Question

You purchase equipment for $154,431. The company's marginal tax rate is 21%. Three-, five- and seven-year MACRS schedules: Year 3-Year 5-Year 7-Year 1 33.33%

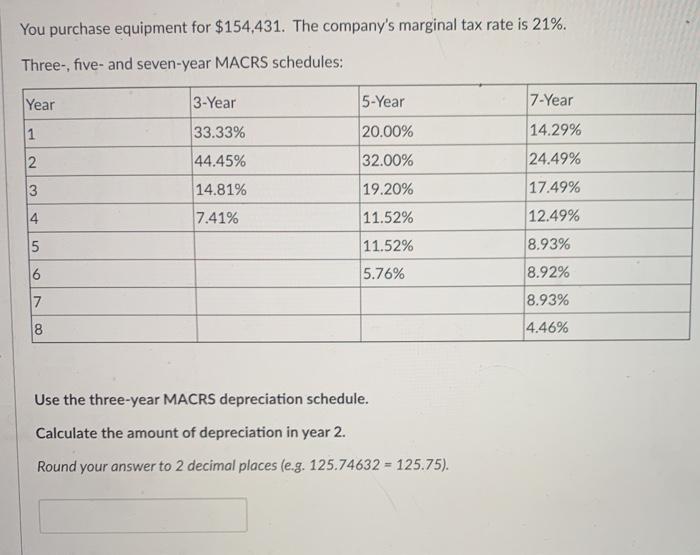

You purchase equipment for $154,431. The company's marginal tax rate is 21%. Three-, five- and seven-year MACRS schedules: Year 3-Year 5-Year 7-Year 1 33.33% 20.00% 14.29% 2 44.45% 32.00% 24.49% 3 14.81% 19.20% 17.49% 4 7.41% 11.52% 12.49% 5 11.52% 8.93% 6 5.76% 8.92% 7 8.93% 8 4.46% Use the three-year MACRS depreciation schedule. Calculate the amount of depreciation in year 2. Round your answer to 2 decimal places (e.g. 125.74632 = 125.75).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the amount of depreciation in year 2 using the threeyear MACRS depreciation sch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Calculus For Business, Economics And The Social And Life Sciences

Authors: Laurence Hoffmann, Gerald Bradley, David Sobecki, Michael Price

11th Brief Edition

978-0073532387, 007353238X

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App