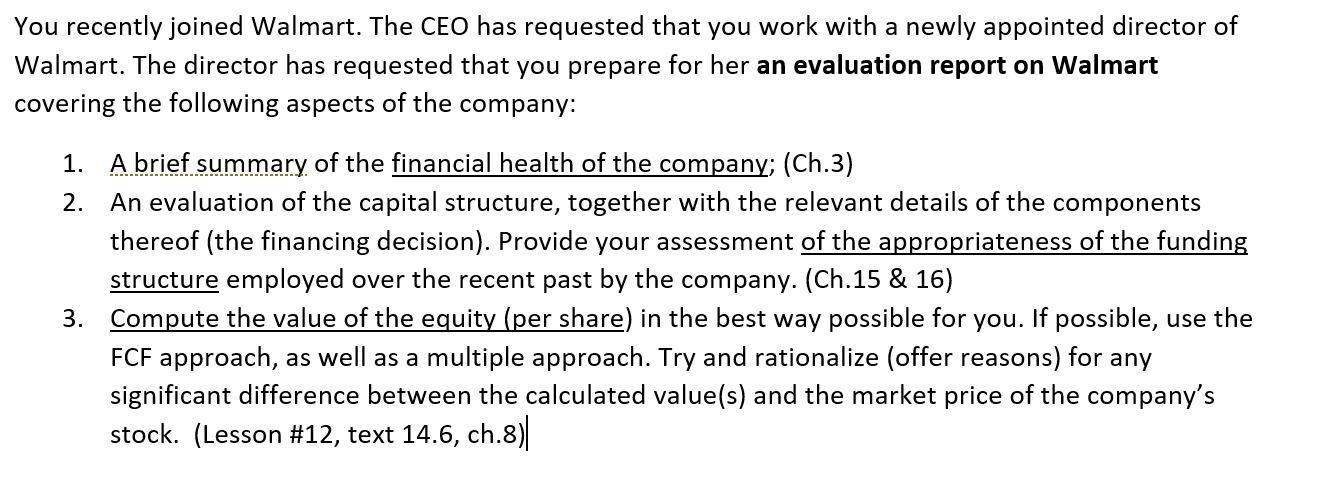

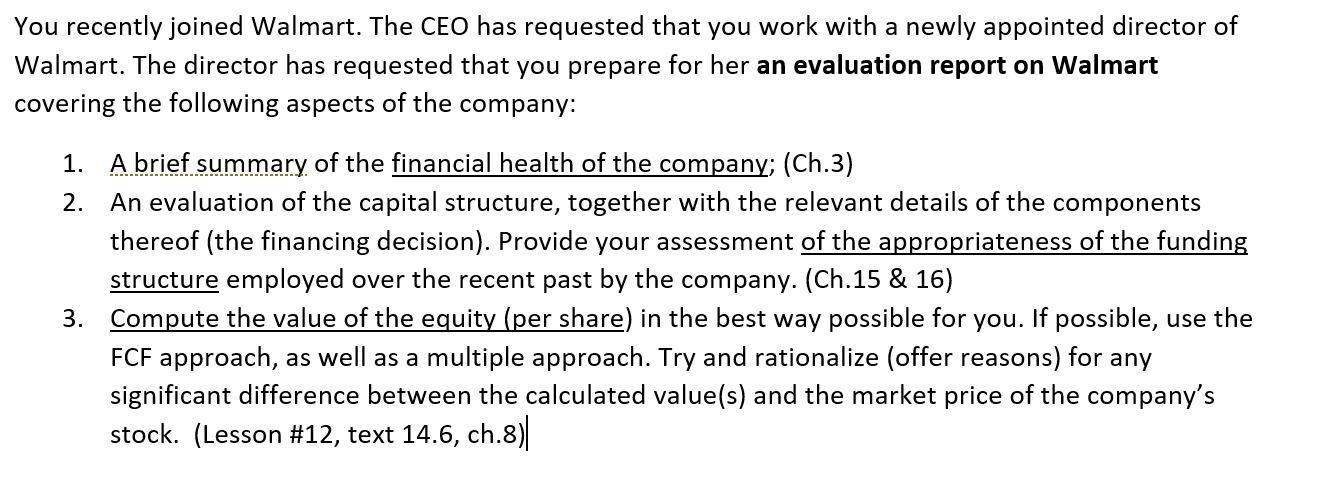

You recently joined Walmart. The CEO has requested that you work with a newly appointed director of Walmart. The director has requested that you prepare for her an evaluation report on Walmart covering the following aspects of the company: 1. A brief summary of the financial health of the company; (Ch.3) 2. An evaluation of the capital structure, together with the relevant details of the components thereof (the financing decision). Provide your assessment of the appropriateness of the funding structure employed over the recent past by the company. (Ch.15 & 16) 3. Compute the value of the equity (per share) in the best way possible for you. If possible, use the FCF approach, as well as a multiple approach. Try and rationalize (offer reasons) for any significant difference between the calculated value(s) and the market price of the company's stock. (Lesson #12, text 14.6, ch.8)| Appendix A Net Margin: 3.6% Walmart has better Net Margin than 59.321 of the companies on the Retail industry Industry ROE (Return on Equity}: 6.59% Walmart has better ROE (Return on Equity than 68.23% of the companies on the Retail industry In ROA (Return on Assets): 2.06% Walmart has better ROA (Return on Assets} than 76.276 of the companies on the Retail industry Walmart Industry Debt to Equity Ratio: 0.84 Walmart has better Debt to Equity Ratio than 65% of the companies on the Retail industry Walmart ty Quick Ratio: 0.25 * Walmart has worst Quick Ratio than 100% of the companies on the Retail industry Wom try You recently joined Walmart. The CEO has requested that you work with a newly appointed director of Walmart. The director has requested that you prepare for her an evaluation report on Walmart covering the following aspects of the company: 1. A brief summary of the financial health of the company; (Ch.3) 2. An evaluation of the capital structure, together with the relevant details of the components thereof (the financing decision). Provide your assessment of the appropriateness of the funding structure employed over the recent past by the company. (Ch.15 & 16) 3. Compute the value of the equity (per share) in the best way possible for you. If possible, use the FCF approach, as well as a multiple approach. Try and rationalize (offer reasons) for any significant difference between the calculated value(s) and the market price of the company's stock. (Lesson #12, text 14.6, ch.8)| Appendix A Net Margin: 3.6% Walmart has better Net Margin than 59.321 of the companies on the Retail industry Industry ROE (Return on Equity}: 6.59% Walmart has better ROE (Return on Equity than 68.23% of the companies on the Retail industry In ROA (Return on Assets): 2.06% Walmart has better ROA (Return on Assets} than 76.276 of the companies on the Retail industry Walmart Industry Debt to Equity Ratio: 0.84 Walmart has better Debt to Equity Ratio than 65% of the companies on the Retail industry Walmart ty Quick Ratio: 0.25 * Walmart has worst Quick Ratio than 100% of the companies on the Retail industry Wom try