Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You required to do income statement Task A (Show all your workings) Prepare the income statement and statement of financial position for Foxes Limited in

You required to do income statement

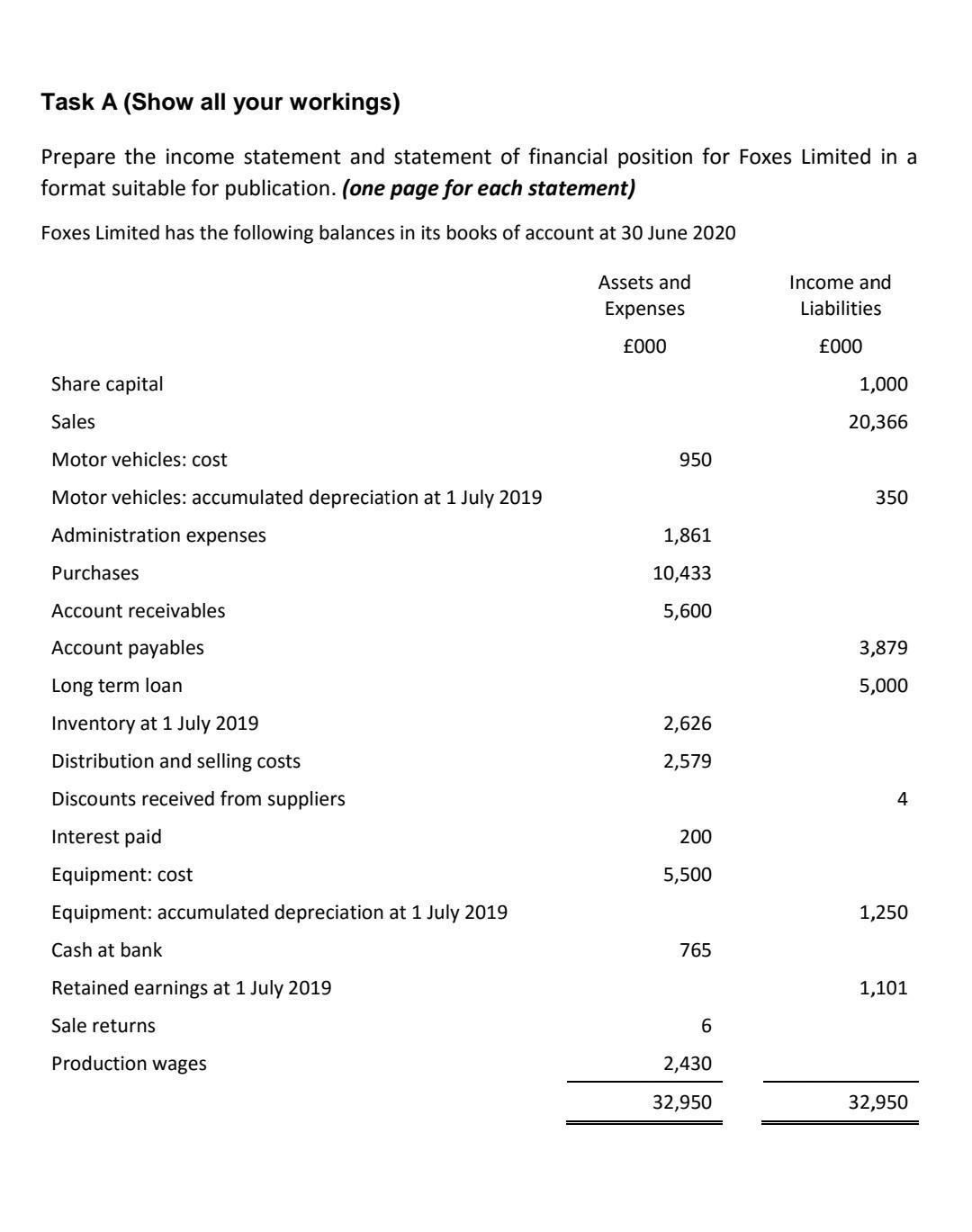

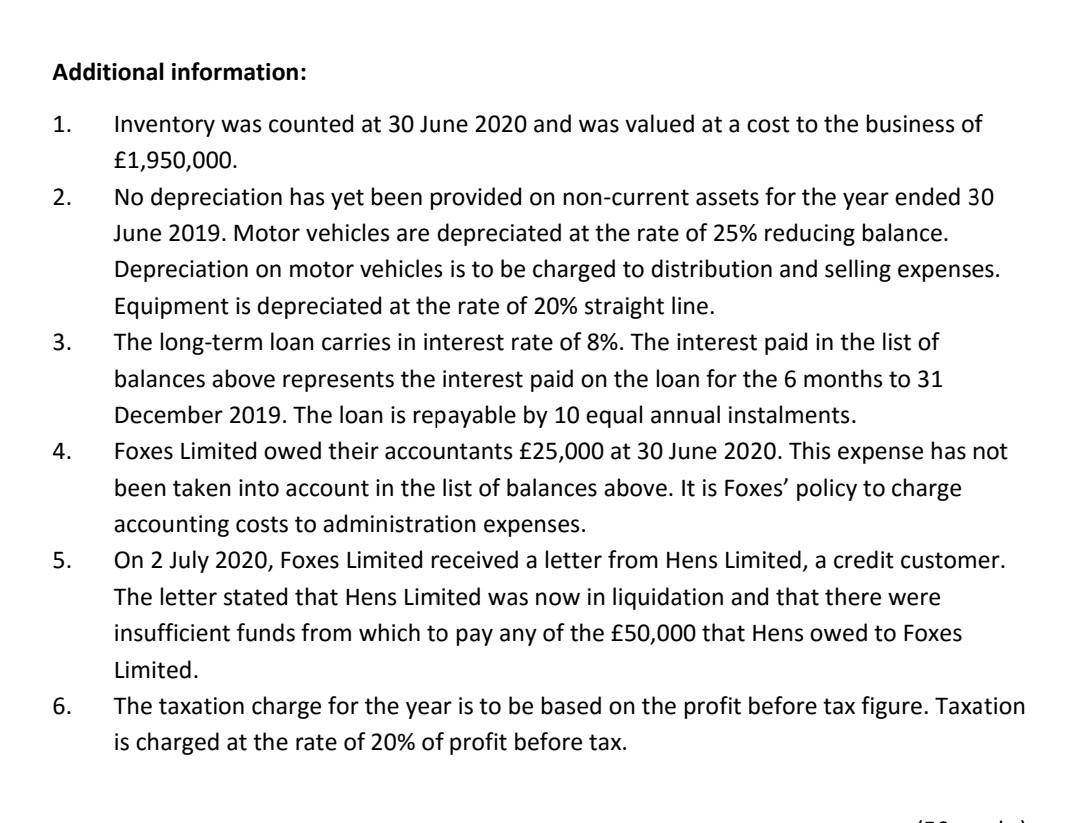

Task A (Show all your workings) Prepare the income statement and statement of financial position for Foxes Limited in a format suitable for publication. (one page for each statement) Foxes Limited has the following balances in its books of account at 30 June 2020 Assets and Expenses Income and Liabilities 000 000 Share capital 1,000 Sales 20,366 Motor vehicles: cost 950 Motor vehicles: accumulated depreciation at 1 July 2019 350 Administration expenses 1,861 Purchases 10,433 Account receivables 5,600 Account payables 3,879 Long term loan 5,000 Inventory at 1 July 2019 2,626 Distribution and selling costs 2,579 Discounts received from suppliers 4 Interest paid 200 Equipment: cost 5,500 Equipment: accumulated depreciation at 1 July 2019 1,250 Cash at bank 765 Retained earnings at 1 July 2019 1,101 Sale returns 6 Production wages 2,430 32,950 32,950 Additional information: 1. 2. 3. Inventory was counted at 30 June 2020 and was valued at a cost to the business of 1,950,000. No depreciation has yet been provided on non-current assets for the year ended 30 June 2019. Motor vehicles are depreciated at the rate of 25% reducing balance. Depreciation on motor vehicles is to be charged to distribution and selling expenses. Equipment is depreciated at the rate of 20% straight line. The long-term loan carries in interest rate of 8%. The interest paid in the list of balances above represents the interest paid on the loan for the 6 months to 31 December 2019. The loan is repayable by 10 equal annual instalments. Foxes Limited owed their accountants 25,000 at 30 June 2020. This expense has not been taken into account in the list of balances above. It is Foxes' policy to charge accounting costs to administration expenses. On 2 July 2020, Foxes Limited received a letter from Hens Limited, a credit customer. The letter stated that Hens Limited was now in liquidation and that there were insufficient funds from which to pay any of the 50,000 that Hens owed to Foxes Limited. The taxation charge for the year is to be based on the profit before tax figure. Taxation is charged at the rate of 20% of profit before tax. 4. 5. 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started