Note: There are no dosing costs other than points paid You plan to purchase a house for $190,000 using a 30-year mortgage obtained from your local bank. You will make a down payment of 10 percent of the purchase price. You will not pay off the mortgage early. Assume the homeowner will remain in the house for the full term and ignore taxes in your analysis. a. Your bank offers you the following two options for payment. Which option should you choose? b. Your bank offers you the following two options for payments. Which option should you choose? a. Which option should you choose? b. Which option should you choose? Note: There are no closing costs other than por Option 1: Mortgage rate of 5.50 percent and zero points. Option 2: Mortgage rate of 5.10 percent and 1.5 points. You plan to purchase a house for $190,000 using a 30-year mortgage obtained from your local bank. You will make a down payment of 10 percent of the purchase price. You will not pay off the mortgage early. Assume the homeowner will remain in the house for the full term and ignore taxes in your analysis. a. Your bank offers you the following two options for payment. Which option should you choose? b. Your bank offers you the following two options for payments. Which option should you choose? a Which option should you choose? b. Which option should you choose? Note: There are no closing costs other than point Option 1: Mortgage rate of 5.10 percent and 0.5 point. Option 2: Mortgage rate of 5.00 percent and 1.0 points