Question

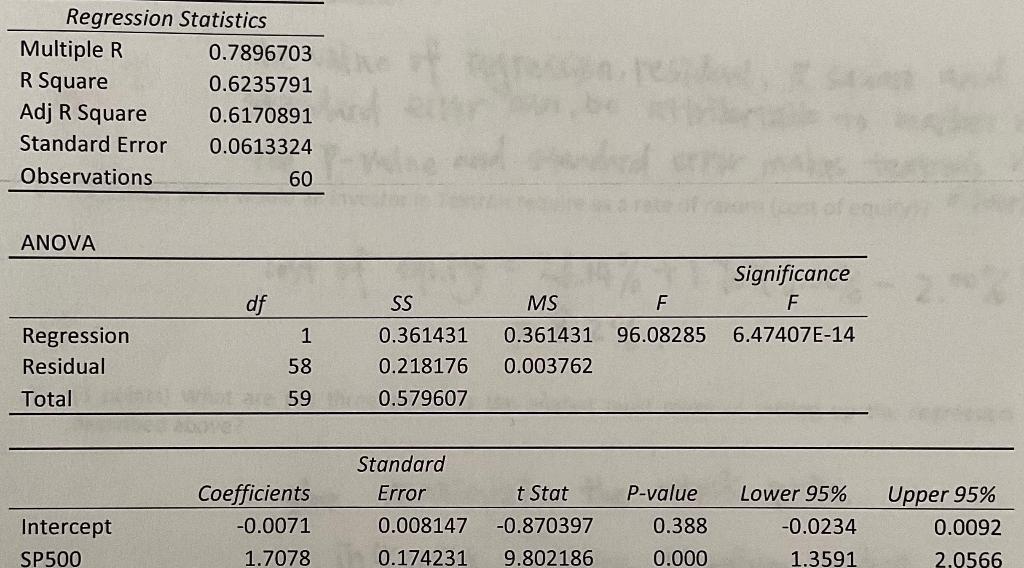

you run a regression of monthly returns of Textron, an industrial conglomerate, on the S&P 500 index and get, the following output. Assuming the3 risk-free

you run a regression of monthly returns of Textron, an industrial conglomerate, on the S&P 500 index and get, the following output. Assuming the3 risk-free of return is 2.00% and the equity premium is 6.00%, answer the following questions Compute the annualized Jensen's alpha. What does this value tell you about management's ability at Textron?

What proportion of Textron's can be attribute to market risk? What proportion of this Textron's risk is diversifiable?

What would an investor in Textron require as a rate of return (cost of equity)?

What are the three decisions the analyst must make in setting up the regression describe above?

\begin{tabular}{lr} \multicolumn{2}{c}{ Regression Statistics } \\ \hline Multiple R & 0.7896703 \\ R Square & 0.6235791 \\ Adj R Square & 0.6170891 \\ Standard Error & 0.0613324 \\ Observations & 60 \\ \hline \end{tabular} ANOVA \begin{tabular}{lrlrrrr} \hline & \multicolumn{3}{c}{ Standard } \\ & Coefficients & Error & \multicolumn{1}{c}{t Stat } & P-value & Lower 95\% & Upper 95\% \\ \hline Intercept & 0.0071 & 0.008147 & 0.870397 & 0.388 & 0.0234 & 0.0092 \\ SP500 & 1.7078 & 0.174231 & 9.802186 & 0.000 & 1.3591 & 2.0566 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started