Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You purchase a share of stock for $45.98, hold it for 9 months at which time you receive a dividend of $5.00, and then

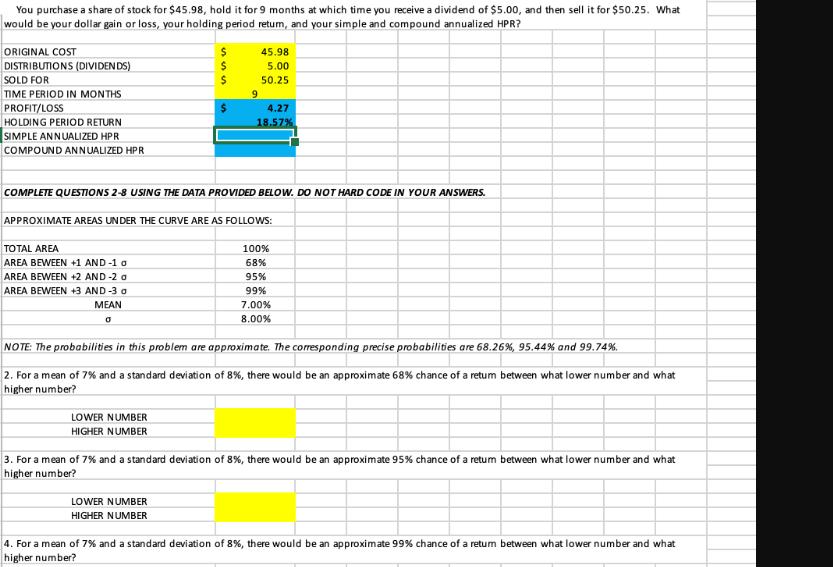

You purchase a share of stock for $45.98, hold it for 9 months at which time you receive a dividend of $5.00, and then sell it for $50.25. What would be your dollar gain or loss, your holding period retum, and your simple and compound annualized HPR? ORIGINAL COST $ 45.98 DISTRIBUTIONS (DIVIDENDS) $ 5.00 SOLD FOR $ 50.25 TIME PERIOD IN MONTHS 9 PROFIT/LOSS $ HOLDING PERIOD RETURN 4.27 18.57% SIMPLE ANNUALIZED HPR COMPOUND ANNUALIZED HPR COMPLETE QUESTIONS 2-8 USING THE DATA PROVIDED BELOW. DO NOT HARD CODE IN YOUR ANSWERS. APPROXIMATE AREAS UNDER THE CURVE ARE AS FOLLOWS: TOTAL AREA AREA BEWEEN +1 AND -1 o AREA BEWEEN +2 AND -2 a AREA BEWEEN +3 AND -3 o MEAN 100% 68% 95% 99% 7.00% 8.00% NOTE: The probabilities in this problem are approximate. The corresponding precise probabilities are 68.26%, 95.44% and 99.74%. 2. For a mean of 7% and a standard deviation of 8%, there would be an approximate 68% chance of a retum between what lower number and what higher number? LOWER NUMBER HIGHER NUMBER 3. For a mean of 7% and a standard deviation of 8%, there would be an approximate 95% chance of a retum between what lower number and what higher number? LOWER NUMBER HIGHER NUMBER 4. For a mean of 7% and a standard deviation of 8%, there would be an approximate 99% chance of a retum between what lower number and what higher number?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started