Question

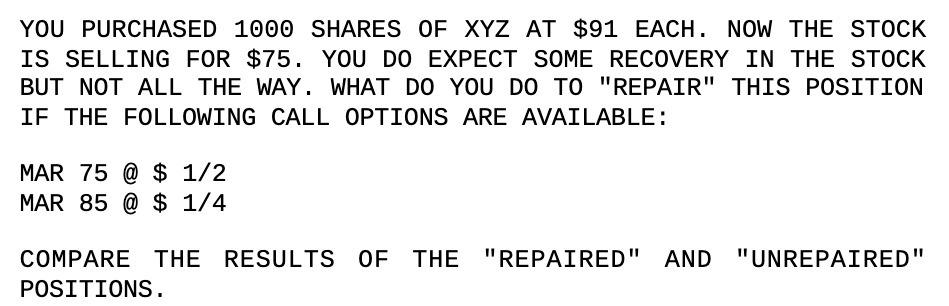

YOU PURCHASED 1000 SHARES OF XYZ AT $91 EACH. NOW THE STOCK IS SELLING FOR $75. YOU DO EXPECT SOME RECOVERY IN THE STOCK

YOU PURCHASED 1000 SHARES OF XYZ AT $91 EACH. NOW THE STOCK IS SELLING FOR $75. YOU DO EXPECT SOME RECOVERY IN THE STOCK BUT NOT ALL THE WAY. WHAT DO YOU DO TO "REPAIR" THIS POSITION IF THE FOLLOWING CALL OPTIONS ARE AVAILABLE: MAR 75 @ $ 1/2 MAR 85 @ $ 1/4 COMPARE THE RESULTS OF THE "REPAIRED" AND "UNREPAIRED" POSITIONS.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To repair the position in XYZ stock you can consider using call options to mitigate the potential losses or enhance potential gains Lets compare the r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App