Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You read the following news in the financial media: NEW YORK (CNN/Money), Friday, January 28, 2005 - Procter & Gamble announced the largest acquisition

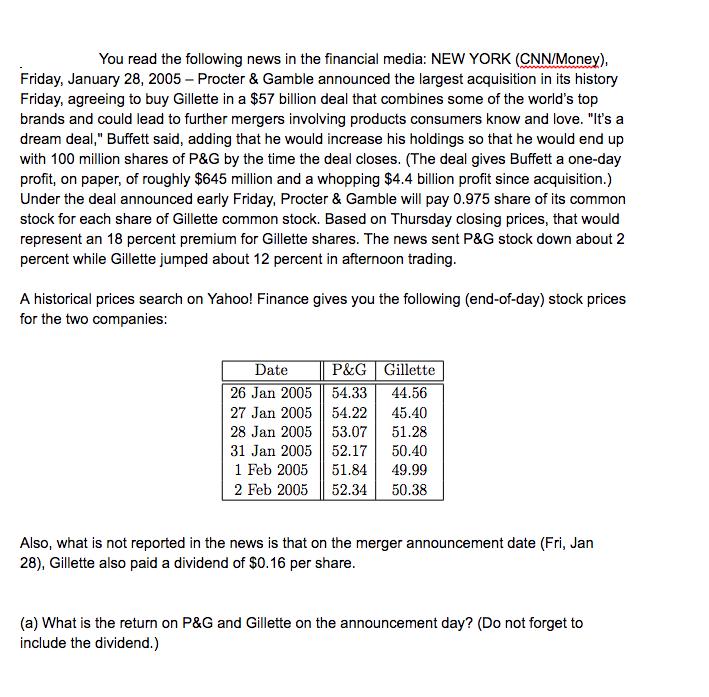

You read the following news in the financial media: NEW YORK (CNN/Money), Friday, January 28, 2005 - Procter & Gamble announced the largest acquisition in its history Friday, agreeing to buy Gillette in a $57 billion deal that combines some of the world's top brands and could lead to further mergers involving products consumers know and love. "It's a dream deal," Buffett said, adding that he would increase his holdings so that he would end up with 100 million shares of P&G by the time the deal closes. (The deal gives Buffett a one-day profit, on paper, of roughly $645 million and a whopping $4.4 billion profit since acquisition.) Under the deal announced early Friday, Procter & Gamble will pay 0.975 share of its common stock for each share of Gillette common stock. Based on Thursday closing prices, that would represent an 18 percent premium for Gillette shares. The news sent P&G stock down about 2 percent while Gillette jumped about 12 percent in afternoon trading. A historical prices search on Yahoo! Finance gives you the following (end-of-day) stock prices for the two companies: P&G Gillette 54.33 44.56 54.22 45.40 53.07 51.28 52.17 50.40 51.84 49.99 2 Feb 2005 52.34 50.38 Date 26 Jan 2005 27 Jan 2005 28 Jan 2005 31 Jan 2005 1 Feb 2005 Also, what is not reported in the news is that on the merger announcement date (Fri, Jan 28), Gillette also paid a dividend of $0.16 per share. (a) What is the return on P&G and Gillette on the announcement day? (Do not forget to include the dividend.)

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Initial Price 4540 Estimated Price 5286 Increment 5286 4540 746 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started