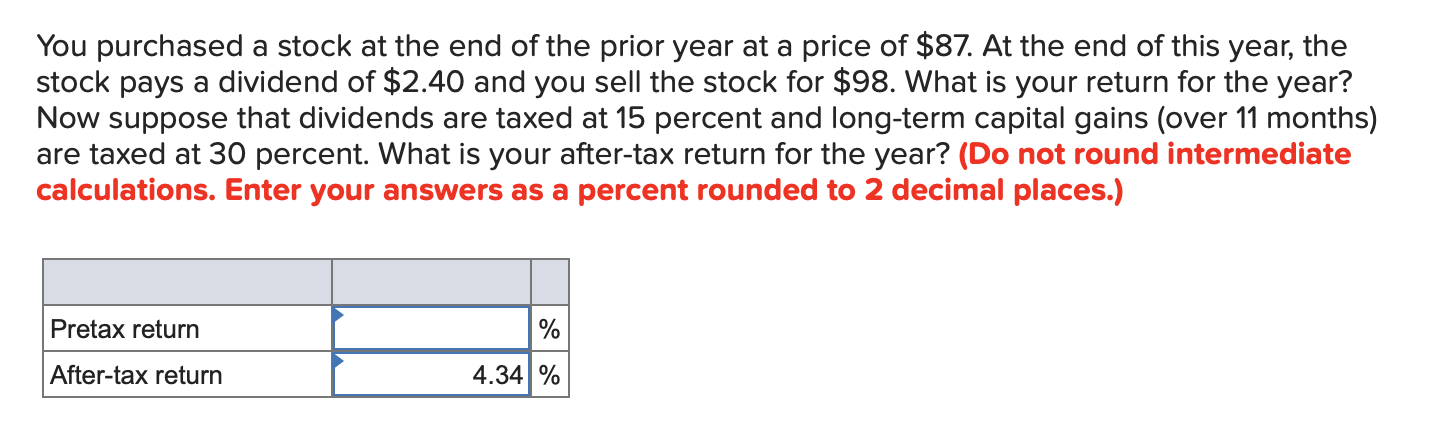

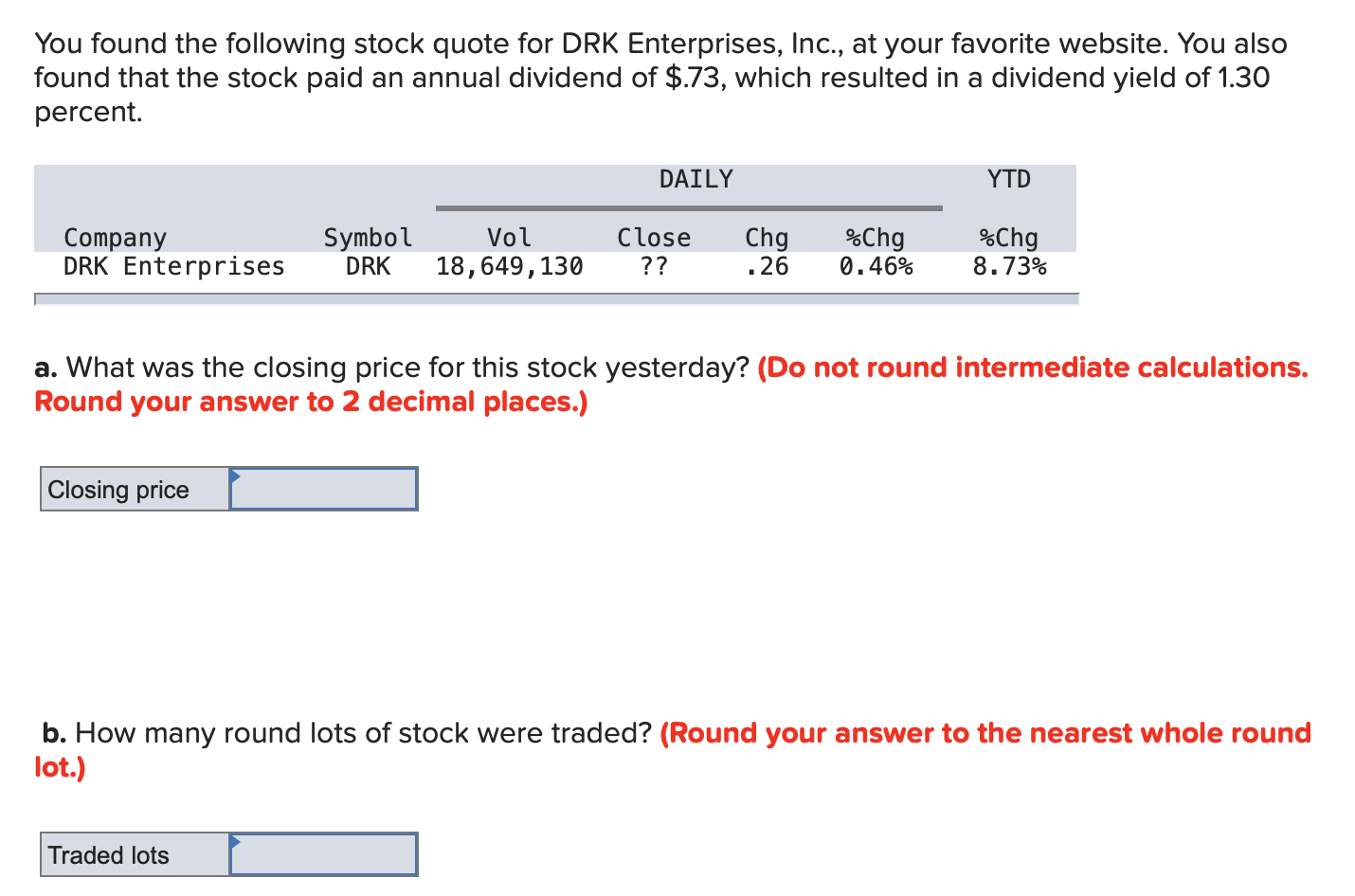

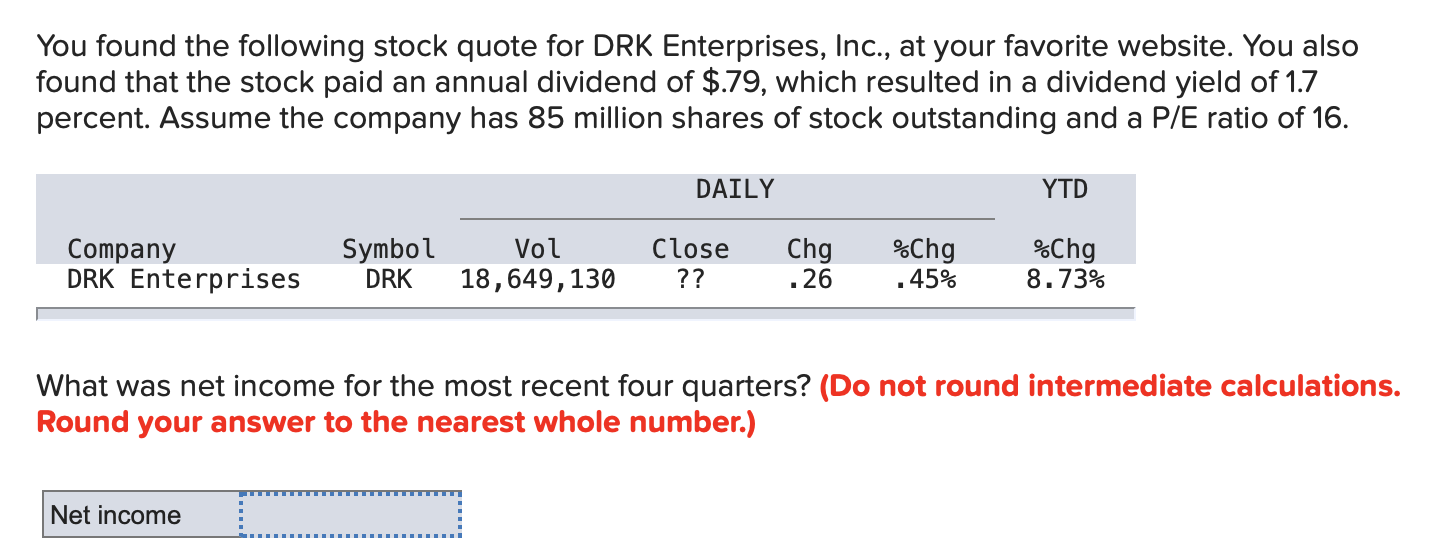

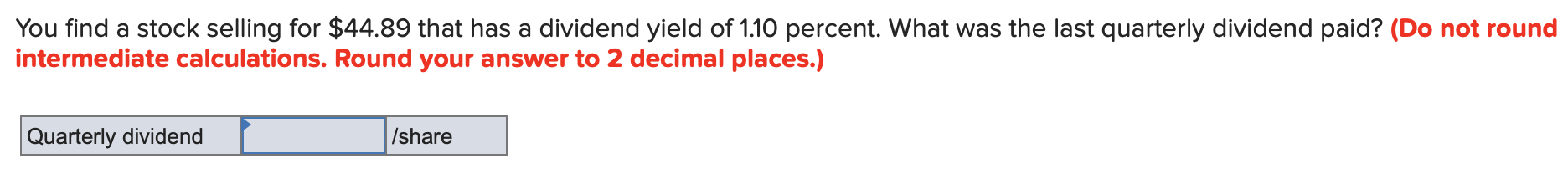

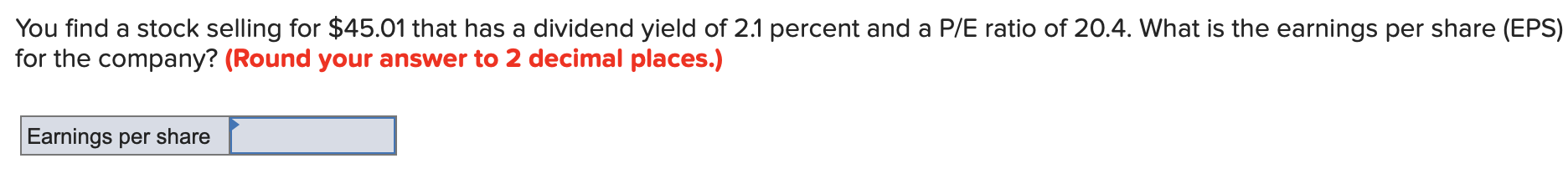

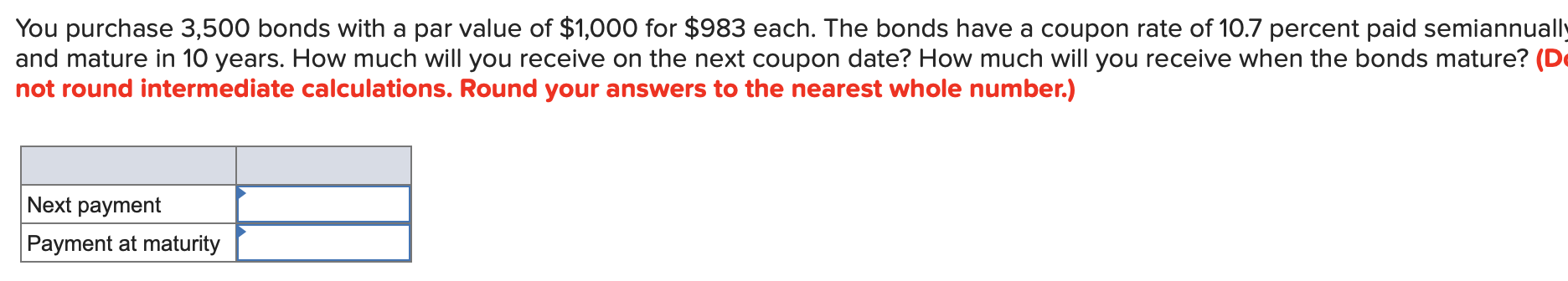

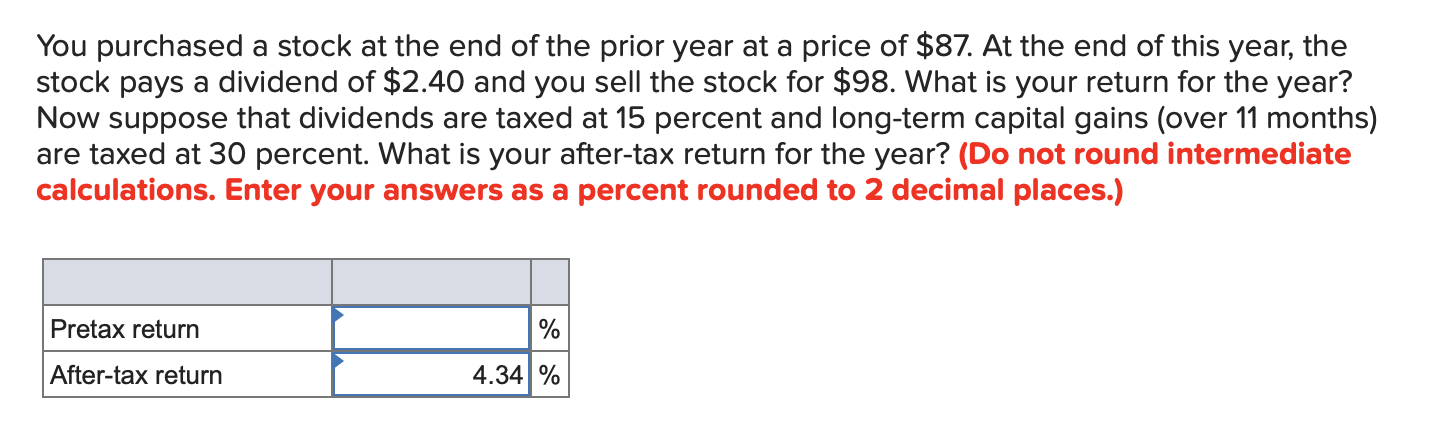

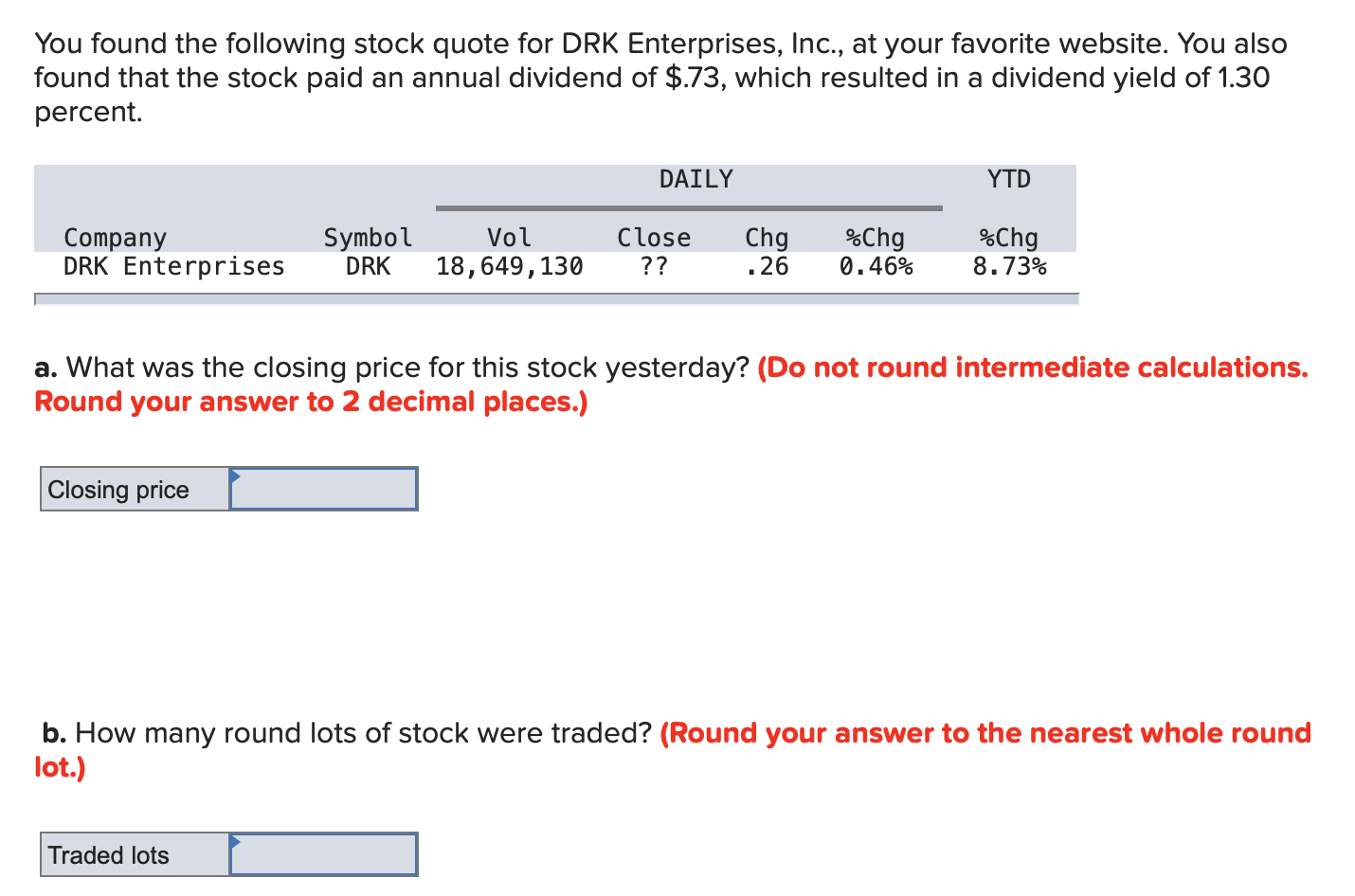

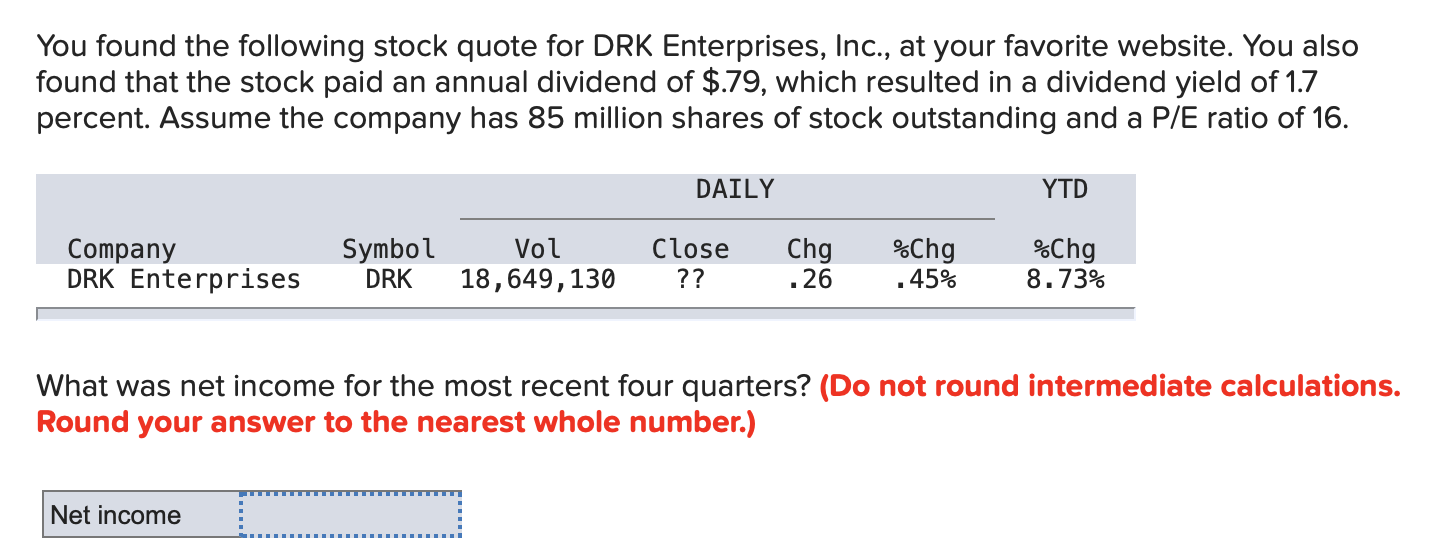

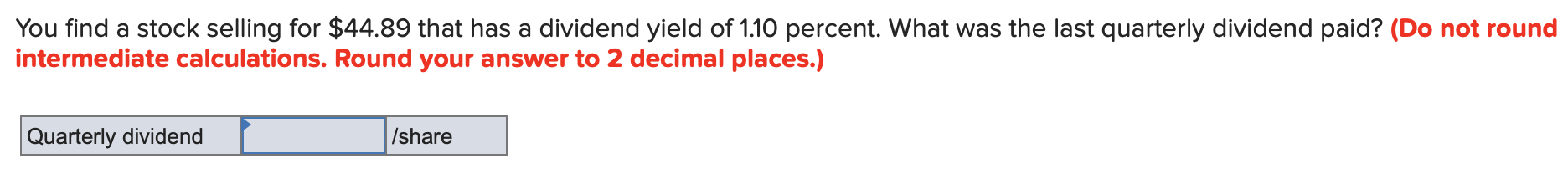

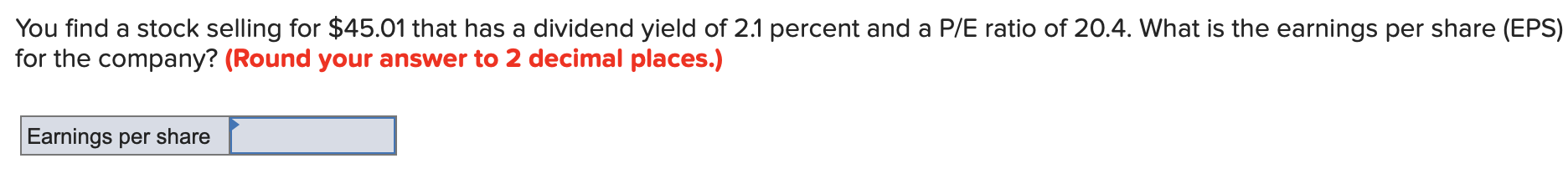

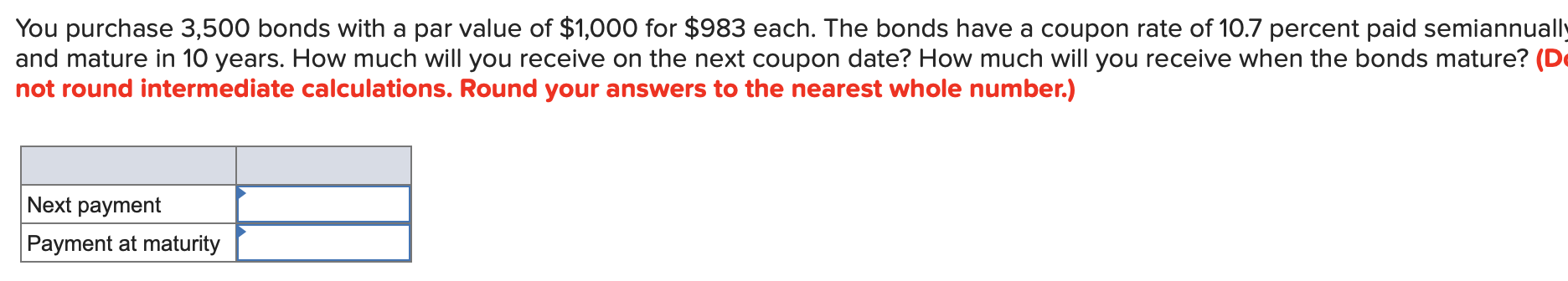

You purchased a stock at the end of the prior year at a price of $87. At the end of this year, the stock pays a dividend of $2.40 and you sell the stock for $98. What is your return for the year? Now suppose that dividends are taxed at 15 percent and long-term capital gains (over 11 months) are taxed at 30 percent. What is your after-tax return for the year? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Pretax return After-tax return 4.34 % You found the following stock quote for DRK Enterprises, Inc., at your favorite website. You also found that the stock paid an annual dividend of $.73, which resulted in a dividend yield of 1.30 percent. DAILY YTD Company DRK Enterprises Symbol DRK Vol 18,649,130 Close ?? Chg .26 %Chg 0.46% %Chg 8.73% a. What was the closing price for this stock yesterday? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Closing price b. How many round lots of stock were traded? (Round your answer to the nearest whole round lot.) Traded lots You found the following stock quote for DRK Enterprises, Inc., at your favorite website. You also found that the stock paid an annual dividend of $.79, which resulted in a dividend yield of 1.7 percent. Assume the company has 85 million shares of stock outstanding and a P/E ratio of 16. DAILY YTD Company DRK Enterprises Symbol DRK Vol 18,649,130 Close ?? Chg .26 %Chg .45% %Chg 8.73% What was net income for the most recent four quarters? (Do not round intermediate calculations. Round your answer to the nearest whole number.) Net income You find a stock selling for $44.89 that has a dividend yield of 1.10 percent. What was the last quarterly dividend paid? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Quarterly dividend l /share You find a stock selling for $45.01 that has a dividend yield of 2.1 percent and a P/E ratio of 20.4. What is the earnings per share (EPS) for the company? (Round your answer to 2 decimal places.) Earnings per share You purchase 3,500 bonds with a par value of $1,000 for $983 each. The bonds have a coupon rate of 10.7 percent paid semiannually and mature in 10 years. How much will you receive on the next coupon date? How much will you receive when the bonds mature? (D not round intermediate calculations. Round your answers to the nearest whole number.) Next payment Payment at maturity