Answered step by step

Verified Expert Solution

Question

1 Approved Answer

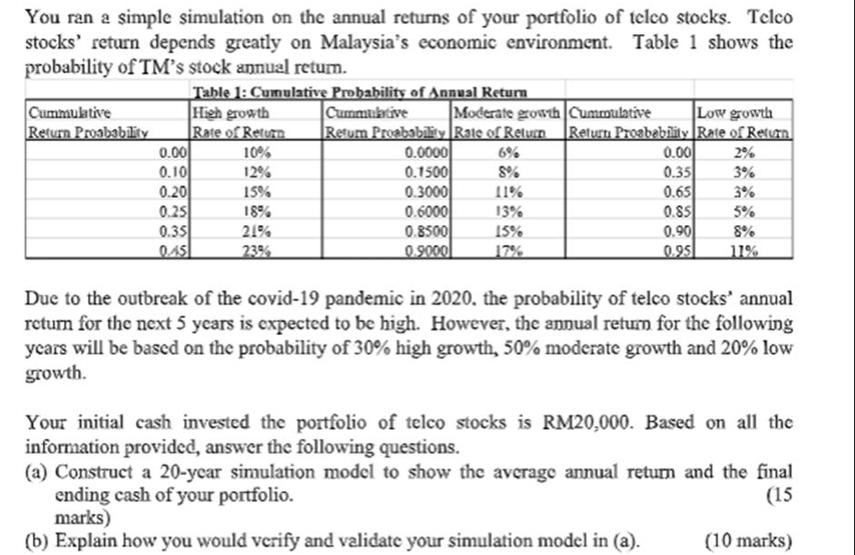

You ran a simple simulation on the annual returns of your portfolio of telco stocks. Telco stocks' return depends greatly on Malaysia's economic environment.

You ran a simple simulation on the annual returns of your portfolio of telco stocks. Telco stocks' return depends greatly on Malaysia's economic environment. Table 1 shows the probability of TM's stock annual return. Table 1: Cumulative Probability of Annual Return Low growth Cummulative Return Proabability High growth Cummulative Moderate growth Cummulative Rate of Return Return Probability Rate of Return Return Probability Rate of Return 0.00 10% 0.0000 6% 0.00 2% 0.10 12% 0.1500 8% 0.35 3% 0.20 15% 0.3000 11% 0.65 3% 0.25 18% 0.6000 13% 0.85 5% 0.35 21% 0.8500 15% 0.90 8% 0.45 23% 0.9000 17% 0.95 11% Due to the outbreak of the covid-19 pandemic in 2020. the probability of telco stocks' annual return for the next 5 years is expected to be high. However, the annual return for the following years will be based on the probability of 30% high growth, 50% moderate growth and 20% low growth. Your initial cash invested the portfolio of telco stocks is RM20,000. Based on all the information provided, answer the following questions. (a) Construct a 20-year simulation model to show the average annual return and the final ending cash of your portfolio. marks) (b) Explain how you would verify and validate your simulation model in (a). (15 (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To construct a 20year simulation model we will use the provided probabilities of annual returns fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started